Defining your organic competitive landscape

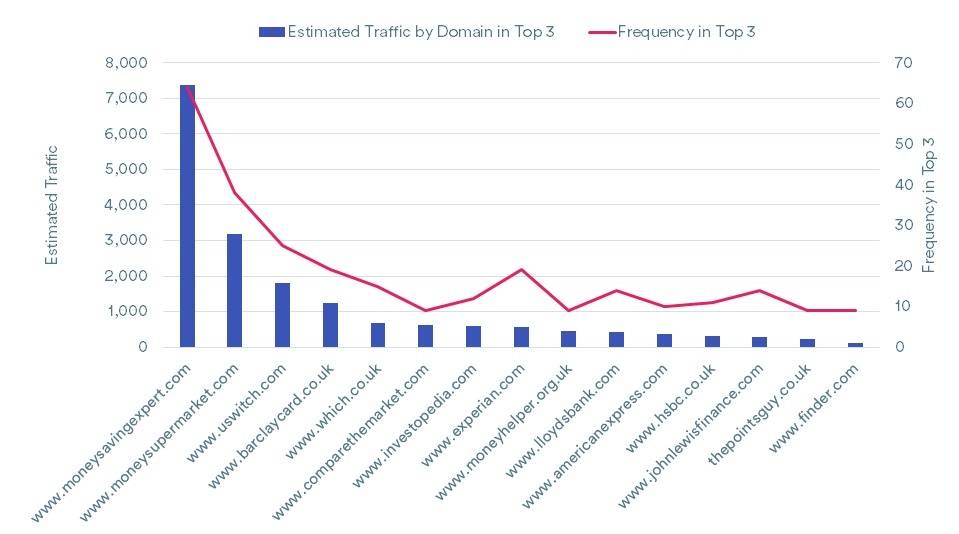

When carrying this task for our clients, the first step we do is to build a relevant – but realistic – set of keywords for them to target organically, along with a number of data points per keyword, such as search volumes, existing ranking positions, CPC, etc. We then use two measures to identify who are they really competing with organically:

- Frequency of appearance in the top 3 organic results positions (for the given keyword set); and:

- Estimated non-brand organic traffic.

The output looks like this:

Organic competitive landscape for a website operating in the financial industry.

When carrying this analysis for our clients’ websites, we usually find ourselves engaged in interesting conversations around points such as:

- Product comparison sites trumping other players.

- Why marketplaces with vast product ranges perform so well.

- Higher visibility does not always equal increased levels of traffic.

- Why editorial outlets perform highly in the landscape.

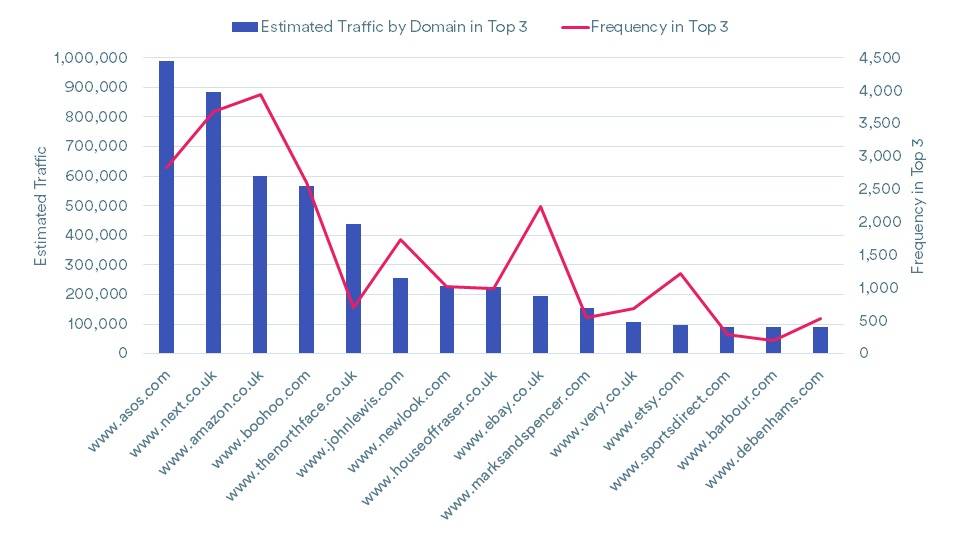

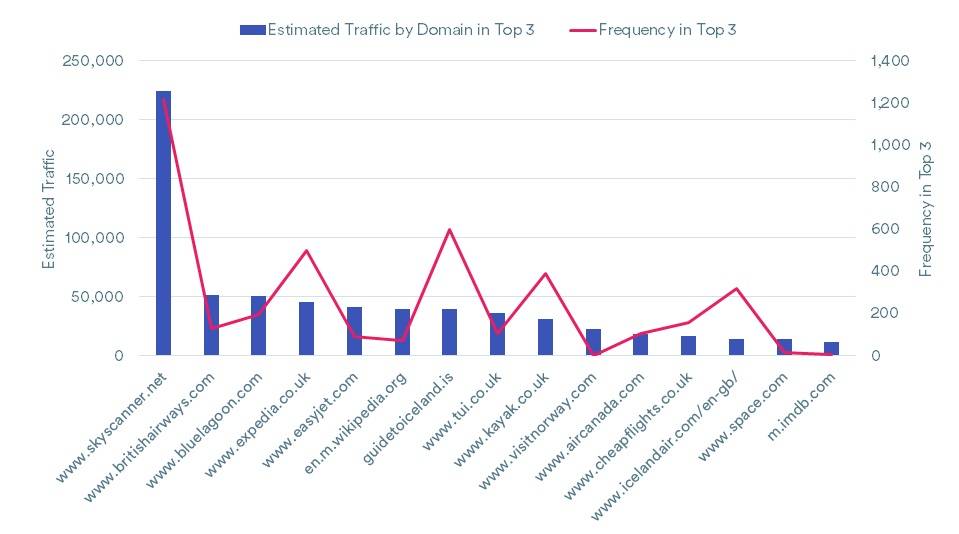

Below are another couple of examples, but this time, the search landscape corresponds to an eCommerce client and another one operating in the travel industry:

Top 15 domains by traffic share for an eCommerce themed keyword set

Organic competitors for a site operating in the Travel industry

This data is incredibly valuable, as it can also allow you to benchmark current performance before carrying out your SEO strategy. By comparing this data before and after your strategy is executed, you can provide a tangible – estimated – impact to your work.

Over the years that we’ve completed this analysis for our clients, we’ve seen changes in the types of websites that surface, reflective of the various algorithm updates and how results are presented on the SERPs. Some of these changes are consistent across multiple industries.

We’ll now look at some of those who consistently appear and why they do so.

Dominant aggregators and ubiquitous marketplaces

In recent years, there has been a rise in aggregators and marketplaces dominating organic search results in various industries, including travel, finance, and eCommerce. These types of sites aggregate and list provider data from across a market on a single page, often with filtering and comparison features, making it easy for searchers to find the information they need and compare different options all in one place. Some examples of websites are MoneySupermarket, Money Saving Expert, Skyscanner and Expedia.

Like aggregators, marketplaces have become increasingly popular with consumers as they offer a convenient and efficient shopping method.

Both have also had a significant impact on the way businesses organically compete. On many results pages, you’ll see aggregators block out the top three positions, and, as a result, the total traffic opportunity for many brands has significantly reduced. In many cases, aggregators and marketplaces have become the primary destination for consumers thanks to their brand-building activity and incentives, meaning that businesses can no longer rely on organic search traffic to drive sales from these searches.

Authoritative top-level domains

Authority remains a key signal when it comes to ranking organic search results and, in some cases, is highly scrutinised where a product or service offered has the potential to impact someone’s financial or physical health. It’s not uncommon therefore for us to see official government websites, regularity bodies, national tourism agencies and health providers appear in competitor analysis when profiling a company operating in a relating niche. These are often easy to spot, as they tend to use top-level domains such as .gov or .org.

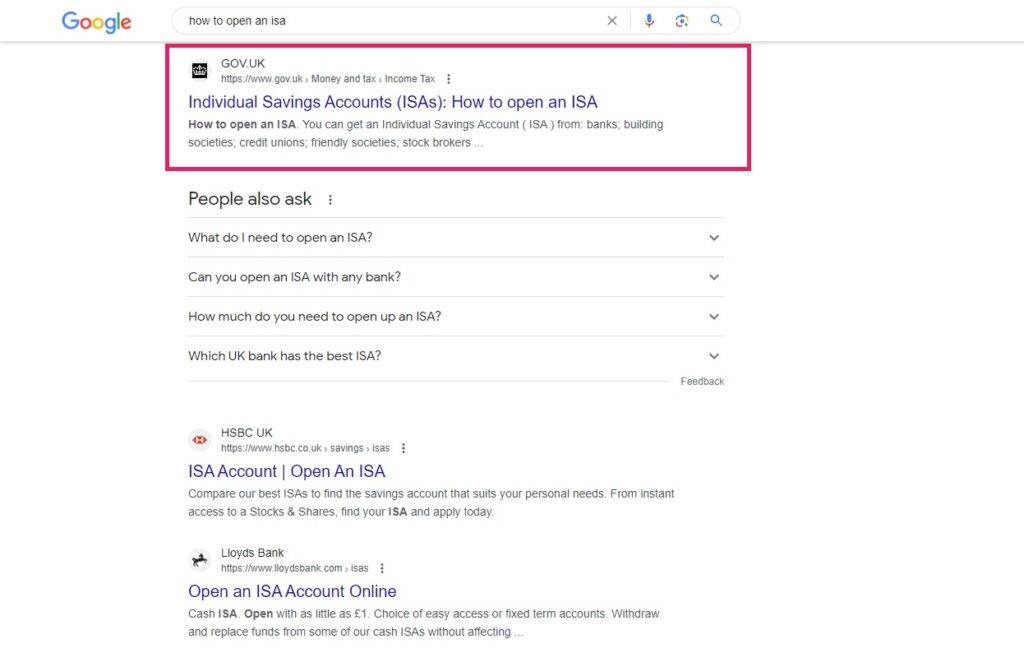

You can clearly see this when searching for ‘how to open an isa’ in the UK. The content of the gov.uk landing page (occupying position #1) is fairly thin, but it’s enough to satisfy intent as it clearly states where you can get an ISA from and allows users to contact a provider directly to gain more information. In spite of being thinner, Gov.uk’s page still ranks first ahead of reputable providers such as Lloyds Bank, Halifax and Nationwide – all of which rank with transactional templates.

Jon Mueller has explicitly stated that governmental websites such as gov.uk aren’t prioritised when ranking results. These domains, though, are highly reputable sources of information which usually satisfy users intent effectively and tend to rank highly. In spite of that, they are rarely thought of when our clients list their competitors. Let’s say you are the CMO at Lloyds Bank; would you list gov.uk as one of your organic competitors when asked by your SEO team?

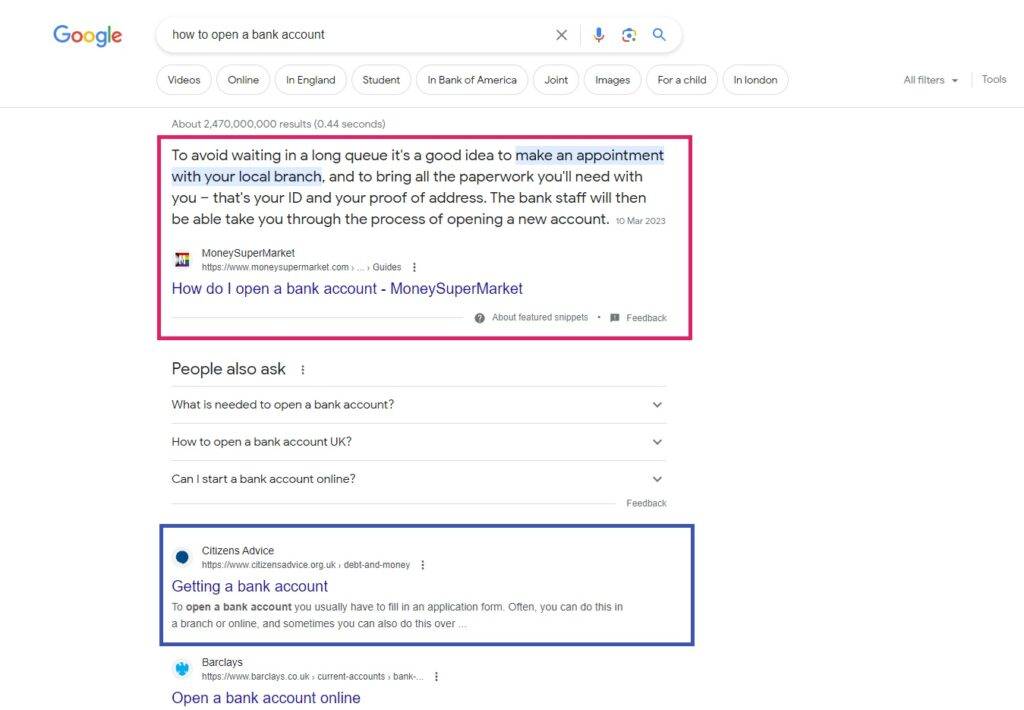

Let’s have a look at another example. When searching for ‘how to open a bank account’ in the UK, MoneySuperMarket hold top spot ahead of Citizen Advice in second. Both outrank Barclays in third:

Publishers and editorial outlets

Due to how Google interprets the intent behind a search query, it’s not unusual to find instances of editorial-based domains amongst your search competitors. These domains publish a wealth of content daily on various topics.

For many searches, Google can struggle to determine the accompanying intent and, as we’ve seen above, they often offer mixed results, ranking informational content along with transactional pages. This is something that’s undoubtedly benefitting this type of sites.

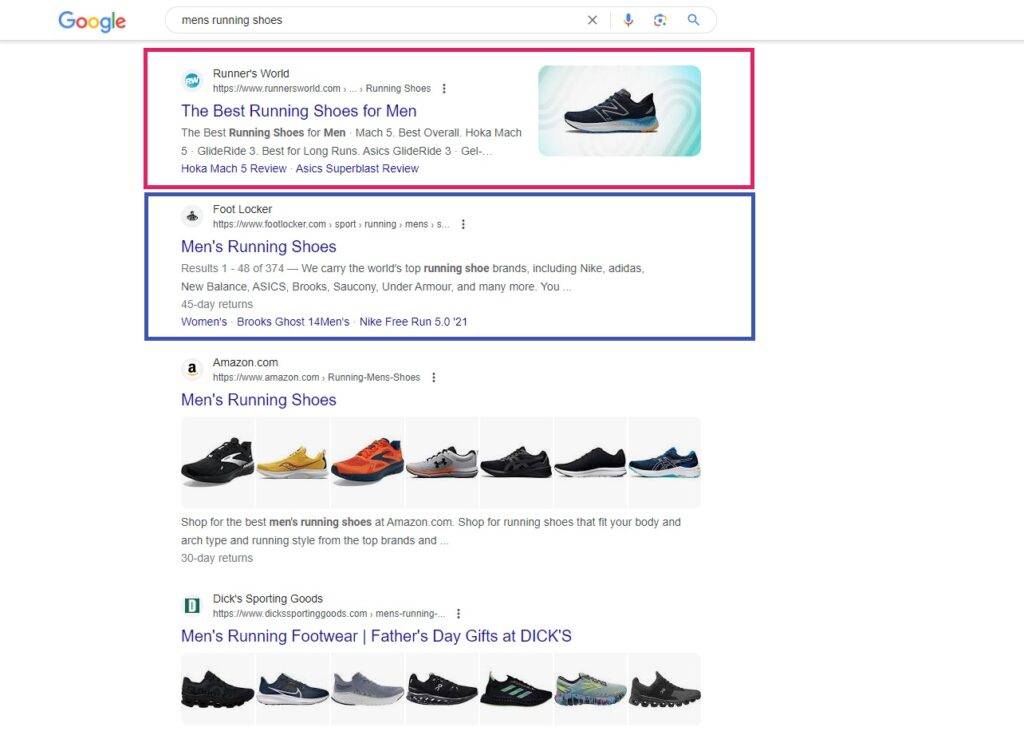

Below is an example for the query ‘men’s running shoes’ (this time we are searching from a US location). The first position is held by Runners World, a publisher of magazine content (both online and offline). In this case, they offer informative content with their take on the best running shoes for men, covering a list of manufacturers. Transactional intent is covered below this, in position two and beyond.

This is a good example of how other websites, away from your direct competition, hold prime positioning and surface in an overview of the competitive landscape. Not considering these when defining your SEO strategy will only lead you to failure.

Sidenote: Should you be in the position of needing links to improve the performance of key landing pages, any industry-specific publications that you find (such as Runners World for health and fitness brands) present prospects for future outreach efforts and improving topical authority.

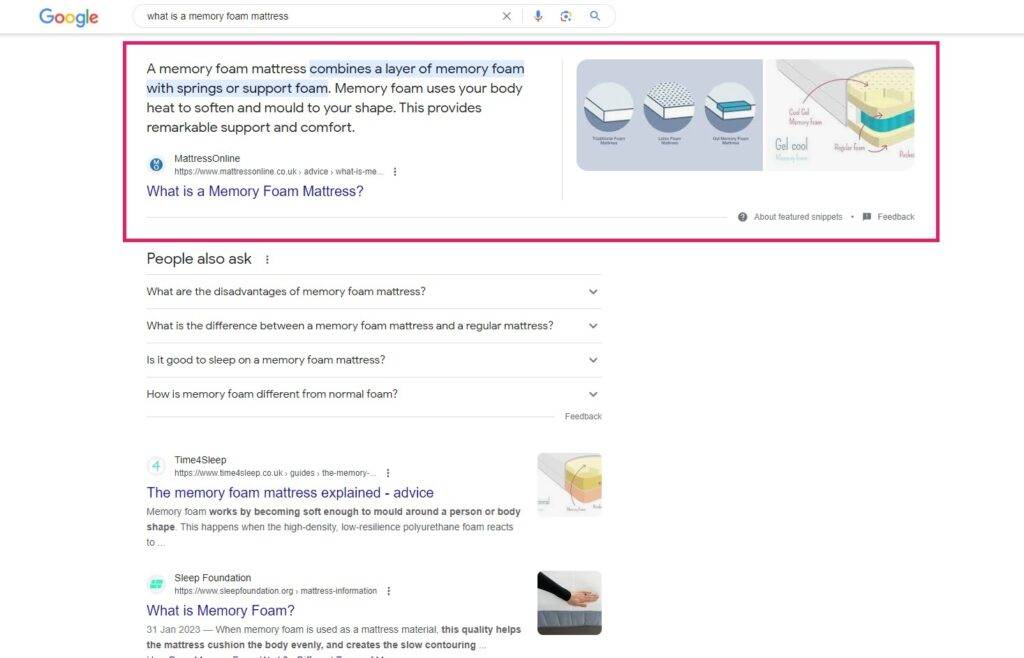

Search feature holders

It’s broadly known that an effective way for brands to unlock organic exposure – and therefore clicks – is by appearing in featured snippets. To quote Google, these are “… special boxes where the format of a regular search result is reversed, showing the descriptive snippet first.” They’re aimed to help searchers find an answer to their query immediately on the SERP and is one of the most impactful features rolled out to date.

This feature allows smaller brands to gain a better seat at the table of competition, albeit for informational search intent. Whilst these searches have a low, immediate transactional intent, they do plant a seed for the brand featured in mind before the consideration stage of the path to purchase and increase the brands’ exposure. If you’re not rivalling for featuring here yet, you should seriously consider this. Start by checking if you have relevant content to do so and, if not, you may well have uncovered a new content opportunity.

Another feature that changed how businesses compete through search is the local map pack, requiring businesses to have a dedicated local strategy should they want to perform well for localised ‘near me’ searches.

In the past, companies could rank well for local searches simply by having a strong website and being listed in online directories. However, today, Google and other search engines are taking a more holistic approach to local search rankings, considering factors such as the business’s NAP (name, address, and phone number), reviews, and proximity to the searcher.

How does the landscape look for you?

These are just a few examples of types of sites that tend to surface when analysing our clients’ organic competition across different industries.

Understanding the competitive landscape that you’re looking to increase your market share within, is the first step if you want to fine-tune the opportunities that sit in front of you. Increased awareness is something you can start building today with a few searches for priority keywords. You will certainly find domains that outrank your site but aren’t direct competitors to your brand.

Extending this to a broader keyword data set will provide extremely valuable insights when defining your SEO strategy and help you to utilise your budget more effectively, providing a higher return on your investment.

When carrying out the analysis, you’ll also need to consider the following:

Why are top-performing domains being rewarded?

Spend time auditing the winner domains at a macro level (high volume, transactional searches) and those at the micro level (low volume, informational searches). When doing so, look to identify the following:

- What type of content is being offered?

- Is it of good quality?

- If applicable, how strong are E-EAT signals?

- Is the above supported with a good page experience?

- Are backlinks a factor?

Understand where you can compete

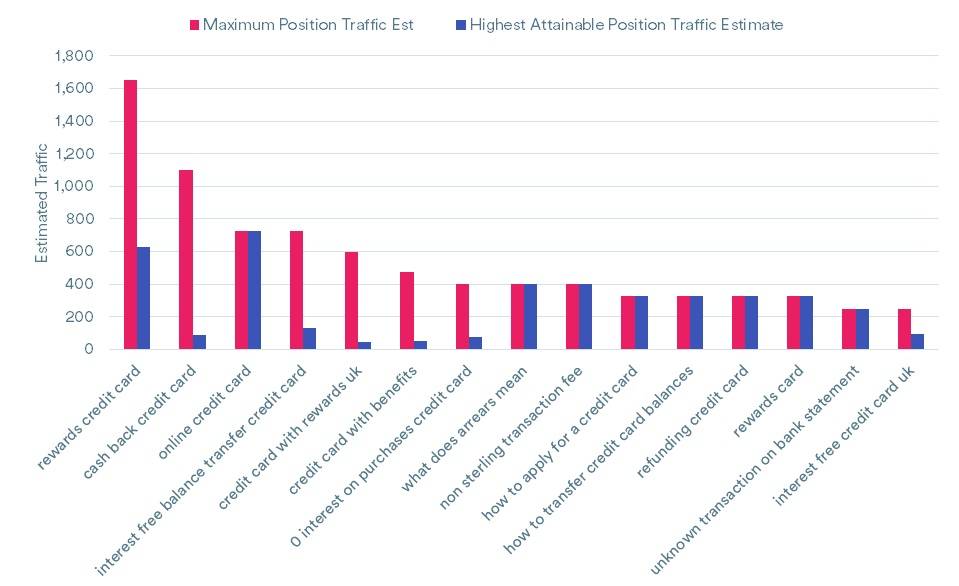

Going deeper, with bulk ranking data, you can better qualify the keywords to compete and capture the first position realistically.

We’ve recently done this for a client within the financial services industry, for which search results were dominated by aggregators. We adjusted the maximum attainable positions for results where aggregators blocked out the top positions to arrive at a more realistic figure when sizing the total organic opportunity.

The chart below shows how, although some keywords offer sizable opportunity, there are significant drop-offs after adjustment for transactional terms.

Closing thoughts

Understanding your organic search competition is a highly valuable activity that will set you up for success. It allows you to extract the most sizeable – and yet realistic – opportunities in front of your brand to capitalise on, allowing you to maximise your return on investment. Not considering this when defining your SEO strategy, will put you at risk to somewhat mindlessly burn through your budget, trying to make inroads on websites that won’t budge from the top-ranking positions.

In addition, knowing your search competition can also help to inspire and generate new ideas for themes of content you might be missing to unlock prime visibility in stand-out features.

Need help defining your search competition whilst defining the SEO strategy to compete? Get in touch to see how we can help.