Search behaviour changes are the new algorithm update

The way people are using the internet has fundamentally changed, and the full consequences of what happened two weeks ago have not yet been realised.

COVID-19 has created a paradigm shift whereby all of a sudden Google’s algorithm – something we have been obsessed with since SEO came into existence – has become a secondary concern.

Those who will prosper in “the new normal” (and I hate myself for saying that) are those who understand, react to and predict shifts in human behaviour, as opposed to Google. The brands that will thrive are the ones that structure themselves, build tooling and employ process around the ability to pivot almost immediately.

Understand the variance: Integrating trends with search volume data for faster insight

Google Trends charts have been flying around on social media and even making their way into the mainstream press. It is all very interesting at a granular level, but I would argue lacks the scale that will help brands capitalise on the duality of the Stockdale Paradox. At scale, the overlaying of trends data onto more traditional keyword data informs marketers of the potential variance between seasonal expectations and reality. This merger of data can make re-forecasting on a regular basis more meaningful.

And this isn’t just about organic search. As our client at Adidas discussed at length at our recent ecommerce breakfast event, robust, relevant SEO data can be used across businesses to help inform decisions far beyond the scope of many C-suite perceptions of SEO.

Everything happening around us right now gives SEO practitioners the license to add value far beyond their remits by helping business leaders and decision-makers remove the scariest thing outside of the virus itself – uncertainty.

At Builtvisible, we have a wealth of data from our clients and have used this to counter the panic culture we have seen proliferate in the wider economy (hope everyone is well-stocked with toilet roll now). We have worked over the past week to build tooling that helps us drive at-scale trend tracking insights to arm our clients with intelligence that helps them take the sting out of the snap decisions they are seeing around them. This means they can make rational, strategic decisions to protect them now, capitalise on any opportunities that the next few months unearth and arm them for growth when recovery comes.

There is a strong and widely stated argument that says we should keep SEO activity running now to drive rankings for when the demand returns, but as SEOs, we can be going far beyond best practice to influence our clients and their businesses positively .

We, like everyone else, are a business who have experienced a shock to the system. We’ve spent the time so far re-grouping and planning a strategy to keep the doors open and to find ways to help our clients do the same. We hope that this work will pay dividends in the medium term by forcing us to review our products and processes to make them more relevant to sudden economic shocks. Our advice to clients is the same as our advice to ourselves: accept reality but also choose to stand up and tackle the challenge head-on or they simply won’t exist in 6 months’ time.

What we’re seeing in our clients’ data

The reality is that rank tracking as we know it is dead. For it to be useful, it needs to be augmented with trends.

Two of our core sectors are ecommerce and financial services – both of which have seen huge fluctuations in searcher behaviour over the last few weeks. As such, we have offered some high-level insights into the trends we are seeing, based on data pulled from our own tooling.

We are using the SERPwow API to pull Google Trends data into our existing setup, and for the purposes of this exercise have parsed data back to January 2019. This approach gives us the ability to see variance against seasonal expectations on specific groups of keywords and highlights rapid trend changes as consumers learn to cope with their new situation.

Our data focuses on rising, at peak and falling demand trends in our client keyword data:

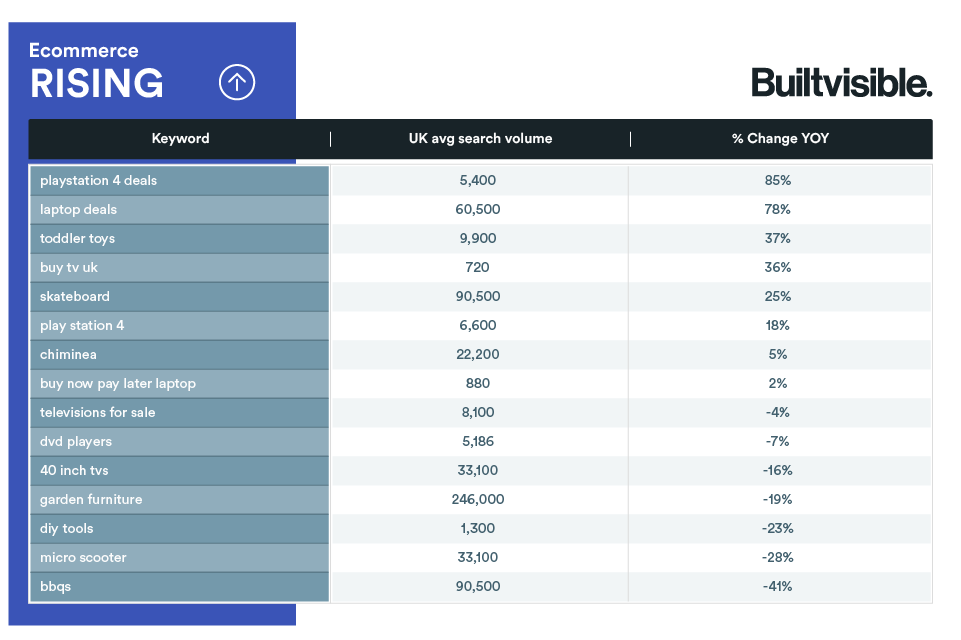

- Rising: keywords where demand has increased consecutively each week for the last 4 weeks

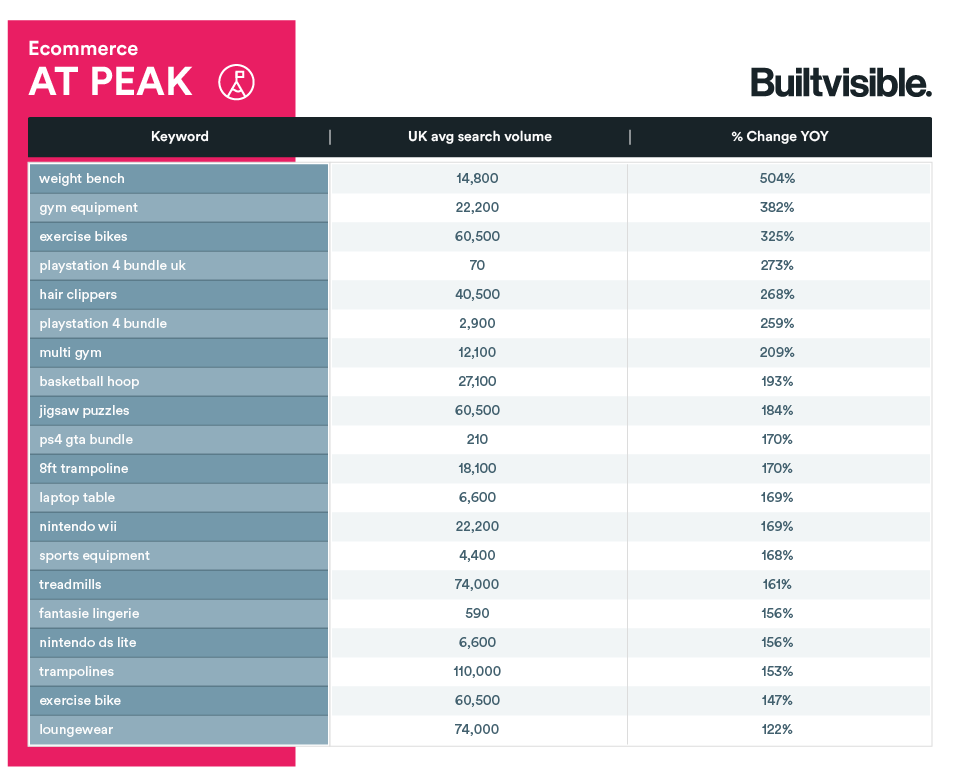

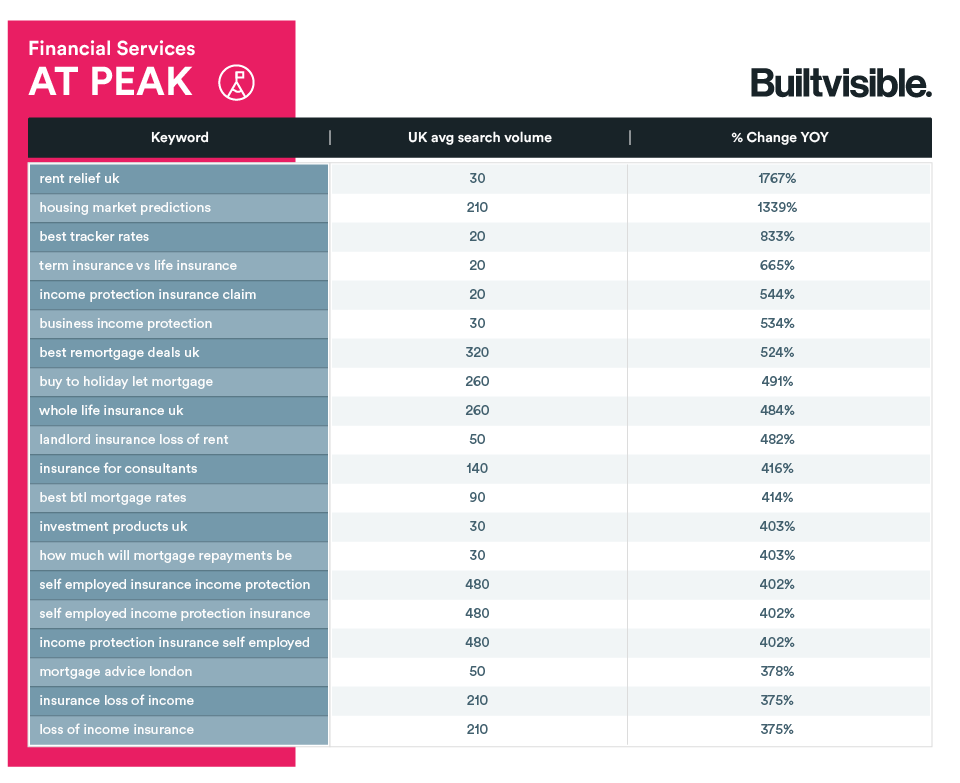

- At peak: keywords that have reached a peak demand since January 2019, during w/c23rd March 2020 (last week at the time of writing)

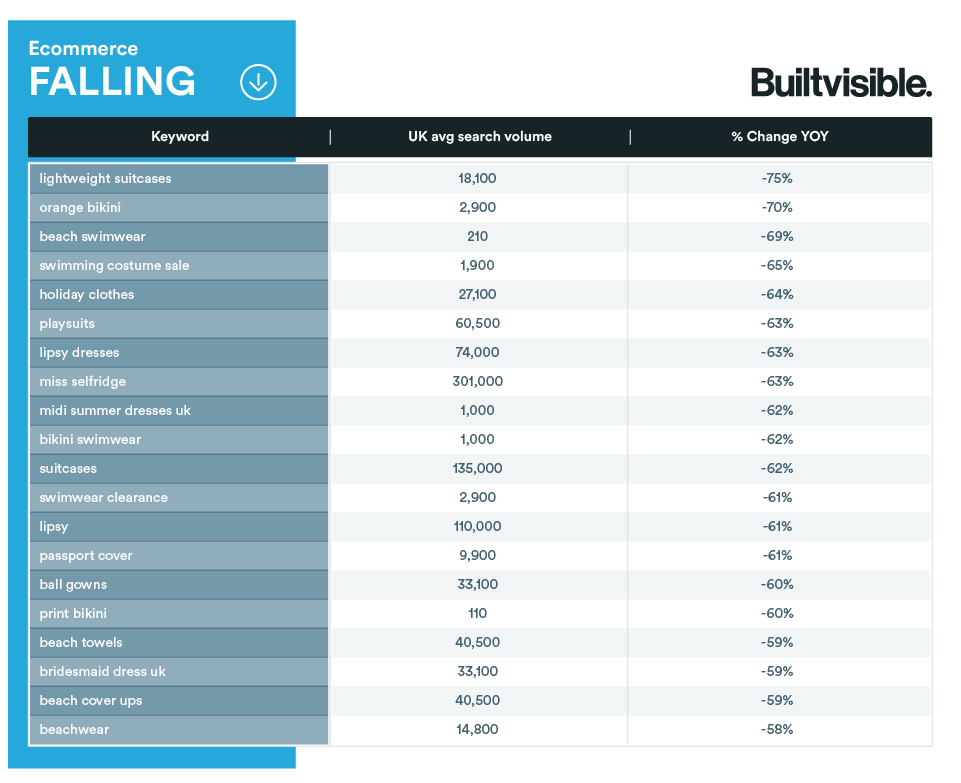

- Falling: keywords where demand has decreased consecutively each week for the last 4 weeks

We have included YoY percentage change data for broader context here, but the above three criteria are what qualify inclusion in our examples.

Ecommerce

Data from our ecommerce clients painted some very clear pictures.

The cataclysmic shift in employees now working remotely has seen some astonishing but unsurprising shifts in demand for things people can do to look after themselves or stay occupied at home. Seasonal demand for the “Les Mills body step” program is up by 622% and spin bike workouts up 165%, just by way of two examples.

Searches hitting a 15-month peak

Among the keywords that hit a 15-month (presumably all-time in many cases) peak last week were searches relating to gym equipment (up 382%), “multi gym” (up 219%) and weight benches, which surged to levels of demand over 500% above what one would typically expect. Trampolines and treadmills are up 153% and 161% respectively.

While not yet at 15-month peaks, we have seen demand around a number of keywords on the rise (for the last four weeks) too.

Games consoles, laptops and DIY tools are all on the rise, and it is interesting to see DVD players having something of a resurgence despite still being down YoY on the face of things. People getting their grandparents set up with some home entertainment, perhaps.

Searches with 4 consecutive weeks of increasing demand

Naturally, while people are stuck at home, they’ll be keen to find things for children to do. Inevitably, this will include toys and games. Demand for “toddler toys”, fun things for kids and indoor activities for kids have all significantly increased.

Moving outdoors now and despite the general consensus that summer will be cancelled, people are clearly looking to adapt and counter typical seasonal trends. BBQs, garden furniture and chimeneas are all on the up as people are not only beginning to get more clarity about the timescales involved here but – due to outside restrictions – are also looking to get outdoors and make the most of their garden space as much as they can. Micro scooters might also be bucking the seasonal trend as people investigate new ways to get around without using public transport.

The surface-level data suggests they are down year on year, but the gold is in knowing they are trending up.

The effect of the restrictions currently in place around the world is unsurprisingly affecting demand around searches relating to travel. Luggage queries, holiday outfits such as bikinis and swimsuits and even passport covers have all been on the slide for the past four weeks. Demand for “best sun cream” is also down 70% against typical seasonal demand.

Searches with 4 consecutive weeks of decreasing demand

Events have also taken a massive hit, meaning demand for dresses, ball gowns and – perhaps most depressingly of all – bridesmaids’ dresses are nosediving as people begin to cancel their best-laid plans.

Financial services

People are concerned about their incomes and the value of their homes; they want to know what’s in store for them down the road and are searching to find answers.

Searches hitting a 15-month peak

Searches around rent relief and income protection hit a peak last week (up over 1,700% and 500% vs seasonal norms respectively) as people explore any avenue they can to protect themselves from the situation unfolding around us. Landlords are looking to seek cover as well with “landlord insurance loss of rent” up 485% YoY.

People are also looking further down the road to understand how they might suffer or benefit in the mid to long term, with “housing market predictions” up 1,139% year on year. Searches for mortgage advice, online mortgage brokers and mortgage products (especially tracker mortgages) are up 300% on where we might expect to see them at this time of year.

As a note, these spikes in demand render all search volume data temporarily irrelevant – with the previous example theoretically hitting over 2,800 searches per month if last week’s demand sustains, despite traditional data telling us demand is 210 searches per month.

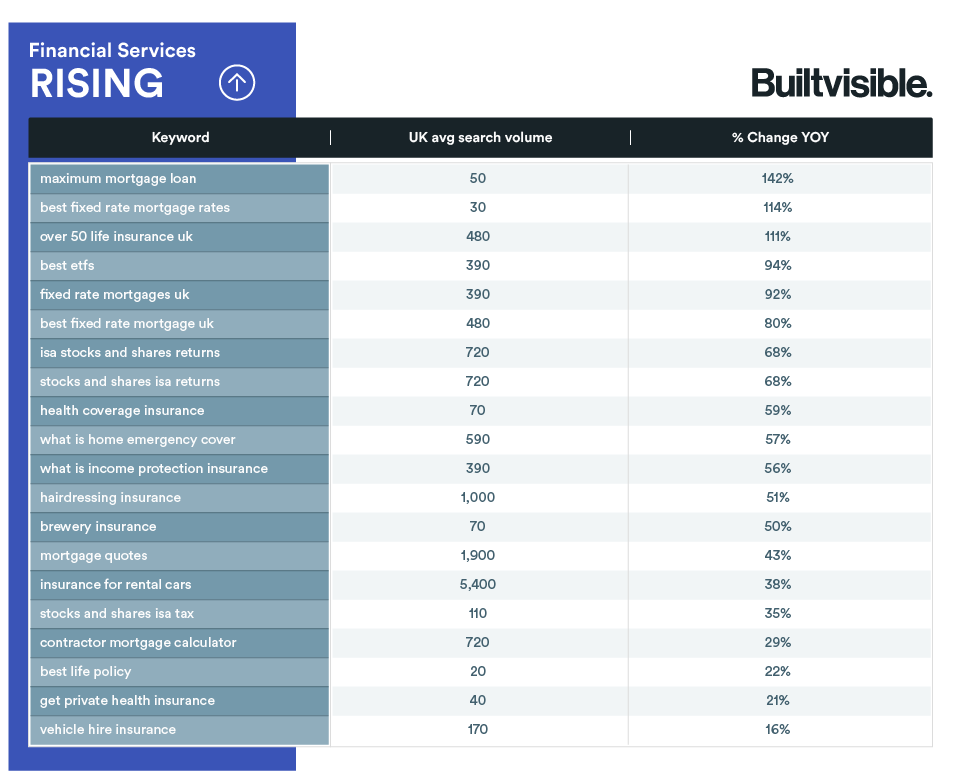

Searches with 4 consecutive weeks of increasing demand

While it remains to be seen how people will invest in making the most of their ISA allowances this year, a rising demand for stocks and shares ISA platforms might be a signal that the cash-rich intend to make the most from the downturn in the stock markets.

The events of the past weeks may have inspired more people to start making plans for the future, with demand for retirement planning up a staggering 938% and morbidly (yet practically) “online will writing service” has risen 969% from last month.

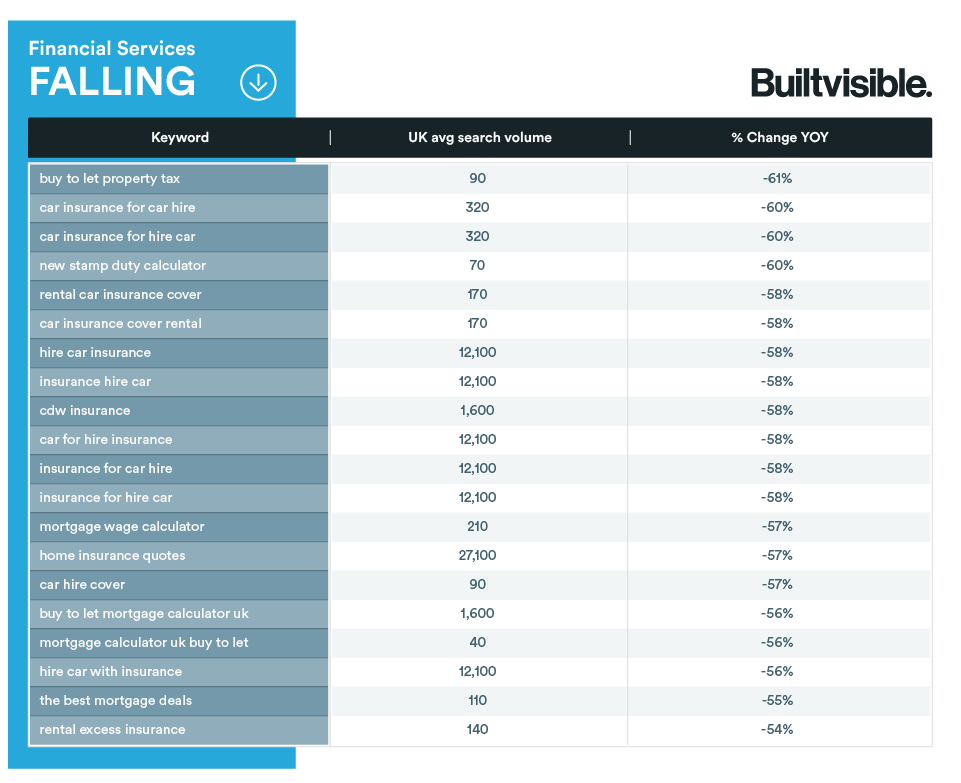

Financial services queries on the decline tend to reinforce what we are seeing on the way up, with people getting itchy feet around property generally. Both buy-to-let and buy-to-live mortgage queries have steadily declined as the more informational searches have risen.

Unsurprisingly, insurance for car hire has been gradually declining as travel restrictions have taken hold and restricted movement.

Searches with 4 consecutive weeks of decreasing demand

What we’re advising our clients to do next

The brands that can act quickly to bake strategic thinking and at-scale data like this into their working processes will be better equipped than their competitors to react. In a world where speed is becoming more and more critical, this could prove the difference between thriving and barely surviving. Equipping your teams to move quickly is key, either through agency support or intelligent restructuring of in-house teams.

Scale gives brands clarity on the opportunities across their entire product/service portfolio as well as their competitive landscape, making it easy to spot the wins, avoid the pitfalls and use investment effectively across the board. You probably already have the core of this data set, why not make the most of it?

We are working with our clients to help them rapidly pivot on content strategy, build processes to embed this data into their SEO workflows and integrate tooling like this into the heart of their organisation so that lean, nimble in-house teams can still compete. Right now, we are reviewing weekly in line with the trends data available and are also looking beyond SEO as a channel to add value through this data.

5 search trend value-adds beyond organic search

The scope for which search trend data can be used reaches far beyond the obvious implications for the traditional SEO channel. Below are five easy-to-implement examples of the ways we are incorporating our tooling into other parts of our clients’ businesses:

1. Work with your finance team to rebuild financial forecasts

With all financial forecasts going out the window, there is a strong case to be made for incorporating search trend data into your forecasting methodology. While it is, of course, prudent to protect your business based on the grim economic outlook, it would be remiss not to consider emerging trends as part of your planning.

2. Align your teams by surfacing trend data and building visual cues

As SEOs realise their value lies beyond the confines of their channel, there is an inevitable education piece that needs taking care of. Training the business in your own methodology behind the use of trend data and building bespoke Data Studio dashboards or similar is a sure-fire way to get teams zeroed in on making the most of this situation.

3. Inform procurement strategy

It is no good optimising your site for products you are going to run out of. Pulling trend data and mapping trajectories can show you what you need to stock up on before the demand really hits.

Likewise, downward trends can indicate when it is time to dial down orders and remove the need to offload at a discount or hold on to unmovable stock.

4. Inform PPC bidding strategy to reduce CPA

We saw a live example of this with a well-known insurance client last week. The PPC matching strategy was inadvertently sending large volumes of paid-for traffic to pages that all of a sudden didn’t match the intent that “normal service” would have catered for or were uninsurable and therefore irrelevant.

Their PPC team adjusted their bidding strategy and we created an organic landing page specifically for the range of queries in question. We caught it quickly but baking this approach in to your BAU makes this type of issue go away.

5. An early warning system to pivot acquisition strategies

Let’s say you spot rising trends in a product or service you know has limited stock, availability or bandwidth. You can use this information to create lead gen/email capture programs specific to the service in question and pivot at the moment you exhaust your supply, ensuring you are capturing warm leads for notification as soon as stocks replenish or for short-term follow up incentivising use of other services.

A friend of mine was ~25,000th in the queue for Ocado the other day, for example…

These are just some simple ideas to get started, but the reality is that trends data, used intelligently at scale, should sit at the heart of navigating the new normal.

The brands that meet the challenge of the near future by adapting early, committing to rational decisions and investing properly in tearing up the rulebook on their terms will win. As organic digital marketers, we have a huge amount of value to add here and must seek inspiration in the Stockdale Paradox.

As the man himself said, “You must never confuse faith that you will prevail in the end — which you can never afford to lose — with the discipline to confront the most brutal facts of your current reality, whatever they might be.”

Jeff Gold

Appreciate the article Geoff, this kind of guidance around how we continue to drive clients immediate value is sorely needed.

On that note, I know you discuss internal tooling you’ve built to do real-time keyword research. Are there public alternatives/tools to tap into trend data at scale (besides the google trends interface)? Thanks!

Branko Kral

Love this line: ” understand, react to and predict shifts in human behaviour, as opposed to Google.”