Paid vs Organic: the importance of balancing your spend

The predictability of returns and the speed at which new approaches can be tested make paid media an incredibly attractive prospect, so it’s easy to understand why many companies have a substantial proportion of their marketing spend focused on it.

Unfortunately, increases in competition and the gradual erosion of reach and targeting specificity have pushed customer acquisition costs (CAC) to a level that’s having a noticeable effect on profit. The impact of COVID-19 brought these challenges sharply into focus.

While some businesses had their marketing budgets heavily slashed in the initial wave, others were able to benefit from reduced CPCs driven by a reduction in competition. As the world started to open up again and it became increasingly clear that changes in consumer behaviour were permanent, more and more marketing budgets shifted online, resulting in significantly higher CPCs in 2021.

Increasingly, investing in organic channels is becoming a necessity to balance out paid, and those who previously scorned the longer investment horizons and lack of predictability are being forced to reassess their worldview.

With organic social reach also declining, the number of platforms increasing and the difficulty in measuring the return from PR activities, SEO is often the obvious choice. Companies that are successful in this channel mitigate risk through diversification and enjoy a predictable stream of potential users that, once established, won’t immediately disappear if the taps are turned off.

“Growing our existing presence in organic search will enable us to balance our spend across channels, reducing our overall CAC.” – Ben Davies, Ecommerce Manager, Soak and Sleep

Increasing investment in organic to offset stagnation

The need to diversify marketing spend and transition from paid to organic will be familiar to anyone who has ever worked in (or with) a start-up.

Embryonic businesses will often base their customer acquisition strategy on a small number of channels (paid, PR, etc.) and invest heavily to rapidly grow their customer base. Doubling down on a few channels makes perfect sense in this context, especially when products and value propositions are being refined – but a failure to diversify will eventually lead to stagnation, something a start-up can ill afford, especially if they’ve recently been through a big investment round and need to hit punchy targets.

The problem here is that every channel has a finite market size, so the only way to sustain growth is to increase the available market – which can only be achieved by expanding into new channels or locations.

Reducing CAC and offsetting stagnation are, of course, only two of many reasons that brands are choosing to increase their investment in SEO. Whatever your reason, within the rest of this article, we’ll cover the steps you need to take to gain clarity on what’s possible and how to define a strategy capable of achieving it.

Assessing your organic opportunity

The first step in developing a channel strategy is understanding the size of the opportunity (otherwise known as market sizing). Going through this process will help to quantify the growth available, helping you to:

- Secure buy in by giving an indication of the likely return

- Ascertain budget and resource requirements

- Understand how your business fits into the wider landscape

- Establish a clear strategic direction and set achievable targets

The simplest way of approaching this is by calculating the total addressable market (TAM).

Calculating the total addressable market (TAM)

As the name total addressable market implies, your TAM is a measure of the total opportunity available and can be a useful yardstick for determining whether a market is worth entering in the first place.

To generate your organic TAM, start by performing keyword research and establishing search volumes.

The steps we’d recommend in this process are to:

- Leverage PPC query data from Adwords

- Pull any existing query ranking data from Google Search Console

- Download competitor keywords in tools like SEMrush

- Feed seed keywords into tools like Ahrefs and incorporate related keywords

At this stage, it’s also worth grouping your data to help with your analysis, categorising by:

- Thematic or product categories

- Intent, mapping to the appropriate stage of the purchase funnel

After this is done, calculate the overall TAM or TAM per category:

Keywords * search volume = TAM

Potential conversions can also be calculated using average conversion rates and revenue by including average order values.

At this stage, you may also want to understand the organic growth trajectory for your market. Historic data for the last seven years is available in a range of tools – mangools, for example – and will give you a good indication of where things are headed. This data is only released monthly, however; if you want to see how things are changing on a weekly basis, you can layer on trends data.

Calculating the serviceable addressable market (SAM)

While TAM can give a quick gauge of the total organic opportunity available, it doesn’t give a good view of what’s achievable for your brand because:

- It’s impossible to capture 100% of the search volume for a specific query. CTR studies usually predict that the top-ranking organic result only drives 25-35% of clicks, and we know a proportion of traffic is being lost to PPC

- A subset of the queries within a marketplace will almost certainly not match our product offering and positioning, or they may not be a good fit in terms of intent

- Technically, the total addressable market would be global, but most brands will be unable to expand into multiple new markets simultaneously

Really, we need to dig a bit deeper to ascertain the serviceable addressable market (SAM) by:

- Limiting keyword data to our core markets

- Cleansing our keyword data to make it as relevant as possible

- Using a curve from a CTR study to establish the potential return for reaching position one on a per keyword basis

By going through these extra steps, you’re left with a smaller but far more accurate view of the market. That said, we still don’t have a good view of what’s achievable within a reasonable timeframe and we haven’t factored in current market share.

Calculating the serviceable obtainable market (SOM)

SOM represents the percentage of the SAM that a business can realistically capture, which can be established by:

- Looking at current performance (i.e. rankings) and subtracting the current estimated return from the total estimated return

- Using link metrics to establish the levels of competition to quantify short vs long term opportunities

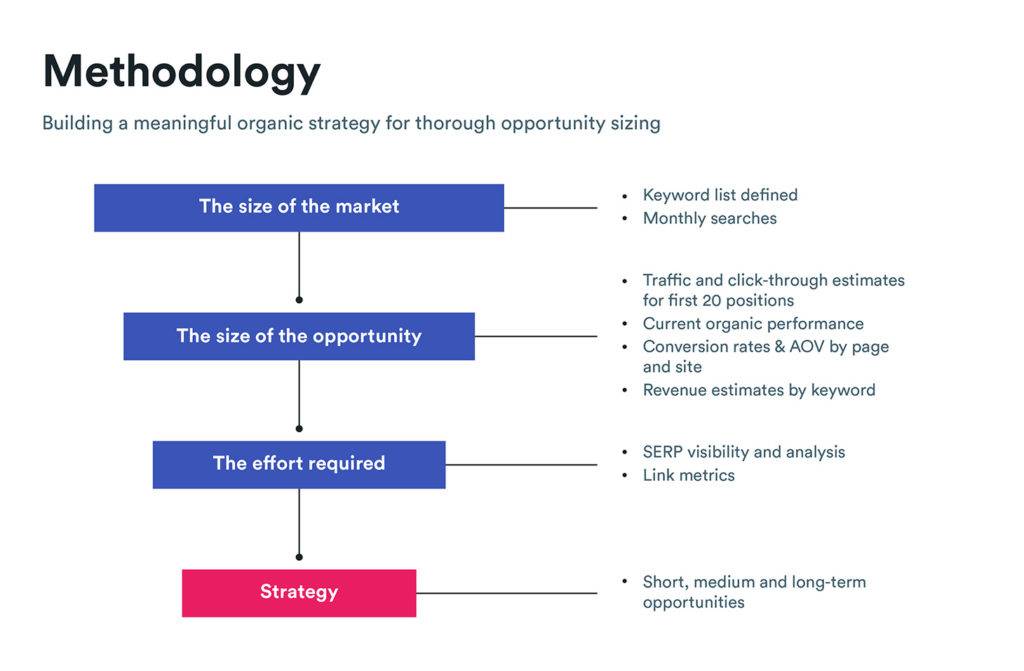

Since 2016, this is the exact process we’ve been regularly going through with clients within our opportunity sizing projects.

By doing so, we can provide them with a solid bottom-up forecast of what is achievable for them with their internal resource and different levels of external spend.

Although going through the full process results in a significantly better output, the substantial number of calculations vastly increases the time requirements, especially on larger datasets – such is the price you pay for accuracy.

Thankfully, we have a web app to do a lot of the heavy lifting for us, which means that we can spend more of our time pulling out insights for our clients instead of spending days crunching data.

Establishing your organic strategy

After you’ve established the size of the opportunity, you can move on to planning how to penetrate the market.

The data within your SOM will provide everything you need to analyse consumer search behaviour and determine the keyword clusters that can realistically be targeted. Use these as the foundations upon which to build your strategy.

Let’s say you’re a car insurance brand that has maxed out paid search and needs better organic performance to grow further.

Initially, the 450k monthly searches available on ‘car insurance’ might entice you, but the first page is dominated by mature brands and aggregators. In fact, the average linking root domains for the top 3 URLs is 504, and the TrustFlow is 36!

Unless you’re launching a truly revolutionary product, breaking into the top 3 for this query could take years.

So, while you’d certainly want to create a high-quality car insurance page, a strategically savvy approach would be to focus the bulk of your resource on other opportunities. This can be achieved by moving up the conversion funnel to target less competitive content topics or identifying demand for your product’s specific features and benefits.

For example, if you offered rewards and discounted policies for users willing to install a telematics device, this could be a better primary target. ‘Black box insurance’ still has 6.6k monthly searches, and the average linking root domains is a more reasonable 39.

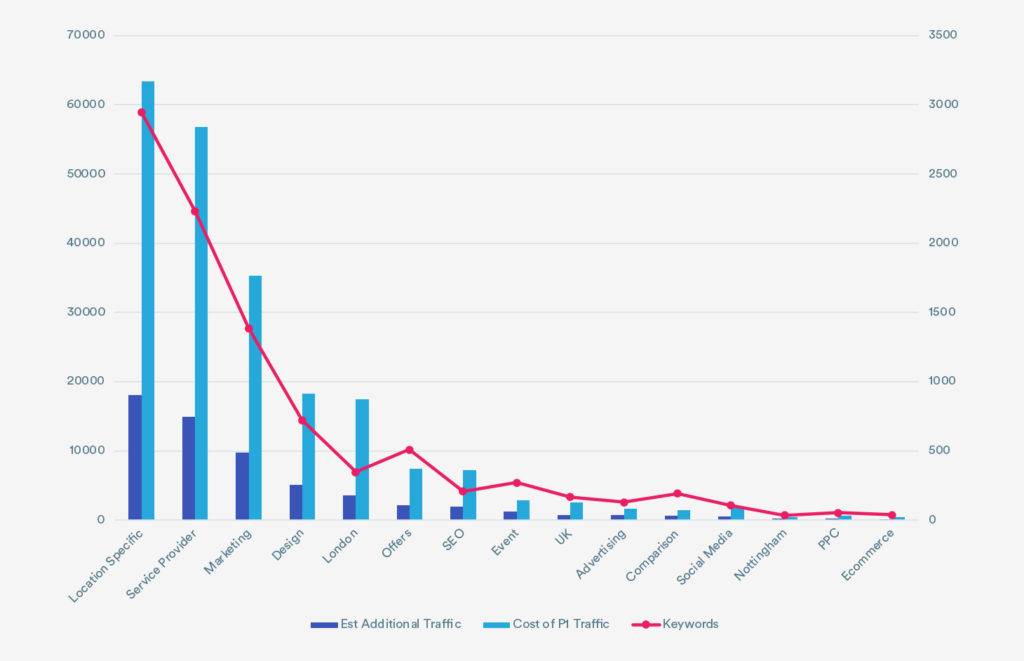

To provide another illustration, let’s say we’re working with a digital marketing marketplace. Ranking for competitive queries such as ‘PPC agency’ is very likely to be a long-term play, but there is a bunch of volume around different locations with the query structure PPC agency + {location}.

Driving scalable results using programmatic SEO

When considering the best way to enter a market, the real gold is often when you uncover keyword clusters that can be targeted in a scalable way by employing programmatic SEO.

Many companies out there have access to valuable data, and this can be used to populate pages on the frontend of a website to capture traffic from organic search. Alternatively, you could leverage a relevant public data source.

A good example of this is Wise’s currency conversion subfolder, which targets an enormous number of FX queries.

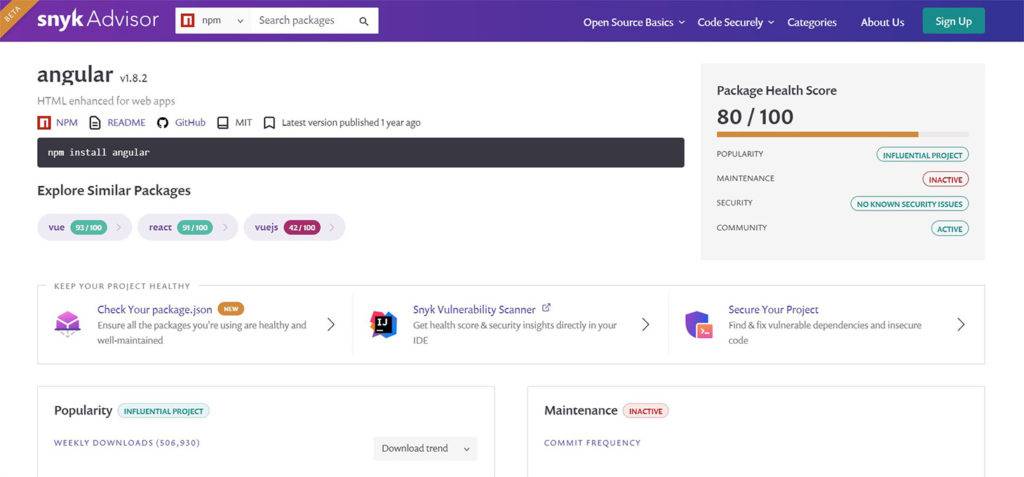

With over 500k indexed pages, Snyk’s advisor web app is also worth checking out. It lets you search and compare over a million open source packages available via NPM, PyPI and Docker.

I’d guess that Snyk’s traffic to this app is significantly higher than is being reported in external tools because there is so much long-tail potential, and a large proportion of that will be ‘zero search keywords’ – queries that have demand, but not enough to register ten monthly searches consistently.

In this scenario, you’re better off taking a top-down approach to market sizing. Using Snyk as an example, the TAM, in a traditional sense, is every developer who wants to use open source packages in a project.

Product focused ‘jobs to be done’ content

Although not as scalable as programmatic solutions, another potential approach is to create product-led ‘jobs to be done’ content. In other words, tutorials that help users solve a problem using the specific product to accomplish the task.

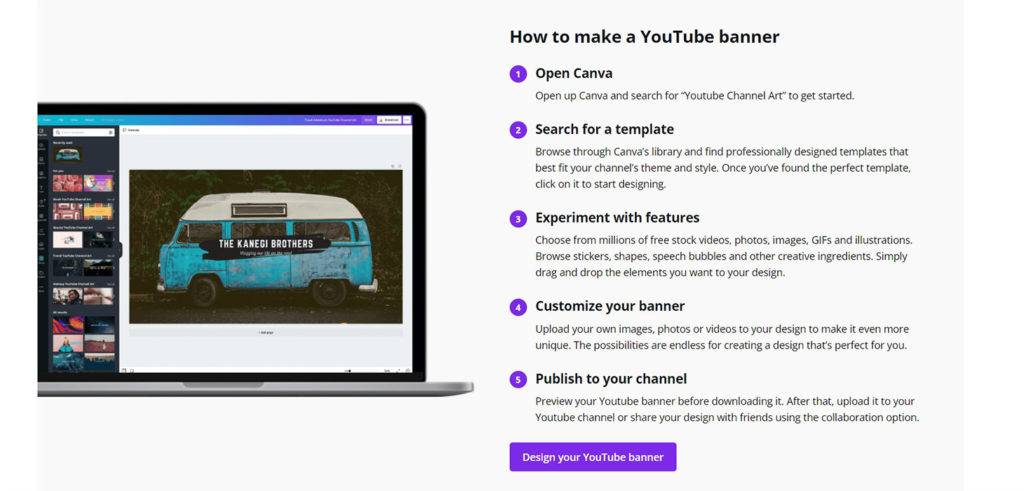

Canva takes this approach within their /create/ subfolder, which primarily targets ‘maker’ queries like ‘free logo maker’.

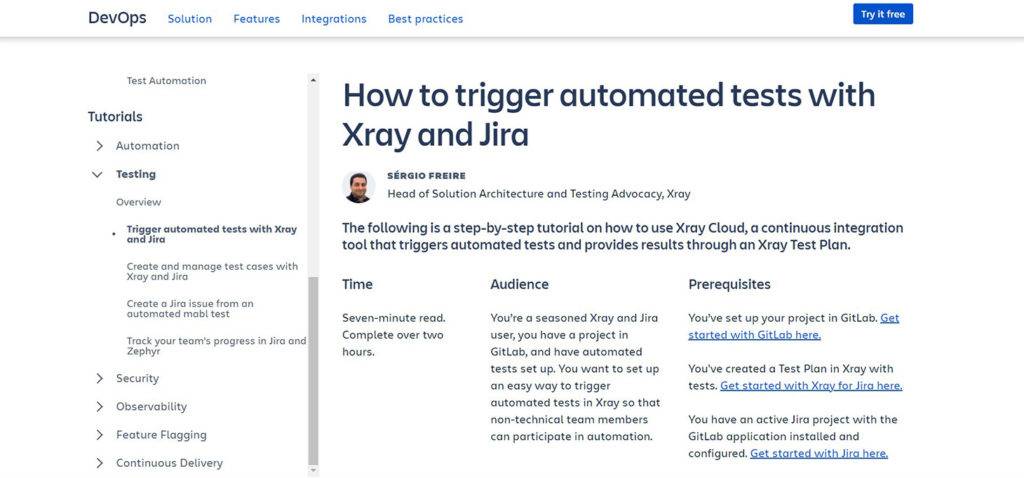

Atlassian does something similar within their DevOps guide, which provides detailed information on foundational principles, frameworks and the necessary tooling, as well as in-depth tutorials for specific problems.

Its products are, of course, referenced throughout, and there are clear CTAs for free trials.

Targeting the top of the funnel using content hubs

Creating high quality, genuinely useful content can be a fantastic way of boosting awareness and pushing consumers down into the consideration stage of the purchase funnel. These users may not be ready to convert today, but engaging with them now will ensure you stay top of mind for when they are.

This is especially important for companies with more complex or expensive product offerings, where lead times are usually longer and levels of conversion-focused search demand lower.

Within enterprise SaaS, for instance, the conversion-focused query ‘cloud based siem solutions’ only has 40 monthly searches in the US. Search volumes are significantly higher around informational queries like ‘siem’ (28k monthly searches).

In such scenarios, consumers may be completely unaware that the best solution to their problem is a product or service.

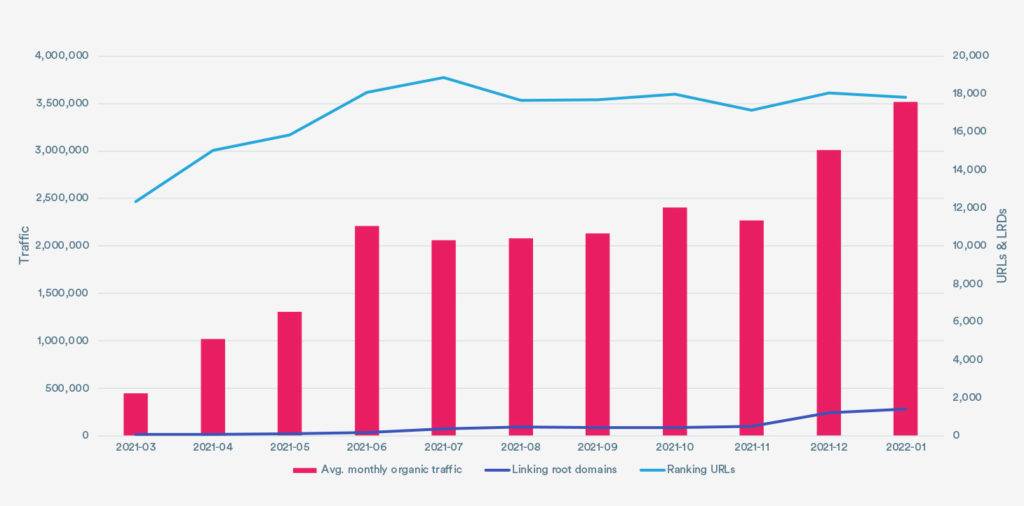

Enterprise SaaS brand Sumo Logic has addressed this problem by creating an in-depth glossary covering a broad range of informational queries.

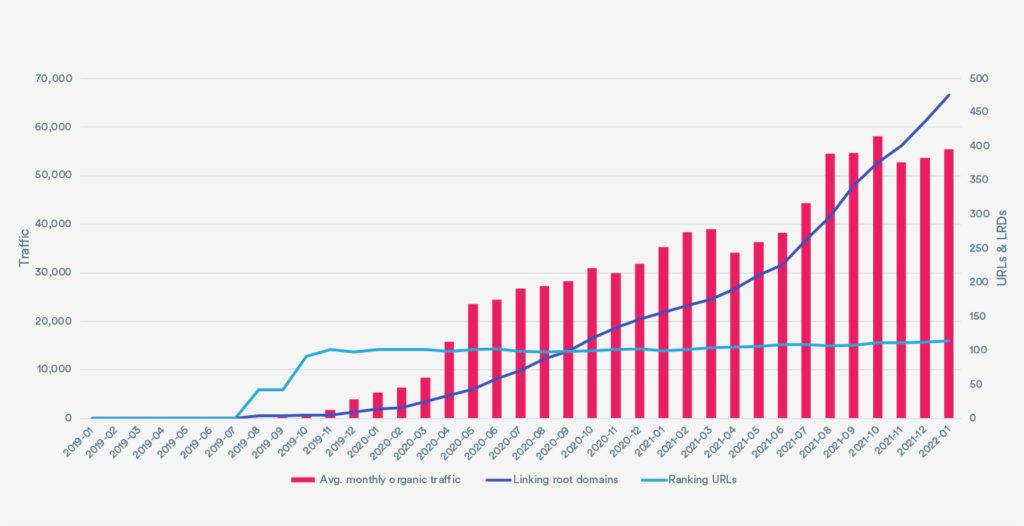

As you can see in the graph below, they invested a significant amount of resource into content creation, but it’s paid off in a big way and now drives a substantial volume of traffic and relevant links.

Market incumbent B&Q are another example of a brand pursuing a successful content hub strategy. Their ideas and advice subfolder contains a mixture of design inspiration and how-to content, created to push users towards products that will help solve their DIY problems.

Segmenting the content by room and the type of job (e.g. wallpapering) is a smart move because it closely aligns with consumer behaviour (if someone is trying to choose a kitchen tap, there’s a good probability they’re redesigning the whole kitchen).

Closing thoughts

Whether you’re working for a start-up that needs to grow rapidly or a mature business looking to reduce CAC, going through the full market sizing process is a fantastic way of establishing your organic search opportunity, giving you the data you need to develop a winning strategy.

Hopefully, the examples above have given you some inspiration – but bear in mind that the best approach for your business will be unique to you.

If you need help establishing that, let us know.