Developing a winning strategy

Technical SEO, content marketing and digital PR go hand in hand when it comes to harnessing the power of organic growth. To make the most of these three pillars, you’ll first need a winning SEO strategy, backed up by data, to inform your actions. This first section will focus on how to create that, including understanding your market, conducting keyword research and making the most of SERP features.

Understanding your market

The first step in establishing a winning SEO strategy is to gain a thorough understanding of your consumer search behaviour.

Financial services is a broad vertical and although there are commonalities, every sub-sector will have its own nuances. For SEO specifically, the typical way to understand your market and these nuances is through a keyword research project.

Before diving in, we’d always recommend an initial discussion with your product and sales teams. As product experts, they’ll be able to provide you with insights which can be hugely beneficial when you’re trying to determine relevancy during the keyword research process and how to best categorise queries into topical clusters – a process that isn’t always straightforward!

If you’re a larger financial services brand, you may have an extensive portfolio of products, not all of which will be covered on the website itself. In this scenario, relying solely on the existing pages to determine relevancy can result in valuable opportunities being overlooked. Again, discussions with product experts will help highlight these easily-missed opportunities.

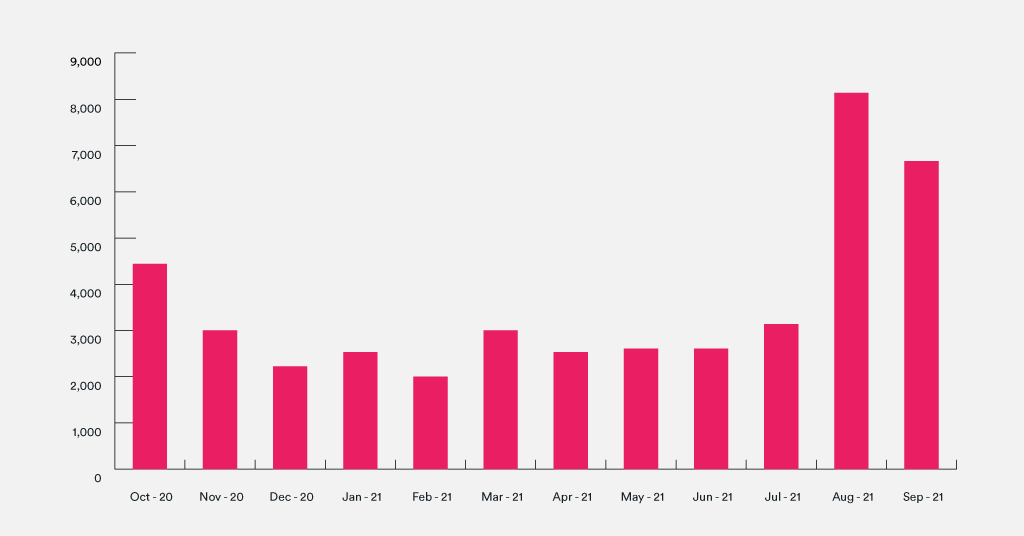

Product and sales teams will also have insights on the types of consumers that typically buy a product (which will commonly be distilled into buyer/user personas), as well as when consumers buy. This is extremely important within financial services, where buying behaviour is frequently dictated by both seasonality and life stage.

A good example of this is students and current accounts. Before going to university, many prospective students will search to see which banks offer an interest-free overdraft specifically for students openning an account. When an account is opened, the consumer will often stick around long after they have graduated, and the overdraft has been taken away. In fact, according to research from Finder, 56% of Brits stick with a current account for more than five years – something that’s great for credit score.

So, for those working in retail banking with a relevant student-focused product, it would clearly be beneficial to spend a fair bit of time researching search behaviour for this life stage and carefully considering seasonality when planning editorial and content distribution strategies.

This type of research is key to understanding your market and building an effective SEO strategy.

Caption: Seasonality for student accounts peaks in August and September before the new term begins

Performing keyword research for financial services

Once you’ve developed a thorough understanding of the target audience and product, the keyword research phase can begin. There are two different approaches you can take when going through this process:

- Finding related queries using ‘seed keywords’ (your newfound product knowledge will help here!)

- Finding related queries using brand or competitor ranking data

As part of this process, we’d also strongly recommend speaking to your paid search team and leveraging any data they can provide. Armed with this information, you essentially have a list of transactional keywords that convert well on search for your brand, painstakingly refined over years of testing. Not using this would be criminal.

Once you’ve completed the initial phases of this process, you can use the data to understand key consumer behaviours in a number of ways before you start producing relevant content:

Understanding demand

As you work your way through your product offering and keyword research you will start to notice commonalities in the ways users structure their queries. Many sectors within the financial services vertical could be described as ‘head-term heavy’, meaning that a large proportion of the demand is clustered around a small number of keywords.

To illustrate this point, take a look at the transactional search demand within ‘stocks and shares isas’:

Caption: Search volume data for ‘stocks and shares isas’ keywords

In this dataset, the query ‘stocks and shares isa’ has a massive 78% of the total search volume. This insight gives brands a clear indication of demand, helping them understand the type of content they should focus on.

Understanding query structure

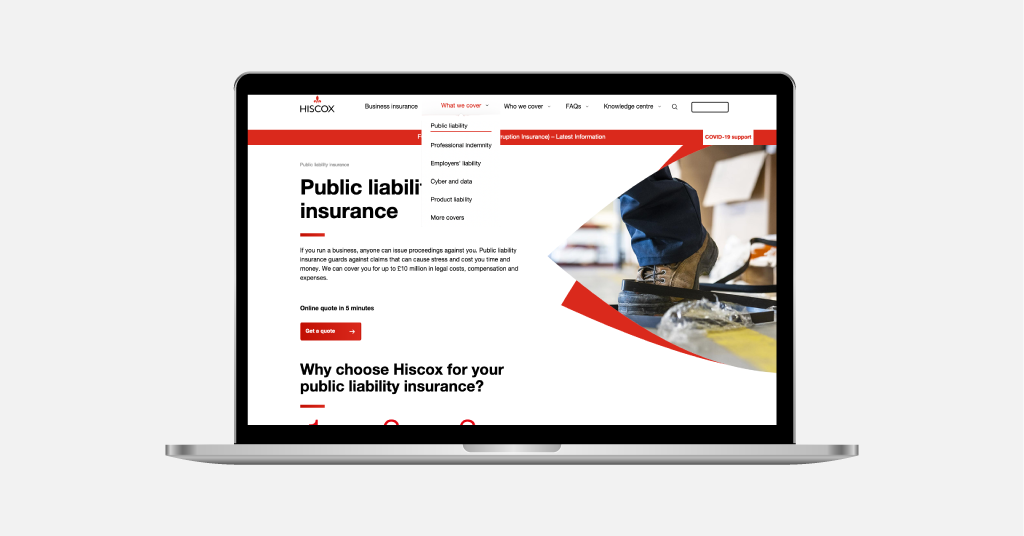

To understand what is meant by query structure, we can look at different search paths within business insurance as an example. Within this sub-sector, most potential customers search in one of two ways:

- By cover type: a search performed for the specific type of policy required

- By trade: a search performed for a specific job type

In reality, the majority of customers will end up being sold a similar type of policy, usually a mixture of liability and indemnity insurance, depending on the individual circumstances. But, because of the different search paths, it’s necessary to build out content in both areas to cater to the search demand fully.

This is exactly what Hiscox has done by creating separate product pages offered for individual trades and cover types. Ultimately, understanding query structure will highlight opportunities and allow you to create relevant content that matches search demand.

Caption: Hiscox’s product pages speak to both types of search query

Identifying modifiers that alter search intent

In addition to query structure, it’s also important to consider how specific modifiers alter search intent. You can establish this by analysing the types of content being returned from a search (i.e. the format and type of site).

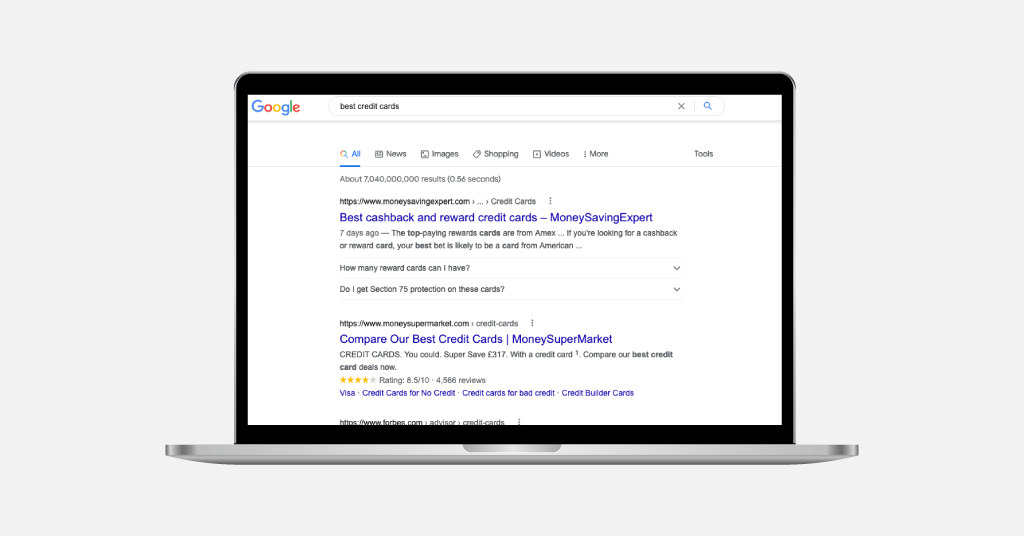

As an example, according to data from SEMrush, credit card related queries that contain the word ‘best’ drive an enormous 216k monthly searches in the UK. However, the entire first page of search results is dominated by price comparison sites.

Caption: SERP for ‘best credit cards’

Credit card companies should then be tempted to remove any queries containing this modifier because the customer intent is to browse a range of options from multiple providers rather than make a firm decision.

Refining and categorising your research

Once you’ve compiled your keyword list, it’s well worth taking the time to prune it down further, making sure the queries are as relevant as possible to your target audience and products.

Skipping this step will give an unrealistic view of the opportunity available to your brand. This can impact upon the quality of forecasting, performance tracking, content production and optimisation efforts.

To keep your research relevant, categorise the queries in a logical way that makes sense for your business. This could be by product, topic, stage in the purchase funnel or a combination of all three.

Sizing up the opportunity

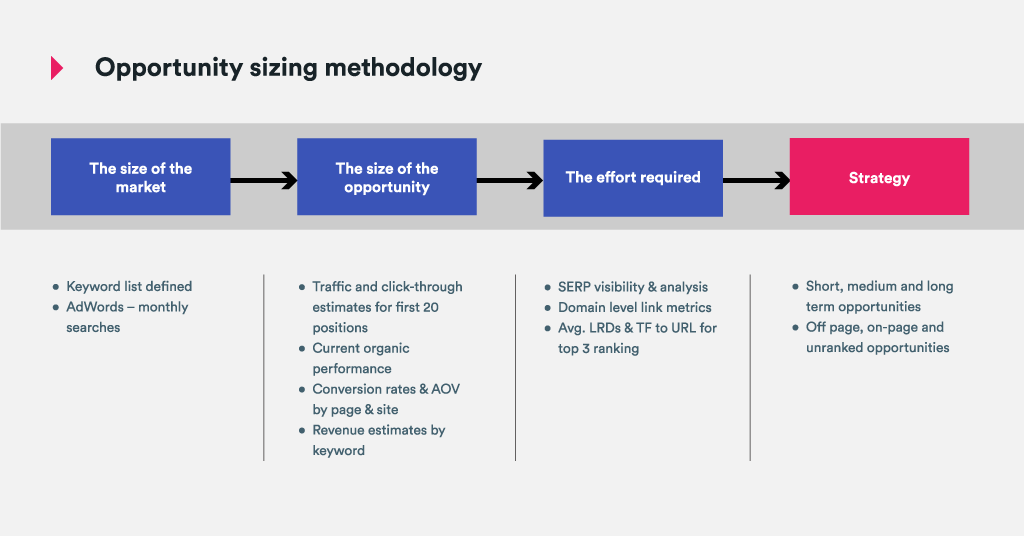

As helpful as a comprehensive keyword research project is, to get a full understanding of your marketplace, we would encourage you to go a step further and undertake an opportunity sizing project.

Keyword research is inherently binary; it will tell you how many people searched for a commercially relevant term, but what it won’t do is tell you how much traffic you would receive if you ranked in position one or how this would translate into conversions for your business.

It also provides no real context on the level of competition, who the competition are (your traditional competitors may not necessarily be organic search competitors), or the SERP features that are present (which can impact CTRs by pushing down the organic results).

An opportunity sizing project will provide you with an optimal revenue-focused strategy for organic growth that is aligned with your wider business goals. It will determine what is achievable in the short, medium and long term, so you can prioritise accordingly and maximise your organic ROI.

Caption: Our methodology for an opportunity sizing project

Going through this process, the key questions to ask include:

- Which sections of the site are lacking in links?

- Are these sections lacking in quantity or quality of links?

- Which pages need better on-page optimisation?

- Which search terms can we improve more quickly?

- Are we missing any pages which could drive more search volume?

- Which categories have the biggest opportunities for growth?

- Which SERPs do the brands or brokers dominate?

- Where can we maximise organic revenue and profit?

If you’re able to answer these, you have everything you need to prioritise your activities effectively and develop a killer SEO strategy.

Using your data to drive decision making

For many financial services companies, SEO is still in its early stages as a traffic growth channel.

Knowledge levels amongst many senior stakeholders is low, making education an important consideration. This lack of understanding also creates challenges as the timelines required to show a return may not align with their expectations.

The beauty of undertaking an opportunity sizing project is that it’ll provide you with sufficient data to head off any unrealistic expectations and keep everyone aligned, even those who aren’t SEO experts.

We’ve experienced this first hand, working with a travel insurance company whose CEO was obsessed with ranking for the trophy term ‘travel insurance’, despite this being largely irrelevant to their business as they specialised in policies for over 65s. Focusing their limited spend in this area would have yielded a terrible ROI and was in neither party’s best interest.

Using opportunity sizing data, we were able to quantify that the spend required to rank in the top three for this term was somewhere in the region of £1,000,000, and it would take approximately three years. Thankfully, these numbers were enough to shift their perspective, allowing us to pursue more worthwhile prospects that were mutually beneficial.

Using search data to steer your content strategy

Even with helpful tools like keyword research and opportunity sizing, developing an SEO strategy and applying it to your content production and optimisation activities can be a tricky business. Resources are finite, and the need to both produce and continuously improve content can be overwhelming.

As a result of these pressures, brands far too often jump straight into production, which usually results in content being created that cannibalises on existing pieces or simply doesn’t align with what users actually want.

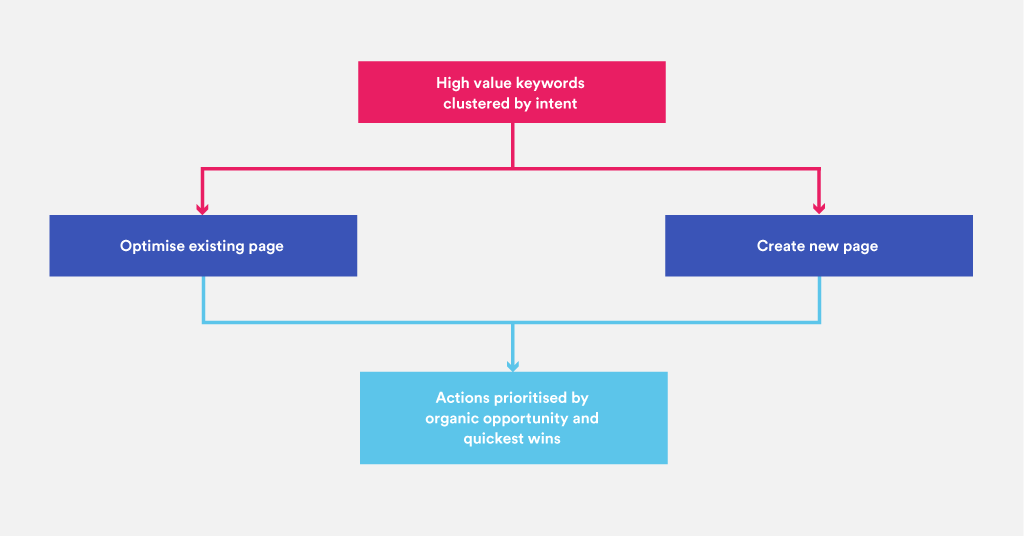

To avoid this, you can utilise data you have gathered on search demand and intent, as well as your site search data, create clusters of keywords around different topics and then map these to your existing content.

By going through this process, you can establish both content gaps and optimisation opportunities and can then prioritise accordingly.

Caption: Creating and optimising content based on clustered keywords gives clear priorities

Creating a site architecture for search success

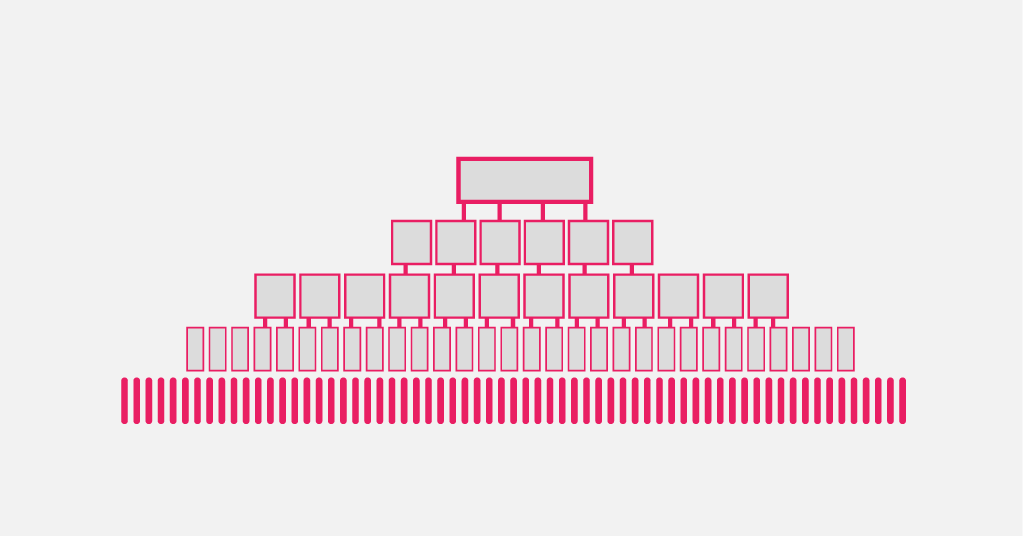

Once you’ve used this data produced an informed content strategy and assembled your keyword mapping, it’s time to plot the information architecture on your site.

By thinking carefully about the structure of your website, you can ensure that all of the pages on your site are best placed to rank well in organic search.

Caption: Example of a well-organised site structure for a larger site

Site architecture for SEO is an extensive topic, but once you’ve mastered it, you can make transformative changes to the traffic performance and UX of your site. You can read more about site architecture for SEO here or learn how those principles are applied to recruitment websites here.

As a part of this process, you’ll undoubtedly identify pieces of content that can either be consolidated or removed entirely. In our experience, organisation and simplification are often two sides of the same coin – the understanding gained from the former invariably leads to the latter.

Identifying SERP features for financial services companies

The final element of SEO you should consider when building out your content strategy is SERP features.

Google’s search results have evolved far beyond the classic “10 blue links” results and today’s ecosystem provides a rich array of options for the savvy technical SEO to discover, implement and exploit. Here’s a selection of the most accessible, easy-to-implement and commonly occurring features in today’s search results that could drive additional traffic:

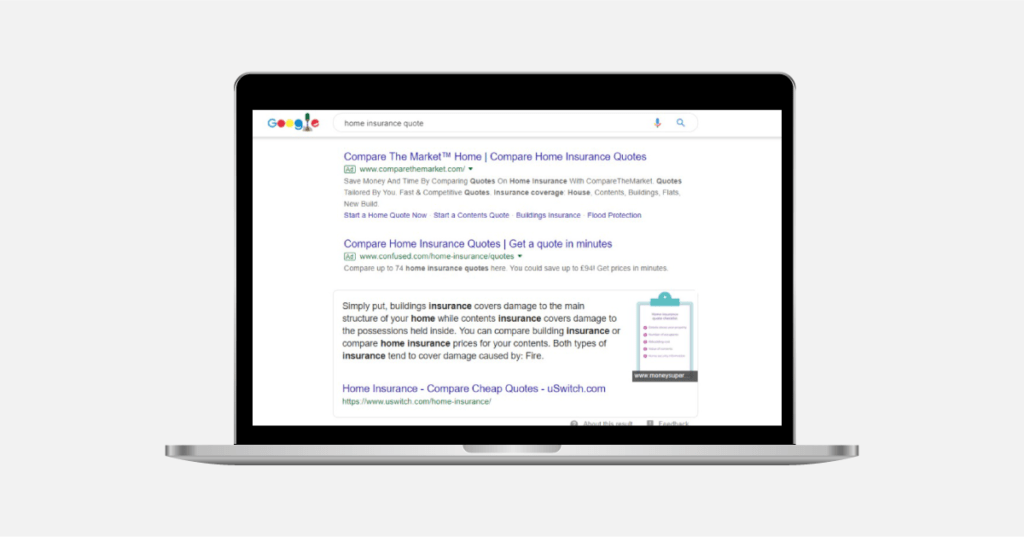

Featured snippets

Featured snippets are boxes that appear at the top of organic search results (referred to as “position 0”). You can easily achieve a featured snippet provided that your page ranks somewhere on the first page of search results. If your page succinctly answers a question, getting the result is usually a matter of using the correct markup on the page. Find out more about achieving these answer boxes in Google Search here.

Caption: Featured snippet result for ‘home insurance quote’

When an answer box appears in the search results, a dramatic drop in click-through traffic can be felt in the rest of the standard organic results as they’re pushed down the page. In contrast, the page with the answer box receives a significant traffic boost.

Given the potential benefit from the additional traffic (and the opportunity to take some of your competitor’s traffic), an answer box strategy is a must in any on-going SEO work for financial services.

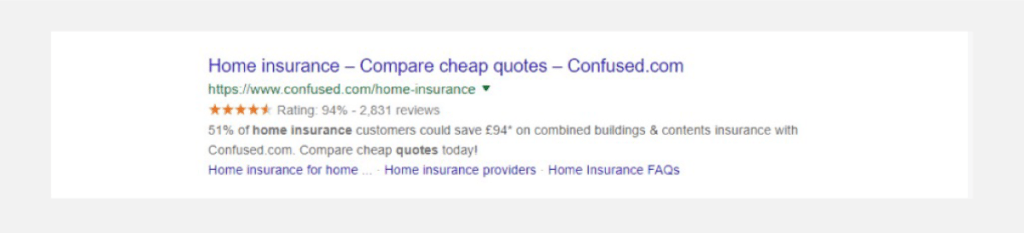

Site links or ‘fraggles’

With a simple HTML navigational aid in your content, it’s possible to create sitelinks in your search results snippets. This feature helps your snippets stand out, and with some thought you can filter the clicks your listing receives and send that traffic to somewhere more appropriate on your webpage.

Caption: An insurance provider using site links to guide users

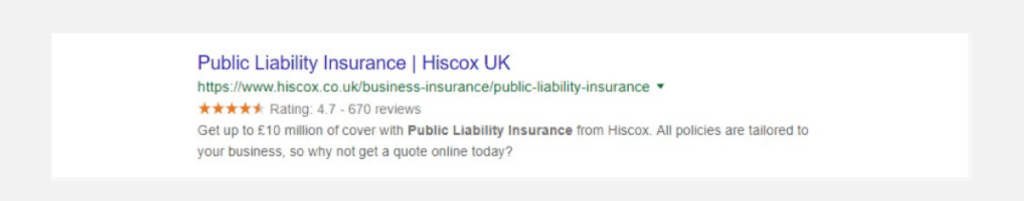

Review ratings

Review ratings have been available as rich snippet results for a very long time and are another great way to boost SERP CTR. The prevalence of review snippets has decreased over the past few years, following on from the introduction of restrictions to the types of schema that can trigger a review snippet. However, when available, they can be very effective in driving traffic.

Caption: An insurance provider using review ratings as social proof on the SERPs

One thing to call out is that this mark-up should be ‘per product’, not aggregated across the entire brand. Many financial services businesses use third-party reviews plugins that provide a singular rating and then try and apply this markup across their entire product portfolio. The outcome of this is usually a rich snippets penalty which prevents any feature from being displayed until this issue is resolved.

If you feel your brand could benefit from using review snippets, you may need to overhaul your existing setup.

People Also Ask (PPA)

People Also Ask (PAA) boxes have become an increasingly prevalent SERP feature since their introduction in 2016. Scraping SERPS for these questions can be useful for building out your own FAQ pages. We’ve used this tactic on several sites and found that FAQ sections become an invaluable resource for customers. You can also use this information to inform your on-page SEO strategy by adjusting the targeting of pages via page titles and headings, or even the creation of new pages.

Mastering measurement: tracking relevant metrics correctly

Before you put pen to paper on any kind of content strategy, you need to make sure your data is right.

Most of the new clients we meet have some sort of critical measurement error in their analytics configuration, meaning the data is wrong, the interpretation is wrong, or worse, the wrong decisions are being made on top of the outcomes of prior decisions based on incorrect data.

For example, for one of our clients, Bravissimo (case study here), online transactions were tracked as an isolated data-point, meaning that while top-line revenue was reported accurately, the team couldn’t gain insight into the wider purchase journey – cart abandonment and checkout behaviour were unknowns. Existing processes also lacked data on customers’ engagement with content, impeding the marketing team’s ability to demonstrate ROI. By implementing Google Tag Manager and applying a measurement plan, we saved Bravissimo days a month in reporting time, buying them free time to do more of the actual marketing work.

Despite 62% of in-house marketing teams believing their content marketing budget allocations will rise, and 78% of them expecting to see their content team resourcing increase over the next three years, 54% of those marketers admit they’re not getting their analytics strategy right or aren’t even sure of what to measure and how.

Data integrity is often one of those “quick wins” issues – a rogue JavaScript tag is all you need to artificially inflate or ignore page views. Issues like this have a knock-on impact on all reporting including paid channel ROI.

So, before any work begins, check that your analytics platform is correctly implemented and its data can be reconciled to real world outcomes.

To read more of our work on KPI measurement and analytics, see articles from our measurement category or check out our guide to Google Analytics.

Making the most of on-page content

Armed with a strategy that takes your market and consumers’ online behaviour into account, you can now start producing content.

On-page SEO is invaluable for creating high-quality content that drives relevant traffic, greatly contributing to your organic growth. When it comes to on-page content, quality and relevancy are critical for organic search success.

Understanding the impact of E-E-A-T and YMYL on financial services

To help brands understand the framework being used to assess quality, Google now publishes its search quality guidelines. Central to these guidelines, is the concept of E-E-A-T (experience, expertise, authority and trust) which Google’s search quality raters use to evaluate pieces of content.

This is especially important for financial services brands and ecommerce sites, which are classed as being YMYL sites (Your Money or Your Life) – essentially, sites that help users make major life decisions and therefore warrant closer scrutiny.

At this point it’s worth noting that E-E-A-T is not a ranking factor in itself; the raters only test the quality of Google’s search results, they don’t rank them. However, the signals that are used for ranking closely align to what a human would describe as being high quality. In other words, applying the criteria when assessing the quality of your own content still holds real value.

Within financial services specifically, it’s important to think about who is producing your content. Wherever possible, content should be guided by or created in collaboration with subject matter experts, to at least, reviewed by them. Taking this approach will vastly increase the probability that the content will provide additional value. It’s also worth paying close attention to trust factors, such as reviews, awards and industry accreditations, all of which can be displayed to reinforce the legitimacy of your brand.

If you’re struggling to be objective when assessing your own content, consider using feedback surveys and asking your users for their opinion. You can read more about E-E-A-T for financial services here.

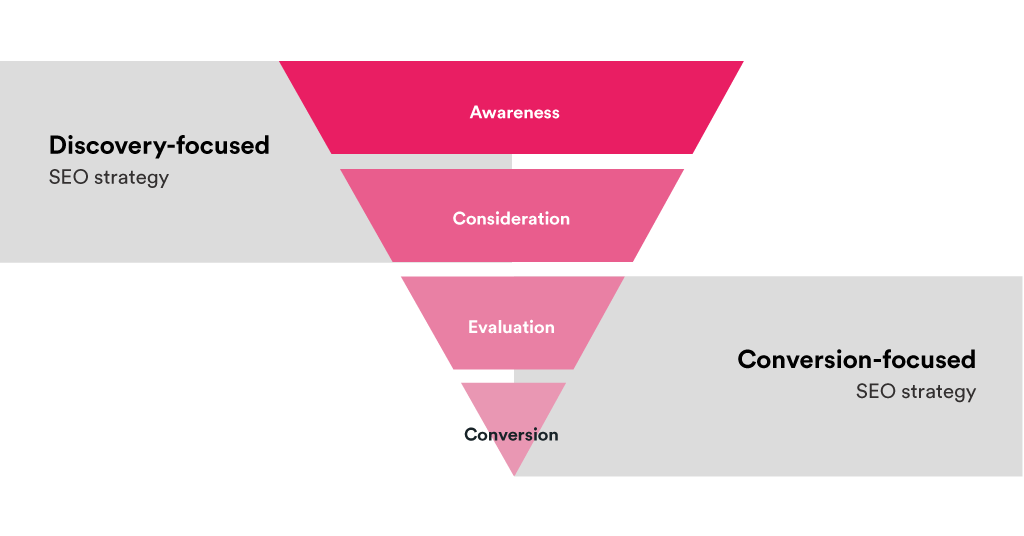

Using the purchasing funnel to steer your on-page content priorities

As well as being high quality, good on-page content also needs to be relevant for the user. The purchasing funnel can be a great too for understanding what types of user your content should be targeting and how you can adapt existing pages to meet specific intents. Using this tool, content can be split into two distinct buckets:

- Discovery-focused content

- Conversion-focused content

Caption: The purchasing funnel can be split into two distinct buckets to help you create relevant content

After using your SEO strategy to gain clarity on what on-page content needs to be optimised or produced, you can begin to plan and prioritise. Wherever possible, try to do this based on a combination of impact and effort (the impact ideally being determined by potential leads or revenue).

If you’ve prioritised using real business KPIs, you’ll usually end up working “bottom-up”, beginning by focusing on transactional, conversion-focused content, which will drive higher conversion rates, and later supplementing this with supporting informational content.

And when it comes to conversion-focused content, the most logical place to start is with your product pages.

Producing industry-leading product pages

Typically, product pages will follow a uniform layout, with a specific subset of modules available for use. Before optimising or creating individual conversion-focused pages, it’s worth analysing these templates and requesting any tweaks or enhancements that are likely to boost organic search performance.

Taking this approach is much more scalable when working with enterprise-level sites, where it’s commonplace to have an extensive product portfolio. Having a solid page structure from the get-go will make your content creation and optimisation activities far easier because you already have a strong foundation. Once you have a template that you’re happy with, you can begin working on your on-page content.

Start by analysing your own product pages, taking into consideration your keyword research and product knowledge from your SEO strategy. Ask yourself whether these pages contain all of the information users will need to move from the evaluation stage to conversion.

Next, look at some of the top competitors within your space. Are there any commonalities between the pages? Which product pages are most appealing to you as a user?

Some of the things we’d recommend looking at are:

- Page headings and subheadings

- Product information

- Price information and CTAs

- Customer service information

- FAQs

- Related content modules

- Trust factors (e.g. reviews)

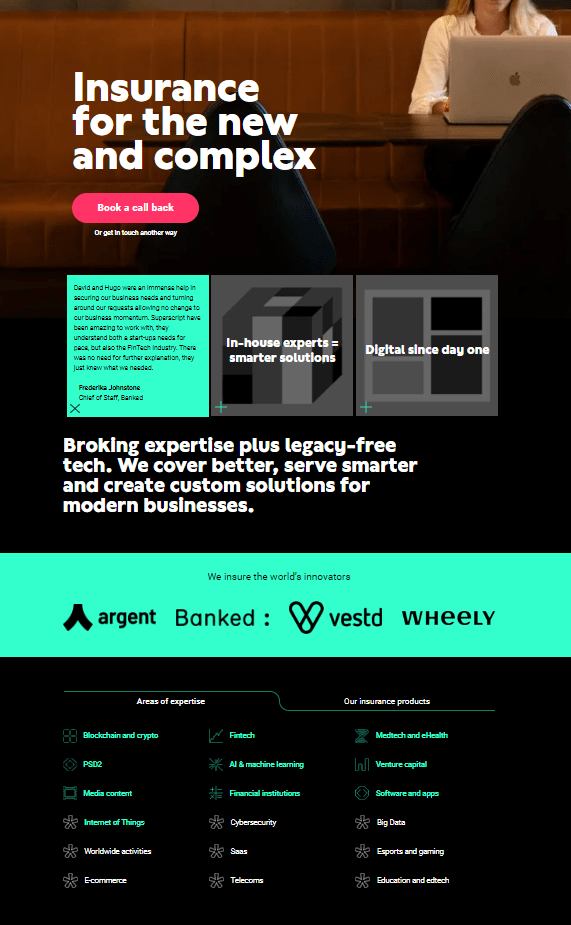

Business insurance provider Superscript are a great example of a brand with an industry-leading product page template. Their headers are well optimised, critical policy information and benefits are prominently displayed, and so are CTAs and trust factors, including reviews and existing customers. Commonly asked questions are also answered on-page within an FAQs module, and informational content is linked within a carousel.

Caption: This insurance page demonstrates Superscript’s industry-leading page template

One small refinement we’d look to make here would be updating the related content carousel, to display content relevant to the specific page rather than the three latest blog posts. This would make it easier for users to discover related informational content and provide another signal that the pages are semantically related.

Creating discovery-focused content with purpose

The most effective content marketing strategies are empathetic to the needs of potential customers. Your strategy should not only prioritise conversion-focused content, but concentrate on driving highly targeted traffic into the awareness and consideration stages of the funnel as well – just make sure the right pages are visible when the customer’s intent screams “I’m ready to buy”.

Conversely, a bad strategy that relies too heavily on one or the other can actively harm a brand’s organic search performance by diluting relevancy and sending negative quality signals.

A good rule of thumb here is to think carefully about the type of information a user would actually want from your brand before committing to an idea.

As an example, a user looking for a credit card may be interested to understand how credit scores are calculated, how to improve their credit score or the different types of credit cards available. They probably don’t want to know what the 10 most expensive cars in the world are. If they did, they’d visit a site about cars.

A good way to ensure relevancy in your on-page content is to start by reviewing your search data to determine the types of questions users are asking as they make their way through the purchase funnel. Make sure you have content that caters to these needs first. Often, this means prioritising things such as buyers guides and how-to articles.

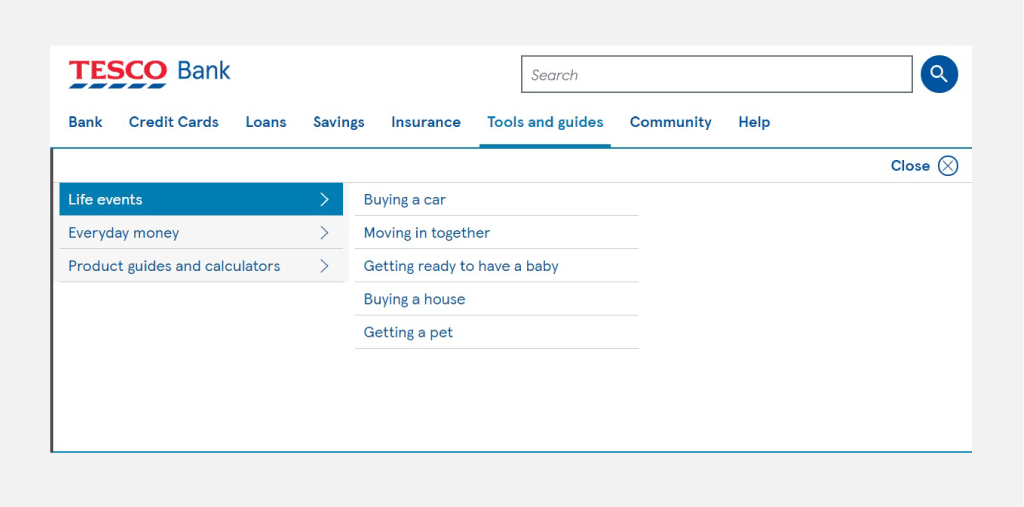

Tesco Bank has done this well by sticking to three core areas for their on-page content: life events, everyday money and product guides. This feels very targeted and aligns perfectly with their offering.

Caption: Tesco Bank’s navigation options show their understanding of audience groups

If you’re struggling for ideas, try spending time with your customer service reps or sales teams. They’ll undoubtedly have a list of the most frequently asked questions because they deal with customers every day.

A query you may well have when going through this process is whether it’s ok to cover the same questions within the product page FAQ modules and a guide. In our experience, the answer to this is yes. While it’s important to avoid cannibalisation, you can use the FAQs module on product pages to provide succinct one/two sentence answers to related questions, and then expand upon these answers within your guides.

This is exactly what Simply Business has done with the question ‘what is professional indemnity insurance’:

- https://www.simplybusiness.co.uk/insurance/professional-indemnity/

- https://www.simplybusiness.co.uk/insurance/faq/what-is-professional-indemnity-insurance/

Catering to diverse preferences through different formats

When you’re creating content, don’t be afraid to experiment with different formats.

Some users will prefer video, for example, and it’s worth bearing in mind that YouTube is the second-largest search engine and can be leveraged as another source of traffic. Short videos also tend to be more popular on social media and can make your content more accessible.

Often, a singular guide can be broken down into a series of short videos as part of a well thought out content distribution strategy.

PensionBee, for example, has a well-optimised YouTube profile which features a host of short videos covering common pension questions, as well as videos featuring customers who have benefitted from its services.

Caption: PensionBee’s YouTube content answers key questions users might be searching for

Navigating compliance

The final thing to bear in mind as you create and optimise your on-page content is internal dependencies.

As part of the content creation process, it’s important to construct an approach empathetic to the constraints of other teams within the business who may need to be involved.

Within financial services, it’s virtually inevitable that all content will have to be reviewed by a compliance team. Often, these teams are under resourced and being pulled in a lot of different directions. It can be difficult for someone within a marketing role to exert much influence over these timelines.

Instead, we’ve had more success by having conversations with compliance teams about what turn-around times they can commit to. This can then function as a rudimentary SLA and be accounted for within project timelines.

If this turnaround time is a month and you want a campaign to launch on a specific date, then the reality is that you need to have a finalised version of the content ready the month before.

Utilising off-page SEO for financial services

Whether you like it or not, links are still a key Google ranking factor. Therefore, off-page SEO will be an irreplaceable companion to on-page efforts.

Within a head-term heavy vertical like financial services, ranking for the top keywords can be extremely lucrative, but competition levels are understandably fierce. A solid link building strategy can boost your organic growth even further and allow you to continue competing.

We recommend a dual approach to link building, combining always-on flexible link building activities with the creation of larger campaigns.

Harnessing the power of niche relevancy

As impactful as Digital PR campaigns can be for boosting organic visibility, it is all too common to see campaigns go live with very tenuous topical relevance to the business. In this scenario, the lasting benefits are often limited, however well the campaign does. This is because:

- The content isn’t that relevant to the business or its users

- The websites – and their link profiles – aren’t that relevant

- The links are quickly pushed deep into the architecture of the colossally large media site they reside on, meaning that minimal link equity is passed through

When it comes to link acquisition nowadays, your focus needs to be on quality, not quantity.

“The quality over quantity conversation continues to be rife with brands and indeed within the industry itself, and it’s very clear that more work needs to be done to overturn continued misconceptions. On surface level it may seem like your competitor is outgunning you because it’s got more links, but chances are it’s down to the quality and relevance of those links, alongside the two other core pillars, technical SEO and on-page.

Digital PR, off-site teams and internal advocates must continue to champion the importance of quality, and take the time to educate in-house teams, particularly more senior stakeholders, otherwise we stand to jeopardise organic performance in the long-term”.

Olivia Wiltshire, Head of Digital PR, Builtvisible.

Identifying prospects

There are a variety of different techniques you can employ to generate a solid list of prospects for flexible link building. One of our favourites is to perform a bulk link intersect. Performing this analysis at scale will help you get a whole market view of link acquisition. This in turn will:

- Surface links that your competitors have which are easily replicable

- Demonstrate the strategies that are likely to work within your sector

- Identify industry-specific media sites to outreach to when you do your next large campaign

If you’re searching for further link opportunities, other approaches to consider include:

- Link reclamation

- Link realignment

- Journo requests

- Local link building

As an example, let’s look at the caravan insurance niche. A quick link intersect (which involves pulling together all the websites linking to a competitor site but not your own) highlights that caravan clubs, parks and associations are a big opportunity, as many have links and resources pages.

Caption: The NCC website feature a list of potential finance and insurance providers for caravanners

This type of business-as-usual (BAU) link acquisition receives a lot less attention than larger campaigns – let’s face it, a few links on a caravan site doesn’t sound that glamorous – but something being boring doesn’t mean it isn’t effective, and some of the link profiles really speak for themselves.

Caption: Example of the NCCs strong link profile. Data from Majestic SEO

Ultimately, it’s worth remembering that Google is building a link graph of the web and using it to rank websites. With such a heavy emphasis now placed on relevance for both off and on-page SEO, there are some sector-specific websites that it simply expects to see within the profile of a site.

If an industry publication links to all your competitors and not you, then what does this say? How can you claim to be an authority if you have no presence here? Filling this gap within your link profile will be far more impactful than another two no-follow links from the Mail Online.

Creating effective campaigns

Whichever way you look at it, investing in larger campaigns can be a risk. Both the costs and time commitment involved can be high, and there is no guarantee that the campaign will succeed.

However, to stand a chance within such a competitive marketplace, the reality is that the bigger campaigns are often necessary to secure larger injections of equity.

What is needed is a risk mitigation strategy. Aim to be objective when evaluating your work and ask yourself questions like:

- Is your idea genuinely useful for the target audience? E.g. does it provide a practical element?

- Is it surprising?

- Is it hot/topical?

- Does it provoke an emotional response?

- Does it have longevity? If not, can the data/material be refreshed?

- Can we provide journalists with robust material?

- Does it have multiple angles and headline potential?

- Is it novel?

Another step we would recommend is conducting preliminary outreach. This will further reduce risk and can often help secure interest in a piece at a very early stage.

Overcoming technical issues to boost your financial services website

Another piece of the puzzle, technical SEO is an important factor in supporting your on-page and off-page growth and further improving your organic rankings. It’s true that financial services websites tend to be smaller than those in other sectors, which means that potential issues, such as crawl budget, are less of a concern. However, it doesn’t mean that technical SEO is less important.

A bad technical setup can actively hold you back and prevent your site from realising its true potential. On the other hand, a good technical setup will put you in a position to be competitive, provided your on-page content and link profile are up to snuff.

What technical SEO factors matter in 2023?

Increasingly, modern technical SEO is presented as a series of activities that are undertaken to improve user experience, and it’s certainly true that UX factors, including page speed, mobile-friendliness, and security, have become increasingly important over time.

However, it’s still very possible for technical mistakes affecting search engines but not users to have a dramatic effect on a brand’s bottom line. In fact, when you consider the expansion of structured data types, you could argue we’re now providing more search engine specific information than ever.

As always, what’s important is providing a good experience to both users and search engines.

In addition to the factors mentioned above, we would recommend looking at crawlability and indexability to check how your website is performing.

In terms of crawlability, you need to ask if key pages can be crawled and if they are well linked to and easily accessible. To answer these questions, check your internal linking, XML sitemaps, pagination, redirects and crawl errors.

To get a sense of your website’s indexability, you need to know if key pages can be indexed and whether lower quality pages are blocked. We recommend checking meta robots tags, robots.txt rules and making sure the main pages have the correct canonical tags.

Fixing common technical SEO issues for financial services websites

URL capitalisation

IIS is case insensitive, meaning it will treat both capitalised and non-capitalised URLs as the same. e.g.

This can create a potential duplicate content issue, as Google is case sensitive and will treat either variant as a unique URL.

To tackle this issue, try manipulating a few URLs on your site to see if the capitalised version either 301 redirects to the lowercase version or has a canonical tag pointing at the lowercase version. If it doesn’t, talk to your devs about introducing a redirect rule to enforce lowercase URLs consistently. This is much better than relying on canonical tags, which can be easily ignored.

Note: check your internal linking to see if you already have a large volume of pages indexed/ranking using capitalised URLs. If you do, this change is essentially a site migration and will need a bit of extra thought.

URL extensions

Out of the box, many IIS CMS’ have questionable URL handling, resulting in even more duplication.

Common scenarios to watch out for, include:

- Homepage duplication:

- File extensions:

- Host name:

- Trailing slash:

- Space in URLs:

Again, you can solve this problem by manipulating a few URLs on your site to see if the same content is accessible at multiple variants. If it is, introduce the appropriate redirect rules and tidy up any internal linking to point to the canonical version.

Soft 404s

Whenever a 404 page is served, it should also return a 404 (Not Found) status code. Unfortunately, on many IIS sites, a 200 (OK) status code is returned.

This is because, technically, the 404 page template did exist (hence the 200 being returned). A similar thing often occurs with the server error page template, which is served when a 5xx status code is returned.

Another variation to watch out for is a 302 redirect being served up before the 404 page.

In both instances, the web.config settings should be updated to ensure that every error page returns the correct status code and page template.

Core Web Vitals for Financial Services brands

Alongside these specific technical issues, making sure other general website factors are robust is essential for both user and search engine experience.

Although it has been a minor ranking factor since 2010, the introduction of the Page Experience update in June 2021 helped reinforce the importance of page speed in search. Google’s Core Web Vitals metrics are an exciting development in this area because, unlike many prior metrics, they are specifically focused on real-world, core user experience needs.

Initial industry data indicates that the impact from this update has been minimal so far. This is unsurprising when you consider that only 14% of URLs currently pass all three metrics within a competitive data set.

In truth, the ranking benefit of passing the CWV assessments will be heavily dictated by your competitive environment. Given the competitiveness of financial services, it’s not uncommon for sites to be closely matched in terms of content quality and authority. In these cases, factors like page speed can become important tiebreakers.

Then again, many finance companies are in the infancy of digital marketing maturity, meaning the bar is often lower than in other sectors. Within stocks and shares isas, for example, out of 169 URLs ranking within the top 50, only 79 return field data. Of those 79, only 19 URLs have scores that would be categorised as ‘good’ for all three metrics (a paltry 24%).

This data doesn’t mean you should ignore CWV entirely, though. Page speed enhancements have excellent conversion rate benefits, and competitors may improve over time. Instead, you should think carefully about prioritisation and use your SEO strategy to decide what to focus on.

Overcoming dev constraints

At large, established financial services brands, technical debt can be a big challenge.

Key website components and journeys are often reliant on antiquated legacy platforms, and dev resource for fixes and upgrades is always in short supply.

To maximise the chances of securing resource, it’s absolutely key that requests are clearly prioritised, development and SEO workflows are integrated, and SEO departments are willing to provide a business case detailing the likely revenue impact of the change.

Taking this approach, you’ll be able to weed out many of the ‘best practice’ requests that are not built upon solid rationale and become laser-focused on the most meaningful activities for your brand.

Conclusion

Often overlooked, SEO is a great tool for boosting the impact of organic traffic growth. While this is important for all brands, it’s a particularly pertinent issue for financial service brands that operate in such a competitive market.

By combining a data-driven SEO strategy with on-page and off-page efforts, excellent results can be achieved in terms of traffic and growth. However, these improvements can be dampened by a technically unsound website. Fixing fundamental technical SEO issues is then the key to maximising your website’s performance organically.

For more information on these other aspects of SEO, take a look at our services pages for technical SEO, content and off-page link building.

If you’d like to talk to Builtvisible about any aspect of its work for financial services companies in the UK and internationally, get in touch via our contact form, and we’ll get back to you for an exploratory discussion.