How to get a Baidu account

Before we delve into Baidu SEO, Chinese content marketing and everything in between, we’re going to show you how to get a Baidu account. This will enable you to action a fair amount of what we’re going through in this guide, and will put you and your site in a handy position moving forward with Baidu SEO.

First, head to this page and fill out the parameters accordingly. Baidu allows you to sign up with verification via a Chinese phone number or, for those of us based elsewhere, by email (thankfully). Here’s a screenshot explanation:

You’ll then get a confirmation email from Baidu to activate your account.

And you’re done! Each time you navigate to a Baidu page or Baidu product page you’ll see your email address in the top right-hand corner, meaning you’re signed in as a Baidu user. If you ever got logged out, click on the login (登录) button in the top right hand corner as shown below.

A Basic Breakdown of the Baidu SERP

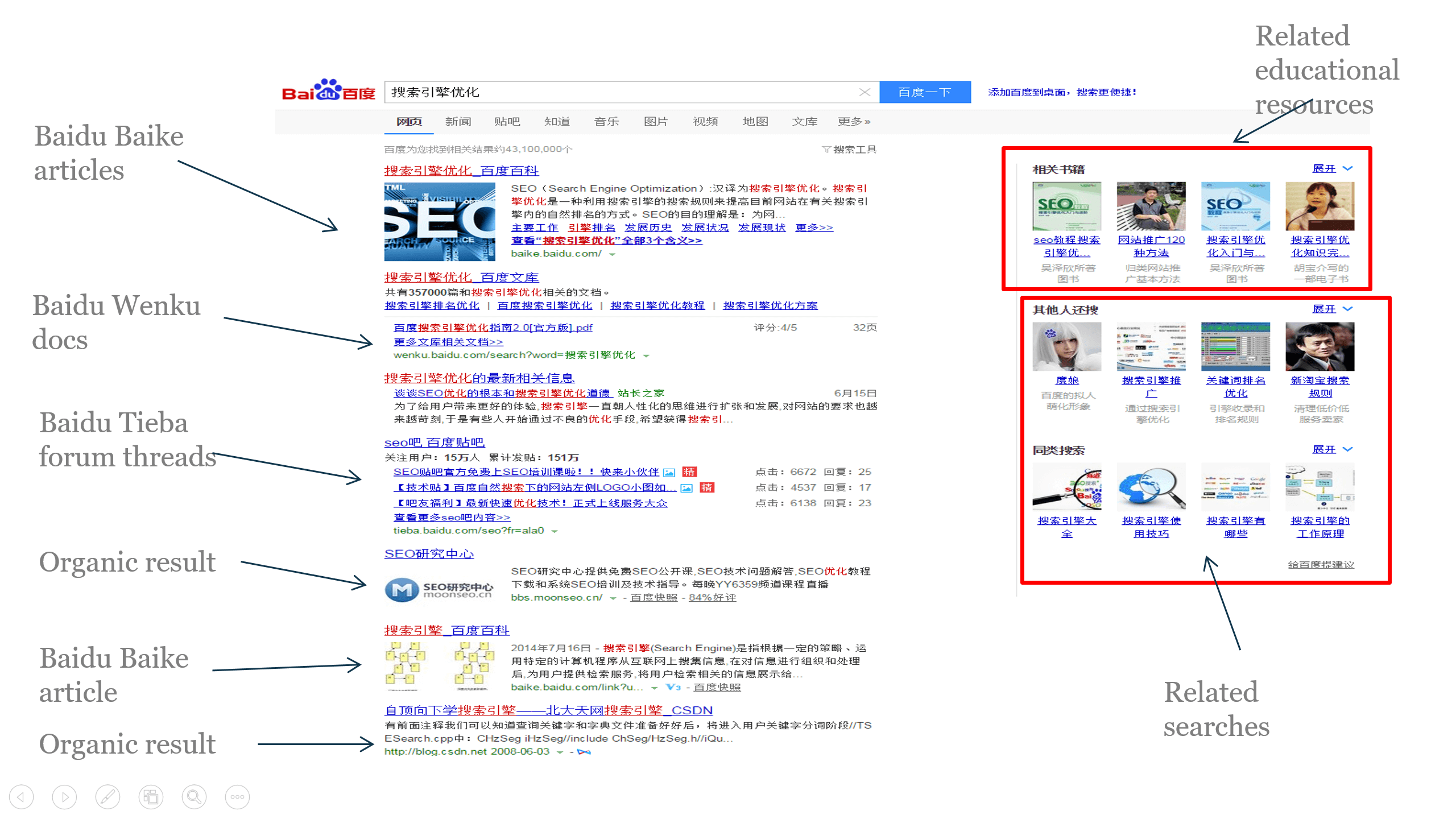

Let’s begin with a snapshot of a Baidu SERP to kick things off. Here’s what Baidu shows us when the term “SEO” in Chinese (搜索引擎优化) is searched for:

As you can see, Baidu, much like Google, employs a familiar two column structure. In this example, the SERP displays a variety of related (and sometimes paid) results on the right and what is a mixture of other types of paid results as well as some organic results on the left. What we want to focus on here is the incorporation of Baidu’s own products into the SERP – something of which this picture illustrates the significance when it comes to embarking on SEO for China.

Now, we all know that Google owns its fair share of products– YouTube, Maps, Flights, Docs, News and beyond. Of course, these do pop up in the overall SERP from time to time, however Google has strived to ensure these products a certain degree of their own space and independence outside of the overall SERP. Baidu entails a somewhat different approach however, allowing these sub-products a liberal amount of free-roaming in the SERP space, as illustrated above. In fact, it is estimated that around 30% of Baidu queries are redirected to one of Baidu’s own products, with the overall strength and trust of the domain resonating with Chinese users who often opt to rely on a trusted, dominant brand to find what they’re looking for. So what are these products, which ones deserve your attention, and crucially, how do we leverage them for optimisation? Let’s take a dive in.

As you’d guess, Baidu has its own maps service, video search (compiling videos from several major Chinese YouTube-esque platforms), news and documents tabs. There are of course countless others doing all manner of things (which can viewed here), but let’s take a look at three of the familiar characters that frequently stake their claim in the Baidu SERP: Baike, Tieba and Zhidao.

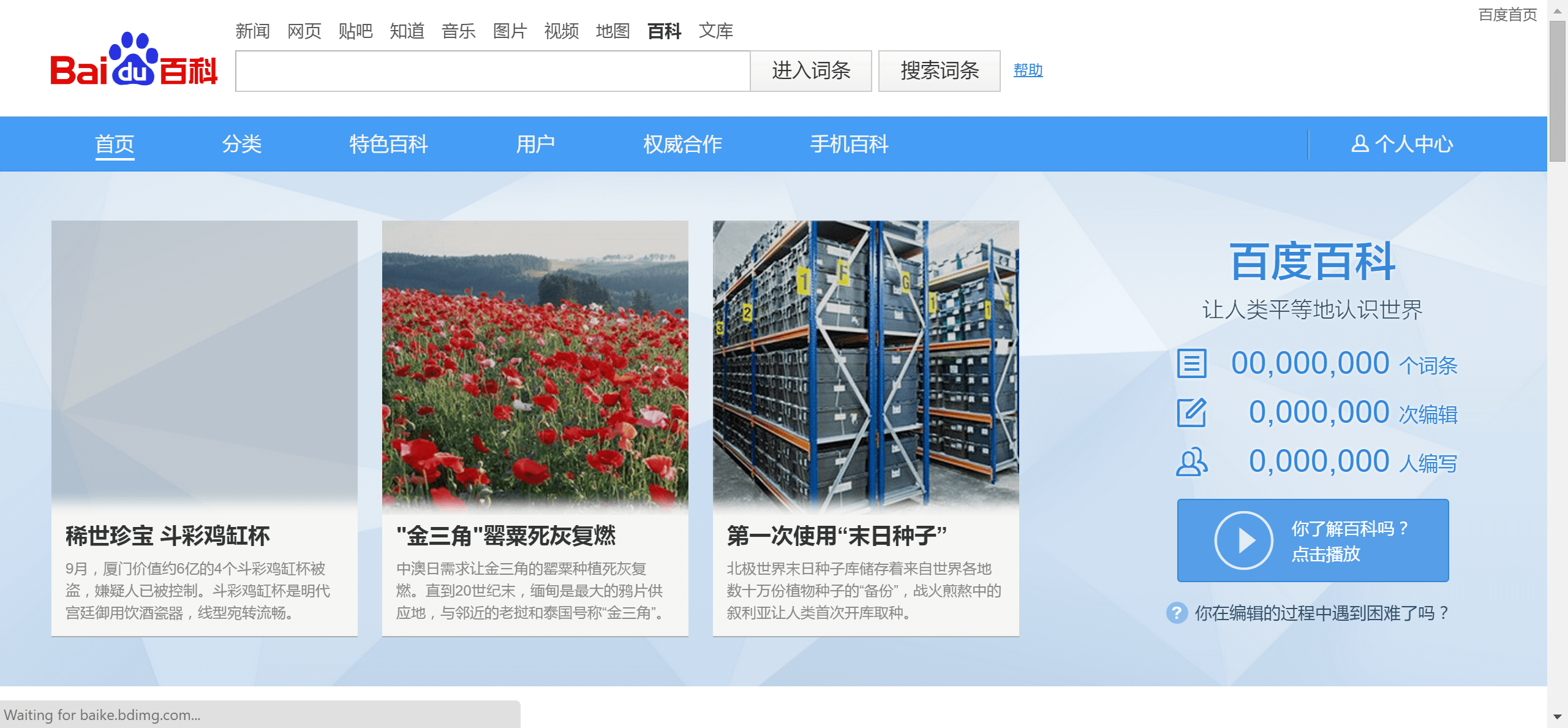

Baike 百科

Baidu Baike, otherwise known as “Baidu Encyclopaedia” is China’s answer to Wikipedia. While it may not currently have the breadth and depth of Wikipedia (11.9 million articles to Wikipedia’s 35 million across the board) the opportunity lies in just that; as well as the fact that a typical Baidu search query will often display around two Baike results with sub-links to related articles on the very first SERP. Given its prominence in the make-up of the Baidu SERP, SEO opportunity lies not only in the entry of brand or product-related articles but also in the editing of content, images, links and keyword tagging. Given the stringent nature of verification as well as factors such as censorship, this can be a bit of a long march, though the potential for visibility on such a large and prominent platform really speaks for itself.

Zhidao 知道

Baidu Zhidao, or “Baidu Knows”, is a massive Q&A platform that essentially serves as an enhanced Yahoo Answers, allowing users to create and participate in a deep plethora of topics covering anything from advanced computer science to how to cut vegetables correctly. Users can level up, accrue points and can gain reputations as online experts in certain fields based on the number of answers given, up votes on comments and so on. Given a high tendency for Chinese users to search using long-tail, query-based lexicon as well a general overall prominence in the SERP, Zhidao is a force to be reckoned with and can be powerful SEO-wise if leveraged with the correct amount of subtlety.

As with any Q&A-based forum however, Zhidao has prevalent anti-spam efforts. These are also taken up a notch somewhat given that this is China and constant monitoring is simply part and parcel of online life. Obviously, simply searching for questions related to your brand’s sector and posting short answers riddled with links back to your site won’t do, so here are a few tips on leveraging Zhidao for Chinese SEO:

- Optimise your brand’s Baidu account so it’s as branded and official-looking as can be, and offer up well-informed, credible answers to users who are asking questions related to your brand or its products. This will in time earn trust and reputation from users.

- An organically placed link within the text of the answer, as long it’s relevant and informative, will be indexed.

- Why not flip the tables and ask a question yourself? This could be in the form of asking for potential customer opinions on certain products or debates within the remit of your industry, or simply just a call for help on something related to your brand. It’s a great opportunity to get to know your target demographic and the notion of brand-to-customer discussion and dialogue is key when it comes to forging your name in the Chinese market.

Tieba 贴吧

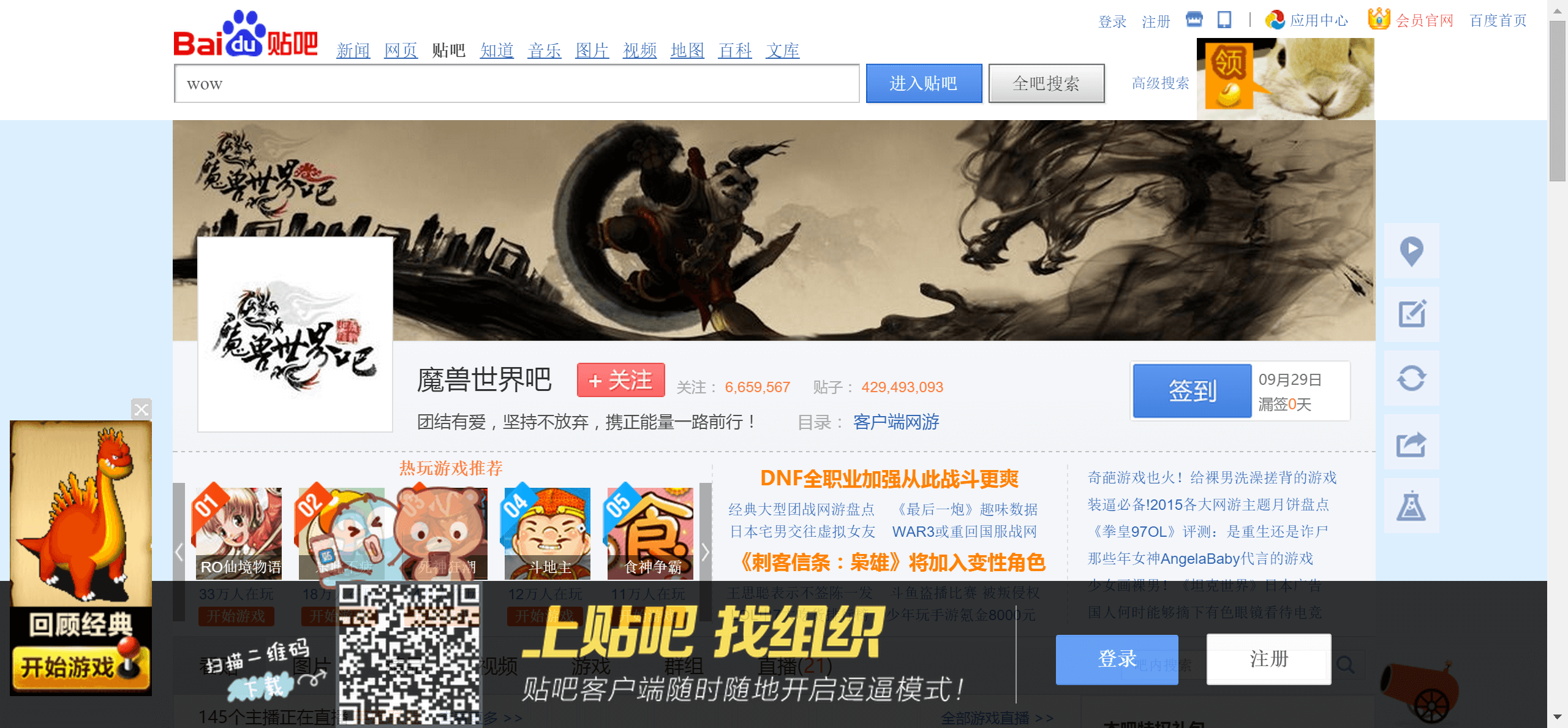

Slightly different yet not vastly dissimilar to Zhidao, Baidu Tieba (or “Post Bar”) is a keyword-based discussion forum where users can follow specific “Bars” (吧) which serve as subreddit-esque BBS spaces and currently boasts around 300 million active monthly users.

As with Zhidao there is opportunity to assert your brand into your target demographic with organic discussion and participation with relevant threads and users.

You also have opportunity to create your own Bar based on your brand (if someone hasn’t done so already!), with the chance to create a hub and redirect users to your forum if they happen to search for your brand in Tieba or Baidu as a whole. This is especially useful if you already have a good degree of brand awareness in China yet have little presence on these platforms.

Currently, the Bar for World of Warcraft has over six million followers and over 420 million threads.

Key SEO and Algorithm Differences

While many of us are familiar with Google’s ranking factors and have a good understanding of the key on-page SEO measures to get your site ranking, there’s little out there in terms of resources with regards to what makes Baidu tick.

Thankfully, the mind-set remains largely the same, and in practice Baidu’s ranking algorithm isn’t too dissimilar to Google’s. However, there are of course some key differences to consider:

Site Architecture and Functionality

- Keep it simple. At this stage, Baiduspider isn’t as developed as Google’s in terms of crawl power, and favours flat-structured sites in which content is accessible in as few clicks as possible (here’s a useful FAQ on Baiduspider in English).

- Baidu also doesn’t deal with Flash or JavaScript, so be sure to provide HTML alternative versions of the content.

- Don’t use Frame and iFrame

- Keep URL structure short and if possible, use Pinyin (Romanised version of Chinese characters).

Page Titles & Meta Data

- Much like with Google, make sure title tags and meta data are unique, descriptive and is in keyword optimised Simplified Chinese.

- Title tag character limit is 80.

- Google may have renounced them from their ranking factor a while back, but meta descriptions and meta keywords do factor into ranking for Baidu.

- Meta description character limit is 200, meta keywords is 100.

- Alt tags and heading tags also have increased prominence in Baidu’s ranking algorithm – be sure to optimise in Chinese accordingly.

Links

Link building is a key factor in Baidu ranking. While the general assumption is that it favours quantity over quality, this is becoming less prevalent with the introduction of recent spam-combating algorithm updates. We’ll look at those later (as well as a quick look at how to link build for Baidu), though here are some key considerations:

- Target links from high-authority, industry-relevant Chinese-based sites.

- Internal and external link anchor text remains of high importance.

- In terms of internal linking, be sure that each URL you want to rank has at least one on-site link pointing at it.

- Baidu does actually count non-hyperlinked URLs as links, allowing these to contribute to ranking.

On-Page Content

As you would guess, it’s vital to ensure that your site content is written in unique, optimised Simplified Chinese.

Never rely on Google Translate for the creation of unique copy and ensure that what you’re writing is correctly localised and is well-informed by keyword trends from Baidu’s keyword research tool.

In a similar vein to Google, Baidu also favours sites that frequently refresh their content, so ensure you’ve got an outlet such as a blog or news section to provide freshly optimised content every now and then.

Tags (hreflang, canonical etc)

- Up until recently, Baidu didn’t support the canonical tag, however now it does.

- Baidu also now supports the nofollow and noarchive tags

- Much like Bing, Baidu doesn’t yet adhere to hreflang and so should instead incorporate the HTML lang attribute to define the language of the page e.g. html lang=”zh-cn”

Domain Hosting

For Baidu, it is best practice to procure a site that is hosted in China on a CN domain. However, this isn’t fully vital in achieving success in Baidu, and for businesses operating outside of China this can be tricky and a little frustrating as accessing Chinese-hosted sites from outside of China is a much slower affair. If possible, get your hands on a Hong Kong-hosted site; though a correctly Baidu-optmised CN sub-domain certainly won’t leave you out of the Baidu ranking race.

Algorithm Updates

It’s an exciting time to begin to get into SEO for Baidu, particularly when it comes to the direction the search engine is taking with its ranking factors and algorithm updates. While born in a similar image to Google back in 2000, many have accrued the notion that Baidu optimisation still lingers in the shade of black hat SEO tactics where spammy link-building and the relentless churning out of low-quality content will propel you to the top. Since the release of two key spam-battling algorithm updates on 2013 however, things are certainly changing, and it’d be advisable to keep tabs on these two updates.

Money Plant (绿萝)

Released in February 2013, Money Plant is intended to combat link spam and penalise link farms and those who partake in public link trading platforms.

Pomegranate (石榴)

Rolled out in May 2013, Pomegranate seeks to punish sites that overload users with excessive ads, particularly of the pop-up kind (the likes of which are often found in pirate sites in China). Seen as a real indication that Baidu is moving towards a Panda-style manner of penalising sites with poor quality content.

Content Research & Marketing in China

The Chinese internet currently plays host to a vibrant hive of creative activity and much like other more technical aspects of Chinese SEO, is ever-evolving and full of opportunity. With an increasingly-savvy and tuned-in online demographic as well as some cutting edge developments on content format, functionality and technology, now is a great time to jump in and apply what we know from our content experiences in the West and make sure it’s localised and tuned-up properly for the Chinese market. First things first though, where do we go to find out what’s hot on the content circuit in China? We can rely on our existing means and tools of content research (such as the wonderful BuzzSumo and Ahrefs) to an extent, though to get a finer picture, the best option is to do things the Chinese way. Here are a few great tools to check out:

Baidu Feng Yun Bang 百度搜索风云榜

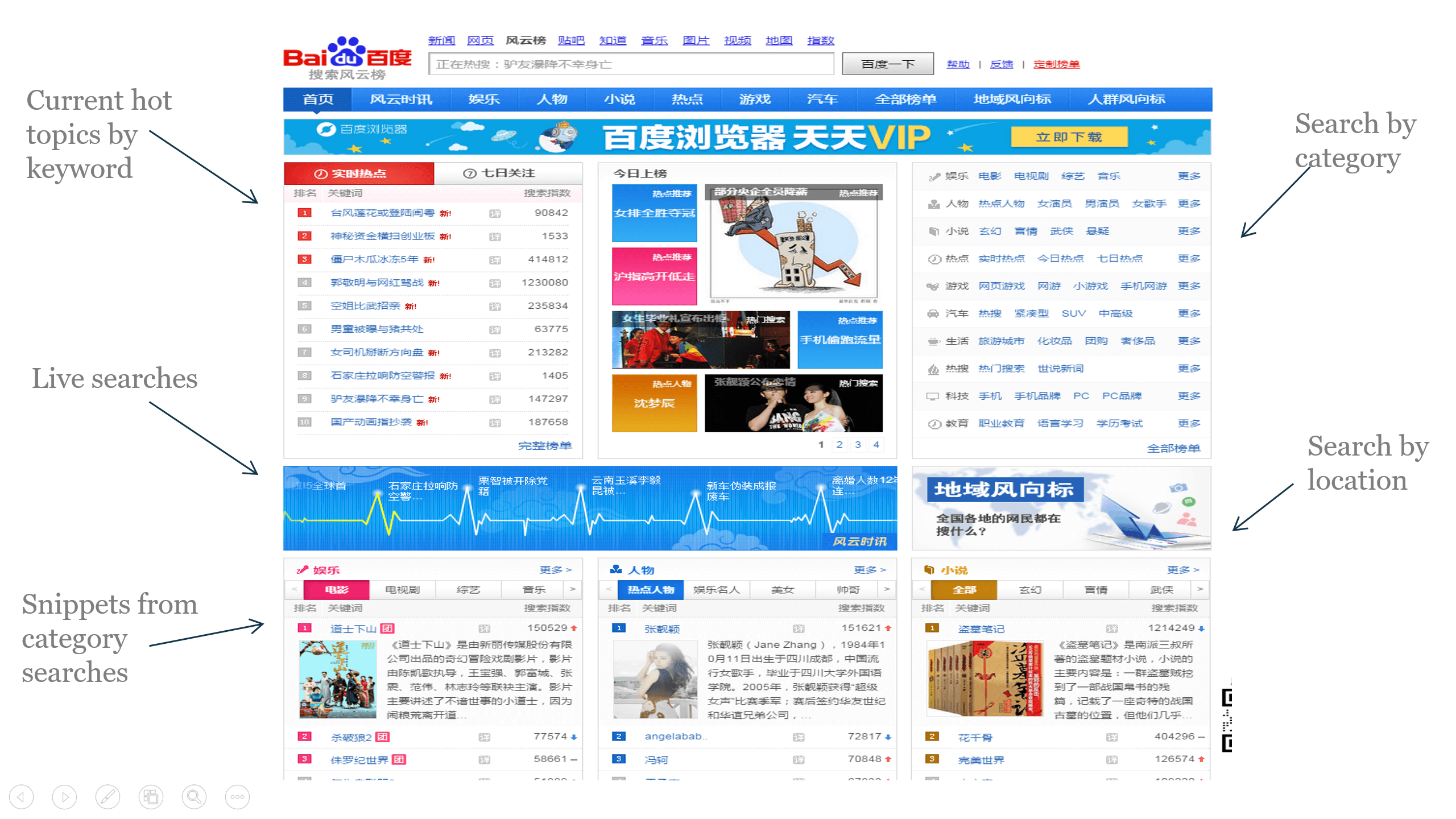

Baidu Feng Yun Bang, essentially Google Trends (and then some), is a fantastic place to go discover what the Chinese internet is talking about in almost any capacity. Here’s a screenshot of its main interface to help with some of its sections:

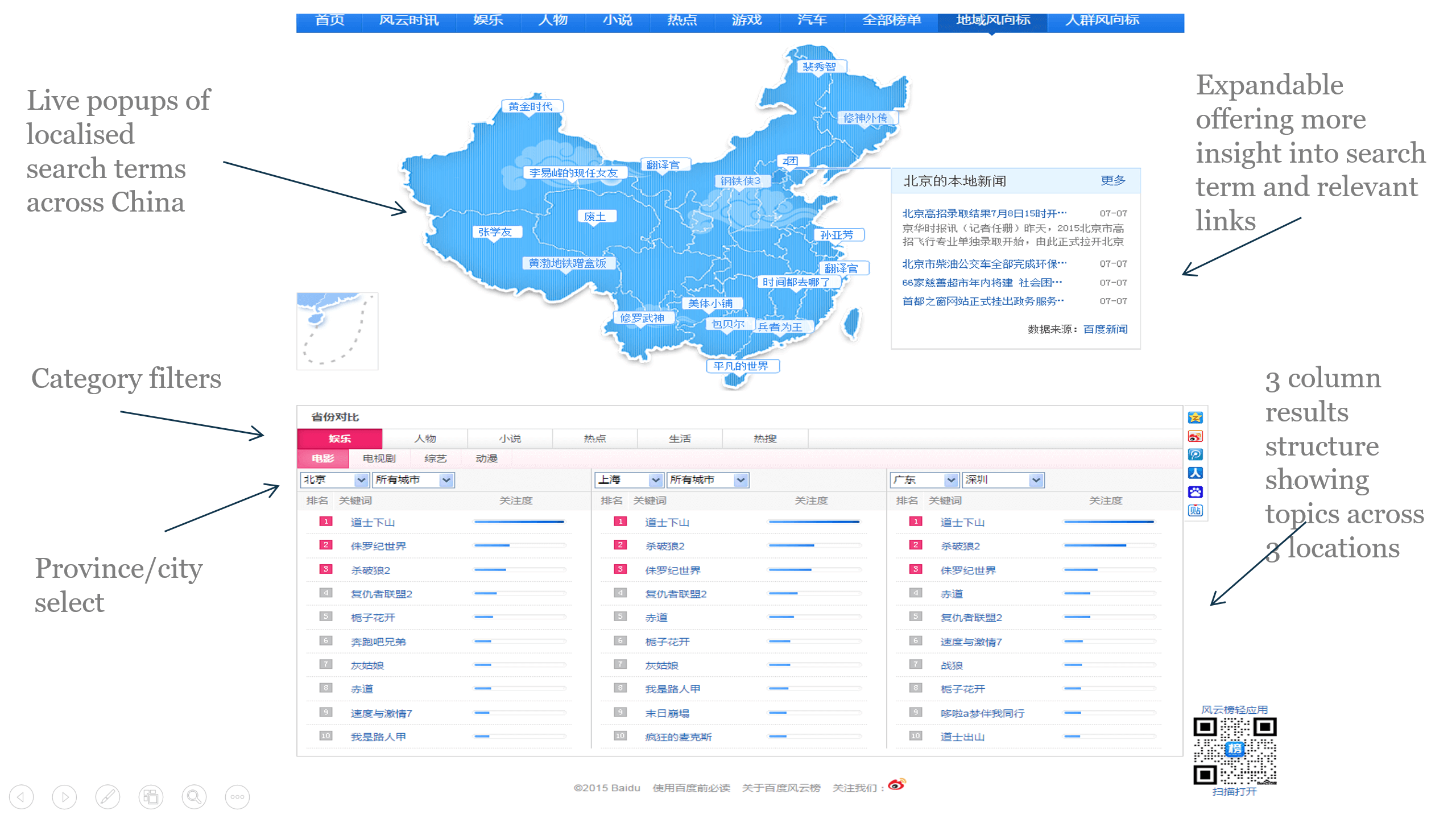

Furthermore, Feng Yun Bang allows you to get really, really granular in your exploration of hot topics, which is important given China’s size and cultural diversity. Below is a screenshot of the location search section of Feng Yun Bang, where you can search by category in individual provinces and cities and really get stuck into what your target demographics are talking about:

Baidu Index 百度指数

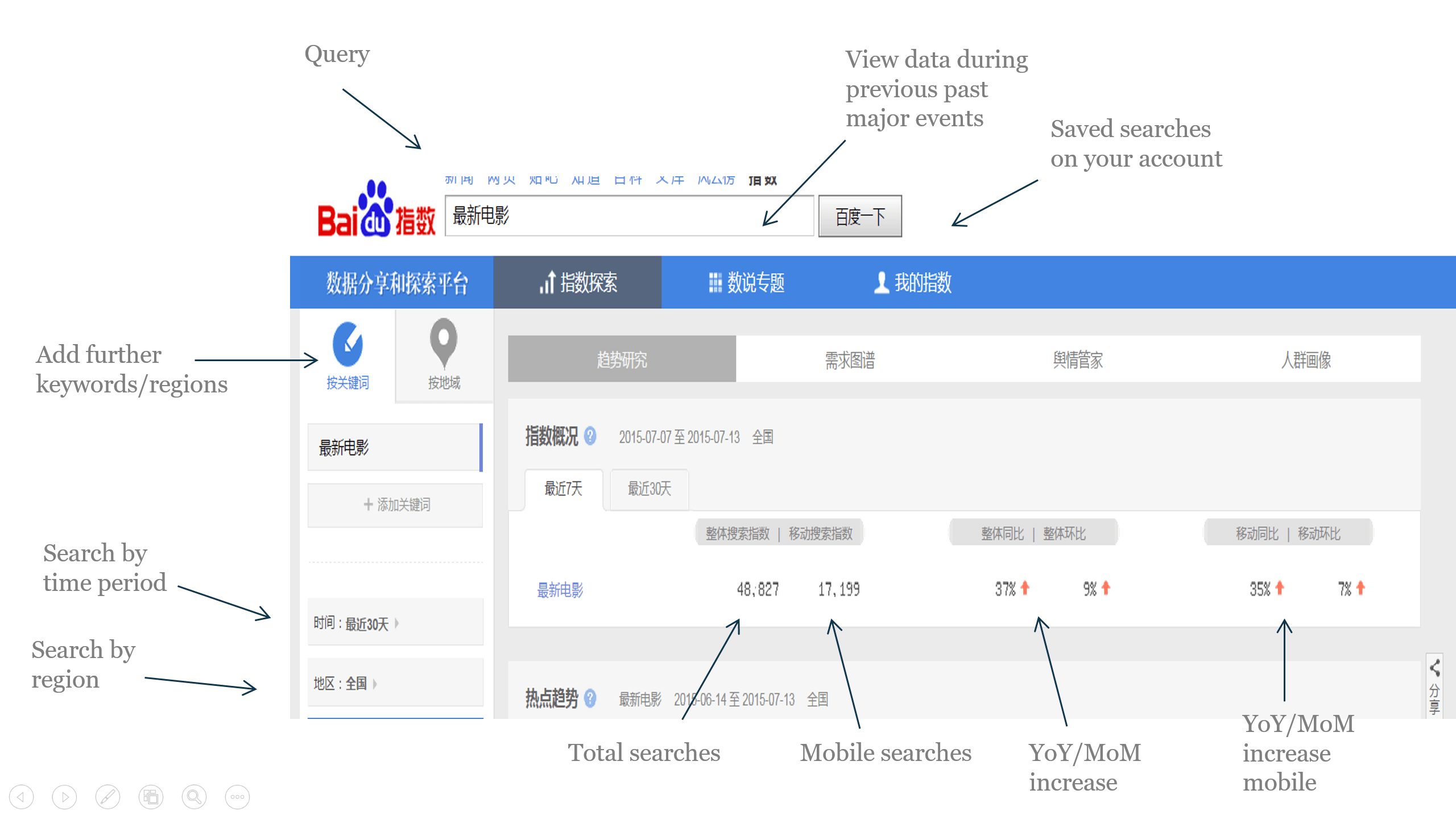

To complement Feng Yun Bang, Baidu Index also serves as a handy Google Trends / AdWords-like platform allowing you to harness data on particular keyword searches and inform content marketing strategies by identifying opportunities within your target market.

Carrying on with the theme of granularity and data customisation, Baidu Index also allows you to analyse keyword trends by city, province, time period and more as well as allowing you to delve further into data on related keywords and their own levels of popularity. Here are a few screenshots to walk you through its key functionalities following a search for the term “最新电影” (latest movies).

Here’s a look at the main interface:

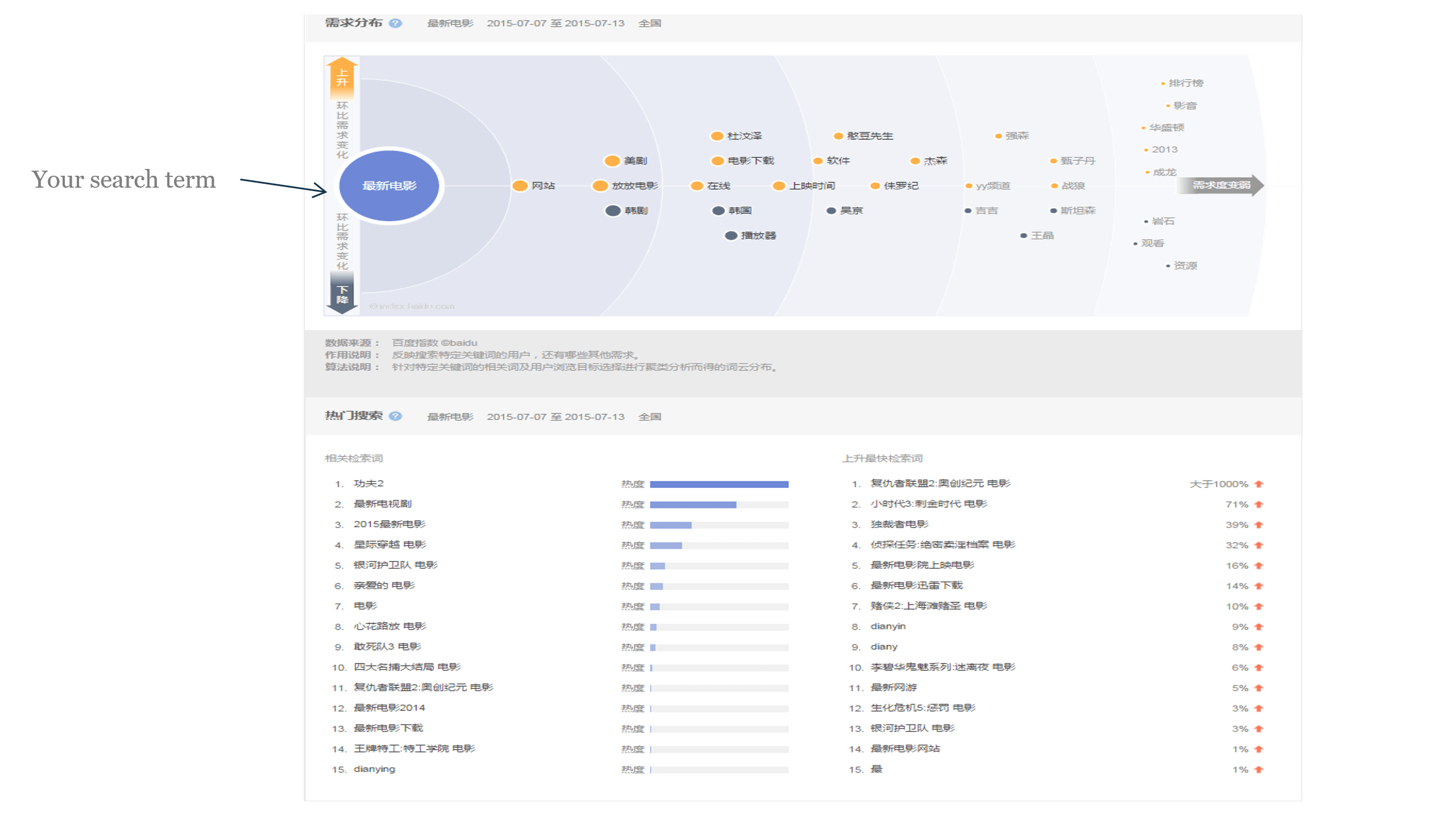

And here’s a look at the display of the second white tab under the top blue one, entitled “需求图谱” which in this context roughly translates as “related search data map”:

As you can see, your key search term is the one in the blue circle, with key related terms spanning out in hierarchy of popularity. Terms marked orange are ones that have increased in volume over the past month, while the ones in grey are vice versa. In this case, following on from “latest films” we can see that “US TV shows” (美剧) “Chapman To” (Hong Kong actor, 杜汶泽) and “Mr. Bean” (憨豆先生) are currently popular film-related terms.

The bottom left column shows further related terms and an indication of their current popularity, and you can actually click through on these terms to bring up the same display for the particular term you click on. The right hand column shows terms with the biggest percentage increase in volume over your selected time period, with the terms being clickable as well (in case you were wondering, the term with the 1000%+ increase is “Avengers: Age of Ultron”).

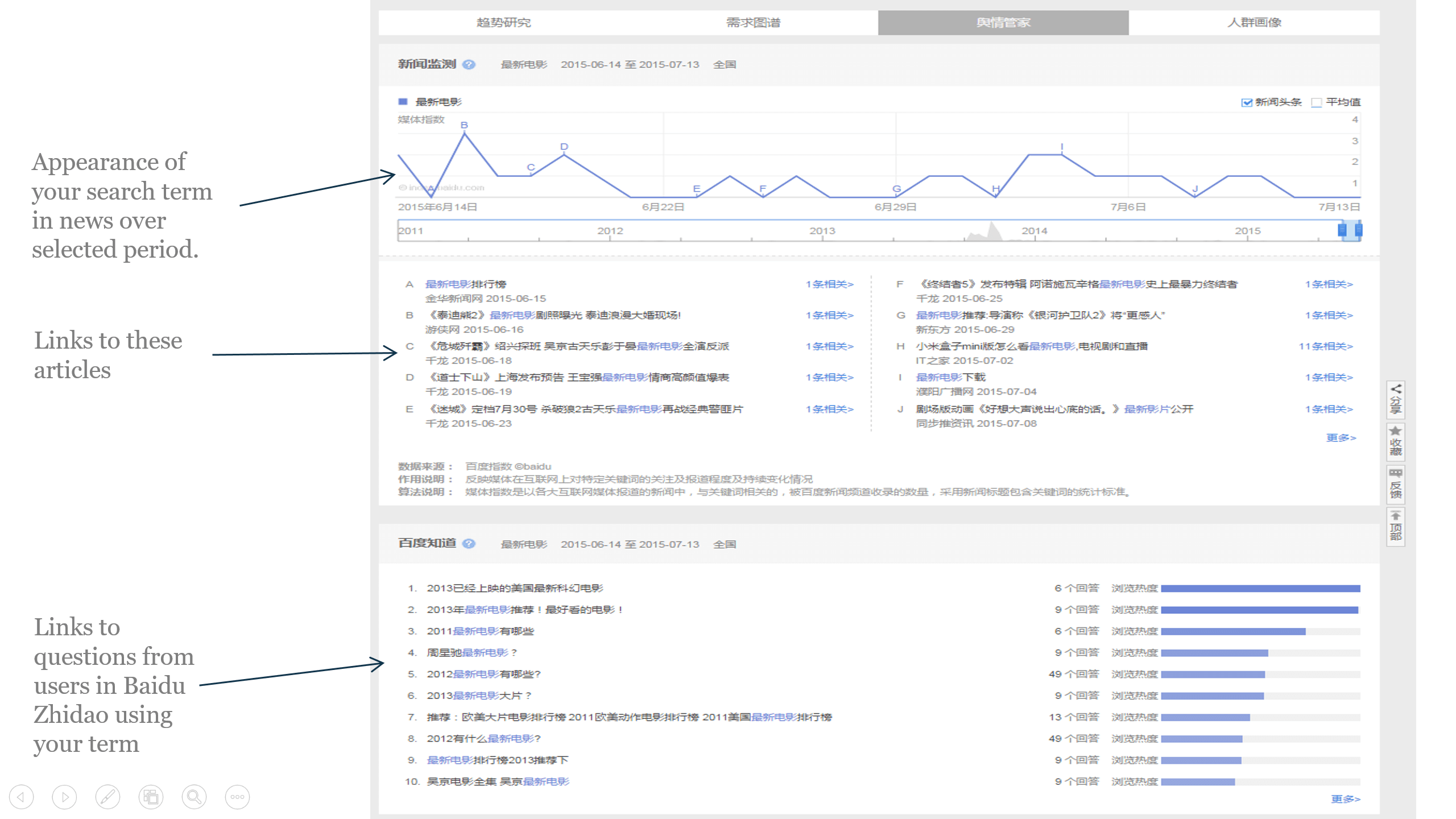

The third tab (舆情管家) allows you to explore how often and where your term is being discussed in the online public domain, pulling up results mentioning the keyword in news articles and on Baidu Zhidao:

As you can see, this is incredibly useful for identifying outreach opportunities and for leveraging Baidu Zhidao for opportunities to engage with your target demographic who are asking questions related to your brand.

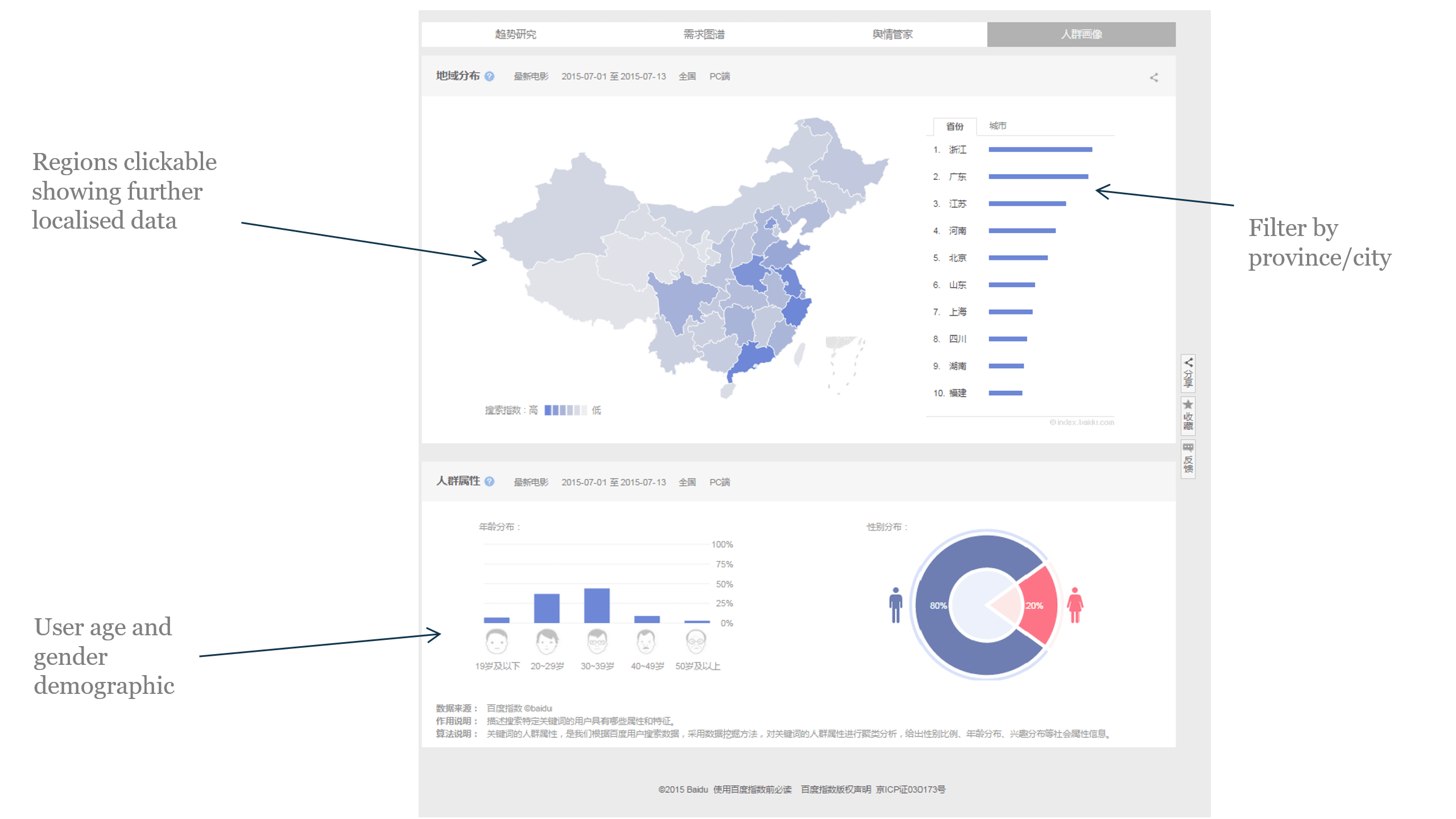

Finally, the fourth tab (人群画像) offers up a look at some top level demographical data on who and where is searching for your term:

Baidu Keyword Research Tool

Google AdWords can be great for establishing some preliminary optimisation quick wins and informing future content strategies, and it does pull data through from China via Google Hong Kong. However, given that it has a minimal share in the Chinese search engine market, it’s never going to be wholly representative. With that in mind, we have to turn to Baidu’s very own keyword research tool which forms part of its PPC platform, Baidu Tuiguang/Phoenix Next (百度推广/凤巢).

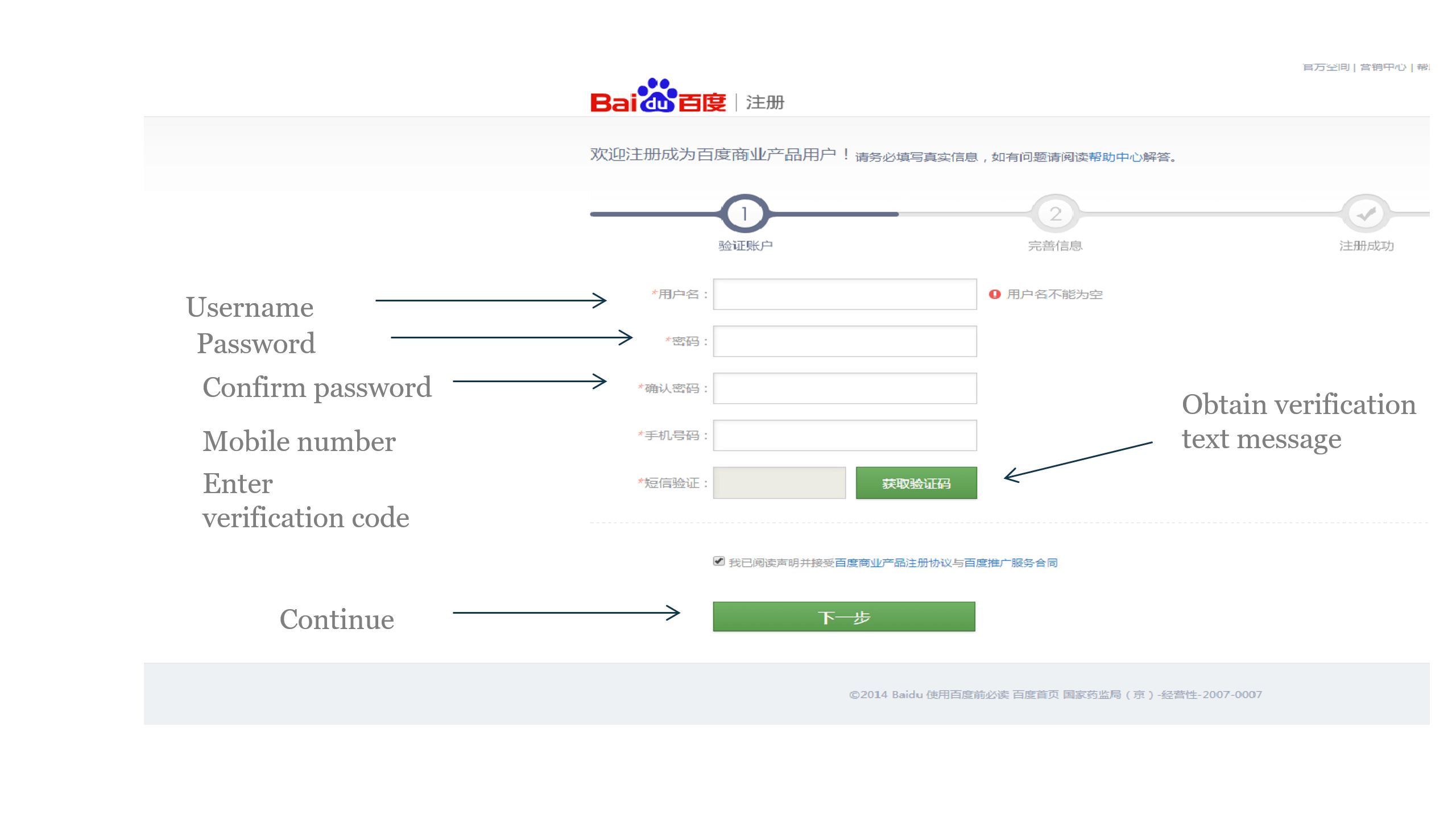

Signing up for access is relatively straight-forward (and free), though the tricky part lies in possessing an 11-digit Chinese phone number in order to enter the security code sent to you by text once you’ve registered. Before we explore the keyword tool interface itself, here’s a step by step guide on how to get in.

a) Click here to go to the sign-up page. Chrome Translate will serve you well by telling you what to enter here, though here’s a quick walkthrough:

Bear in mind that passwords need to be at least six characters long and must contain at least one capital letter and one digit.

b) Once you’ve entered onto the next page you’ll be required to enter further information such as company name and web address before completing verification.

c) Account set-up should then redirect you to a login page. It’ll ask you to download and install Baidu security browsing software before you proceed, though this is easy enough and it doesn’t have any effect on normal browsing activity. Once you’ve done that, refresh the page and enter your username, password and the captcha accordingly.

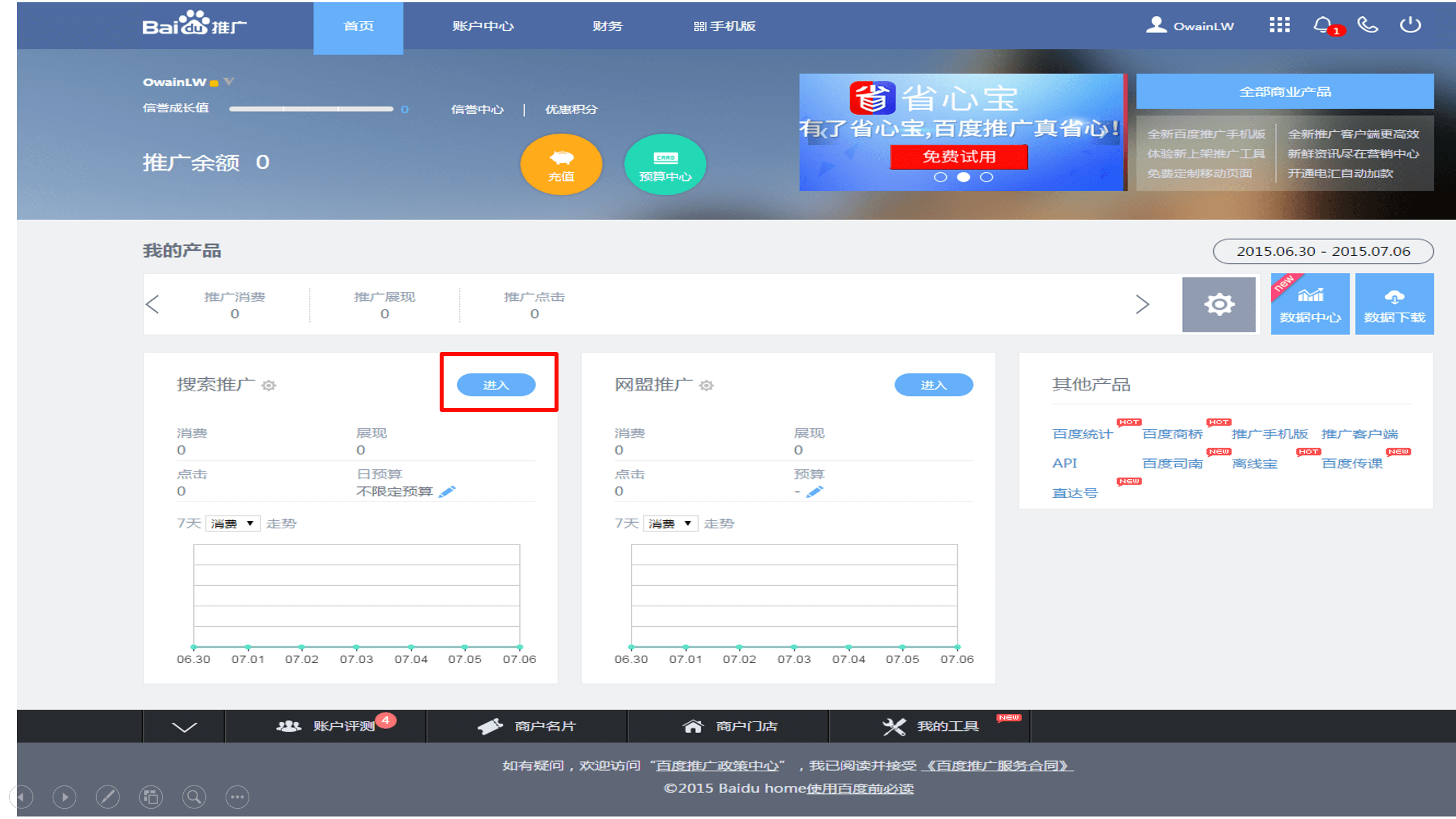

d) You’ll then be taken to the main interface of Baidu Tuiguang. To get to where we need to go for the keyword research tool, click on the first “进入” (enter) button as displayed in the screenshot below.

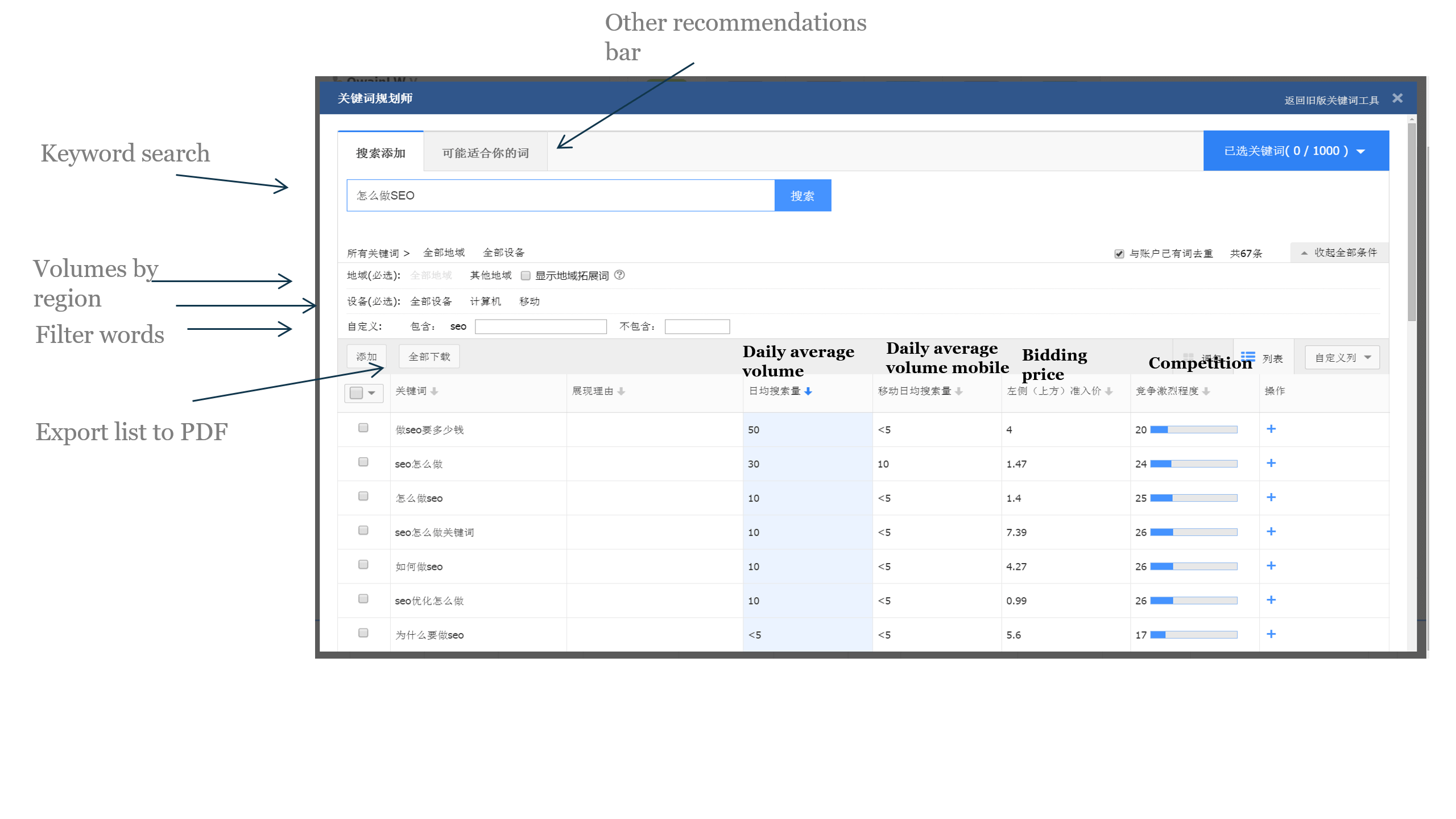

e) We’re getting closer! This screen is the control panel for PPC campaigns. To access the keyword research tool, hover your cursor down to the bottom of the page where you’ll see an arrangement of tool tabs. Click on the one with an image that looks a bit like the Microsoft Word logo (关键词规划师) and voila, we’re finally there!

The Baidu keyword tool does operate similar functionality to AdWords, however as of yet it doesn’t allow you to get search volume or recommendations on a group of keywords at one time, instead requiring you to type them in one by one (frustrating as that sounds). The interface was recently overhauled however and now displays vital mobile search volume and does allow you to search by device. The below screenshot offers an overview on the key functionalities and things you can play around with.

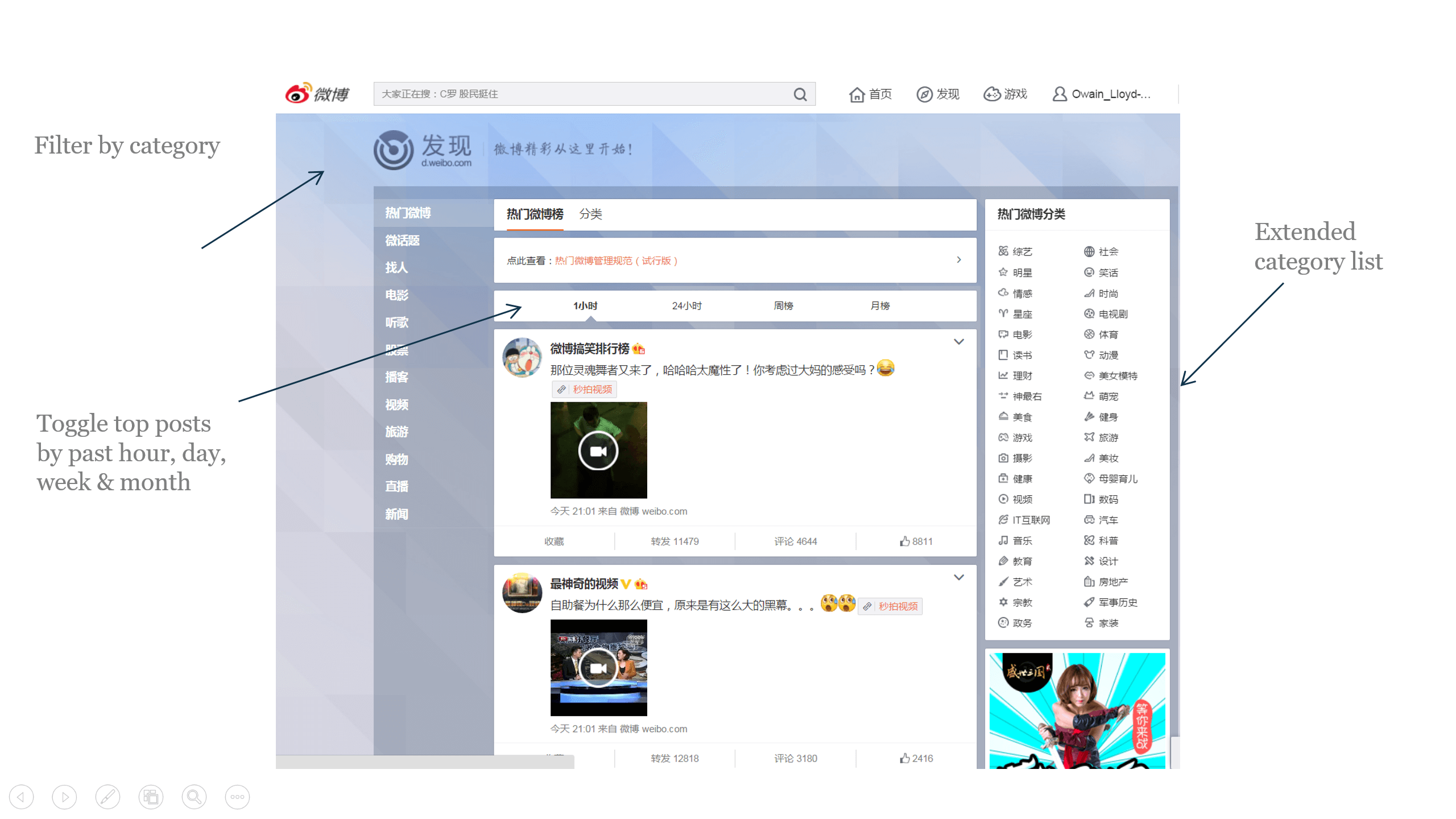

Leveraging Chinese Social Media for Content Insights – Sina Weibo

In a similar fashion to what we have over here with Twitter, Facebook and beyond, the Chinese social media landscape is a goldmine of ideas and information for exploring content and getting closer to what people are really talking about.

A few other additional factors make using social media in China particularly pivotal, however. First, the sheer volume of users on each platform – a combined total of 1.4 billion accounts on QZone, WeChat, RenRen and Sina Weibo alone – make for a vast depth of ideas and variety of content and discussion.

Social media in China, although still heavily monitored, also allows China’s modern, savvy internet demographic a certain degree of expression, autonomy and the space to discuss certain topics and taboos in what is still a largely regimented society offline. This allows for a really fascinating and truer insight into what makes people tick in China. Also, the importance of peer-to-peer recommendation, a sense of involvement and belonging as well as the speed at which things are picked up, shared around, go viral and subsequently change is something not to be underestimated.

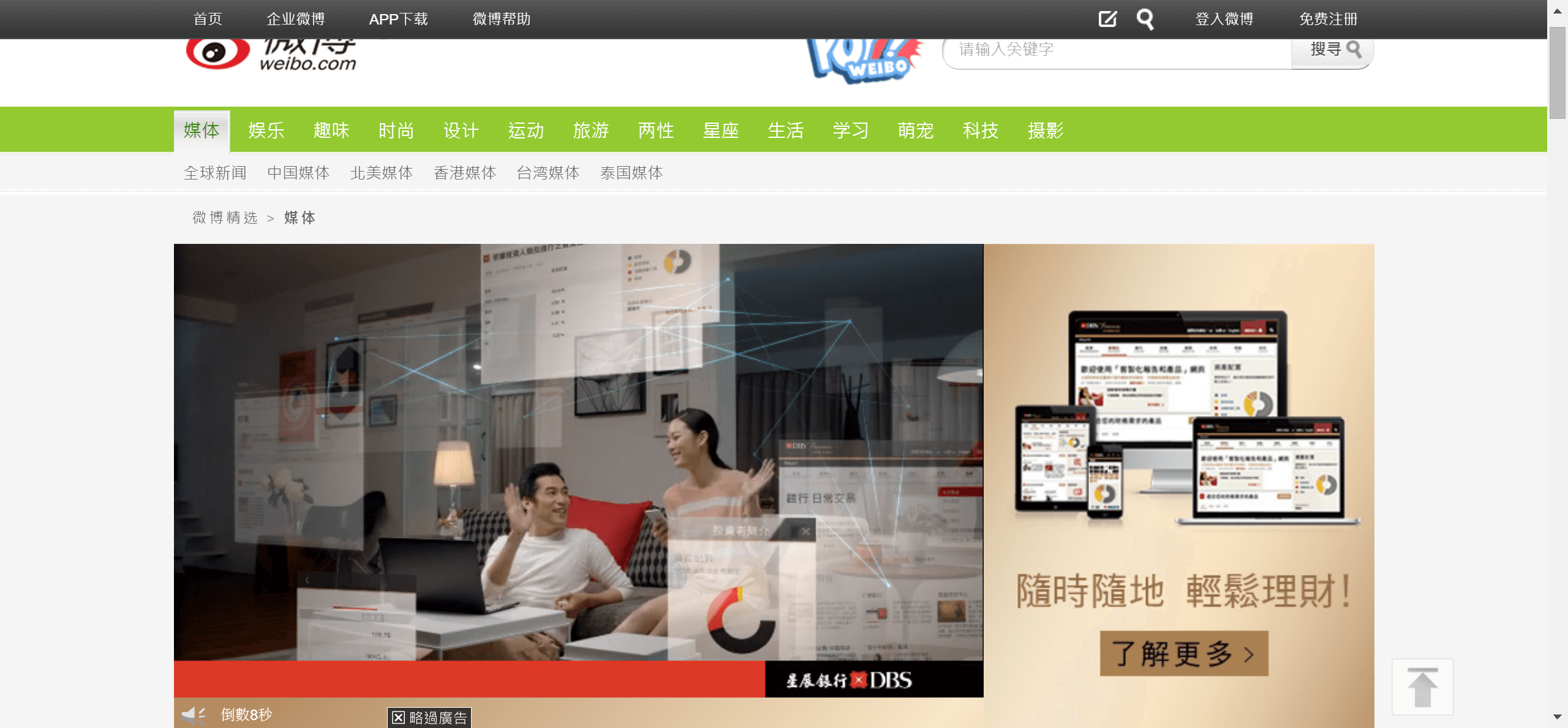

There are quite a few key popular social media platforms to consider (as well as several up and coming ones) however one go-to hub for content research and insights into China’s bustling social demographic is Sina Weibo, China’s Twitter-Facebook hybrid phenomenon.

Here are a few introductory points:

- Launched in August 2009

- 178 million monthly active users, who spend an average of two hours a day on the platform

- Around 100 million posts per day

- Offers 280 character limit as opposed to Twitter’s 140, and features a comment function when users re-tweet posts

- Extra functionality and promotional activities available to paid VIP and Enterprise account holders

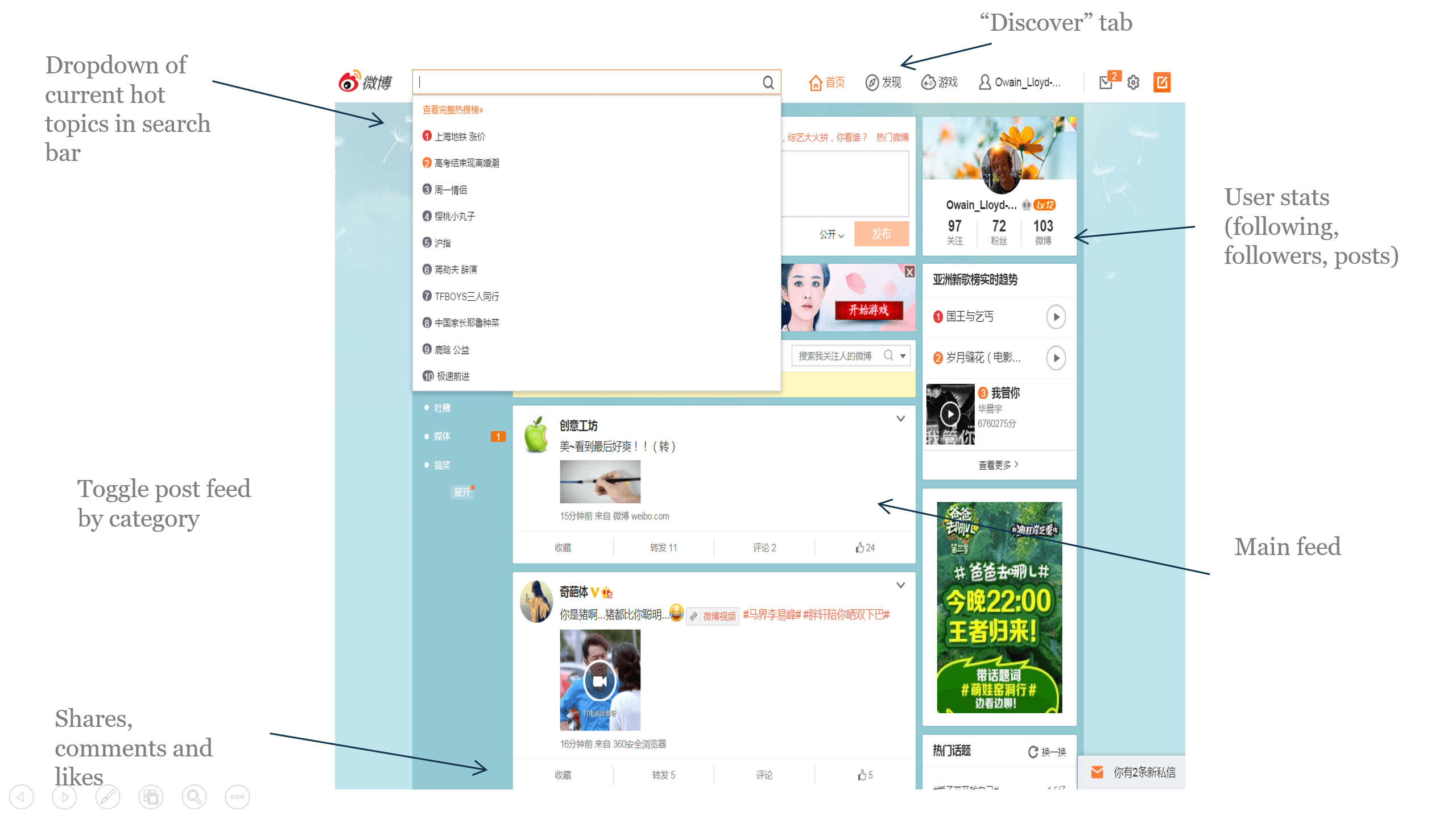

Signing up to Weibo is easy and requires nothing more than an email and password. Its interface does currently support partial English allowing you to guide yourself through some of its key sections, tabs and features. User posts and content however will almost exclusively be in Chinese. Although we recommend employing the use of a Chinese speaker to digest the content accurately, Google Chrome Translate can be relied on to an extent. Regardless, below is a little exploration of some ways to make use of Weibo to get an understanding of the key content topics you’re after.

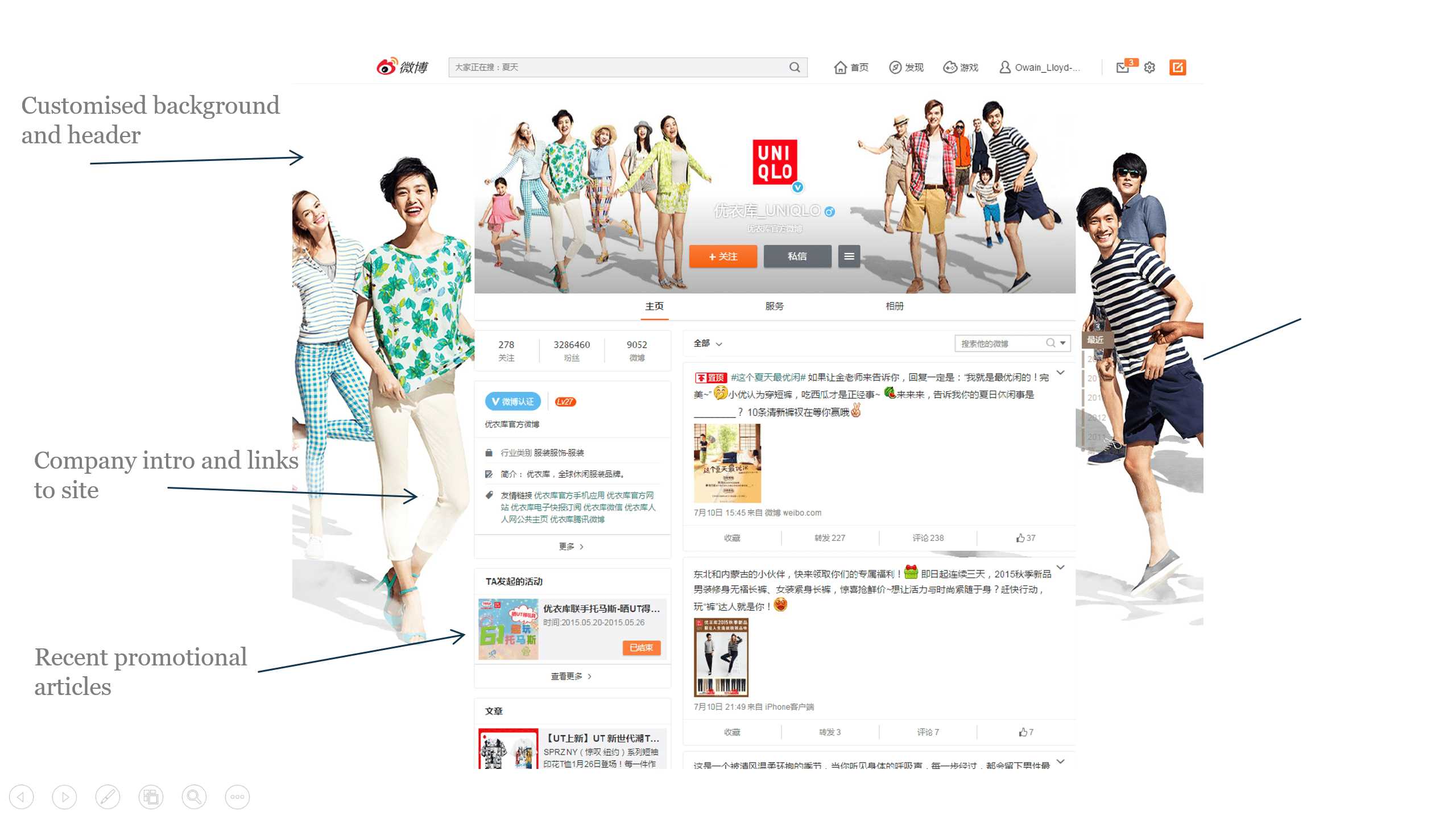

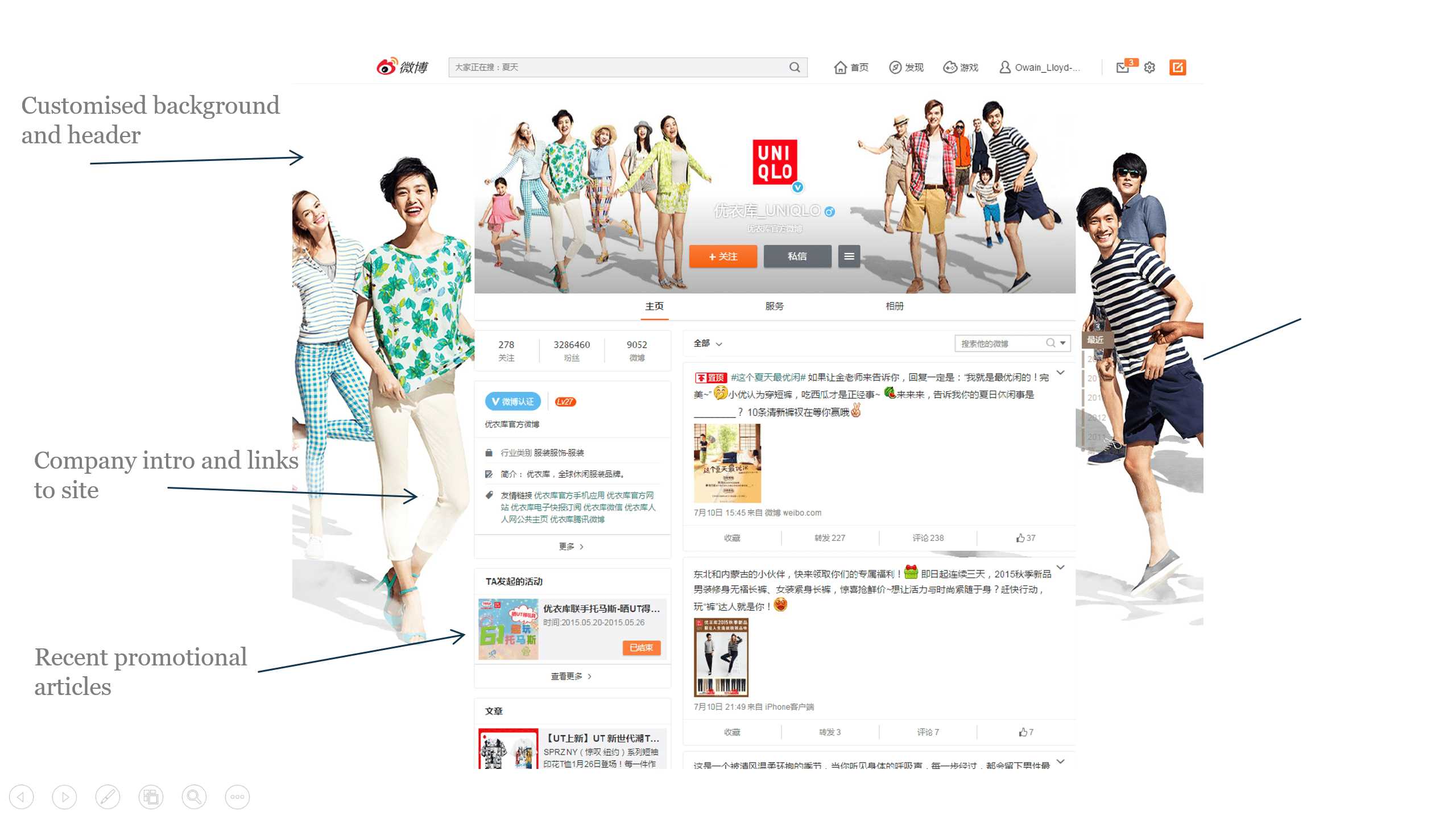

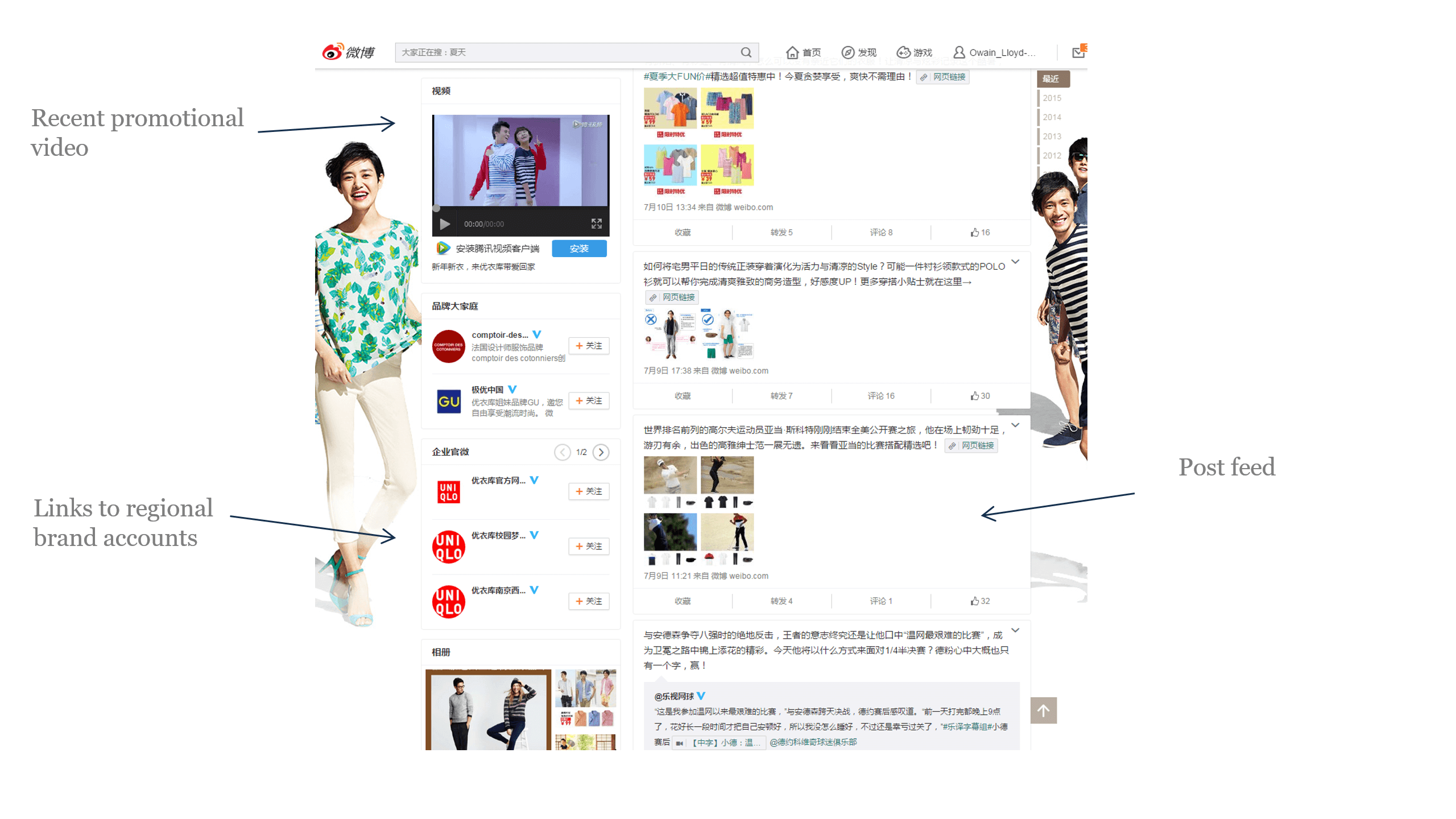

Weibo Enterprise

Weibo also offers a variety of upgraded paid services that allow you access to more features. The cream of the crop comes in the form of Weibo Enterprise. This serves as a customised brand platform allowing official accounts to tailor their own Weibo pages relatively liberally, allowing for the incorporation of interactive elements such as photo albums, videos via Youku, customised widgets, affiliate links, user polls and more.

Moreover, Weibo Enterprise also features its own analytics and task management system, allowing you to identify granular information on precise user behaviour with the content you share, plan content strategies, obtain further social data and identify industry influencers. When it comes to content marketing within Chinese social media, identifying and leveraging influencers, or “KOLs” (Key Opinion Leaders) as they’re known in China, is vital to enhancing brand reputation and reaching out and growing your audience.

Celebrities aside, many industries in China have a wide range of KOLs with significant Weibo following, and while this is rather heavily monetised its significance lies within the notion of users harbouring high levels of trust in these respected individuals.

Weibo Enterprise does require the breaching of some bureaucratic hurdles to obtain however, with photocopied files of company registration certificates, an authorisation letter from the company confirming the management of the account by a third party and costs in the hundreds of dollars depending on the company location. To get a feel for what it can do for you however, here’s a look at the current Enterprise account held by clothes outlet Uniqlo.

What Kind of Content Works in China?

This section probably deserves a guide in its own right, as we are of course dealing with a country that is vastly different culturally, and naturally the types of content that work over there are going to be different. Familiar mantras of humour, awe, originality, debate and shareability still reign supreme, though here are few things to think about before considering content marketing for China that should double up nicely with some of the content research processes we’ve outlined above.

Despite huge leaps in modernisation, tradition is something that still plays a huge role in Chinese society. One shining example of this is the importance of family and the Confucian notion of filial piety, the importance of which is frequently reiterated on Mother’s and Father’s Day in the form of hundreds of millions of “thank you parents” messages being shared on Weibo.

Understanding Chinese Humour

There are rather large misconceptions thrown around regarding the lack of sarcasm and irony in Chinese society. This of course couldn’t be further from the truth, with Weibo’s users staking a well-earned reputation as holders of a unique strand of scathing satire whenever a political scandal or an all too well-known “China problem” (such as pollution) makes the rounds.

To escape censorship, one common method is the use of wordplay and homophones (Chinese being a tonal language of course) to establish running jokes or evade certain forbidden terms. Homophones also play a vital role in advertising and branding in China, with a great example being the Chinese word for Coca-Cola – pronounced as “ker cole ker ler” (可口可乐) with the Chinese characters roughly meaning “tasty fun”.

Read up here and here for a couple of great articles on the nature of Chinese internet humour, and to keep in the know with all the fantastically-creative words and characters that have snuck into the Chinese dictionary thanks to social media, ChinaSmack have compiled a thorough glossary.

Taking Care with Censorship

We had to touch on this at some point as unfortunately it does cast a rather large shadow over the openness of the Chinese internet. Day to day SEO and marketing activities shouldn’t be affected by it, though as many of us are used to forging content that frequently sparks debate on the world we live in, some awareness won’t go amiss. To get an understanding of the type of lexis and topics you should avoid beyond the three Ts (Tiananmen, Tibet and Taiwan), give this Wikipedia article a read. International news publication Foreign Policy also recently published a practical flow chart which offers insight into some of the logic behind content which gets censored in China.

When working within Baidu, be it for outreach or linkbuilding, you’ll seldom come across a censored site in the index, though for whatever reason if you wish to double check whether it or your own site is blocked or not, run the domain through the Blocked in China tool.

Ultimately, Chinese internet censorship is a rather fickle beast that can fluctuate periodically, with sensitive dates such as the yearly national parliamentary meetings in Beijing or Chairman Mao’s birthday (December 26th) causing sporadic 404s and internet blackouts when even seemingly harmless terms are queried. All in all, it’s not something that will disrupt your normal activities so certainly don’t be put off!

China Content Examples

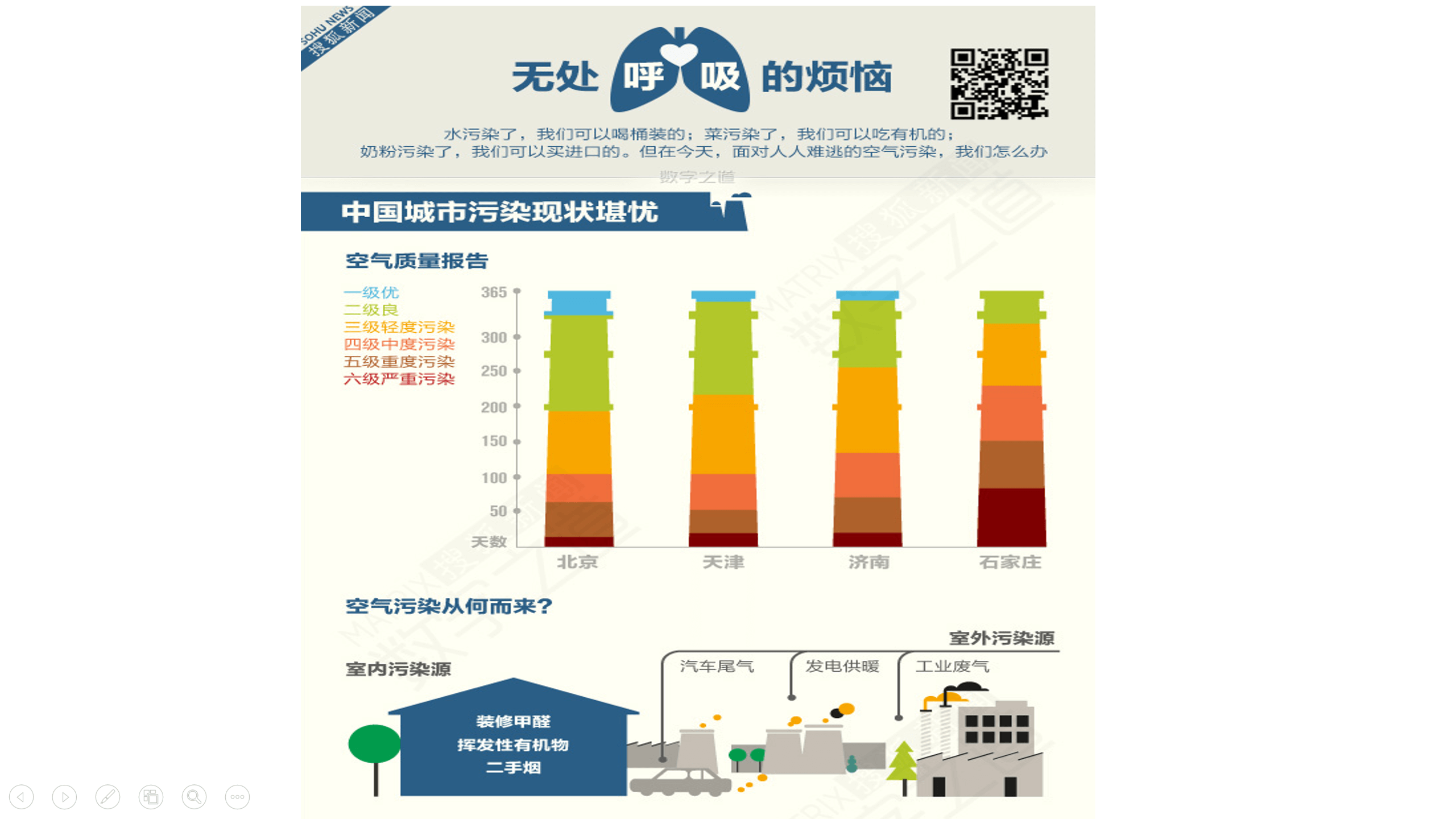

Here are a few examples of content marketing campaigns that we’ve pulled from the Chinese content sphere that recently did well, with thoughts as to why.

a) Sohu News’ “Nowhere to Breathe” (无处呼吸) pollution infographic

What:

- Displays China’s cities with the most severe air pollution

- Breaks down key causes, health statistics and how to stay healthy

Why:

- Addresses a major societal concern in modern day China that affects everyone

- Offers practical, digestible tips on what to do and buy

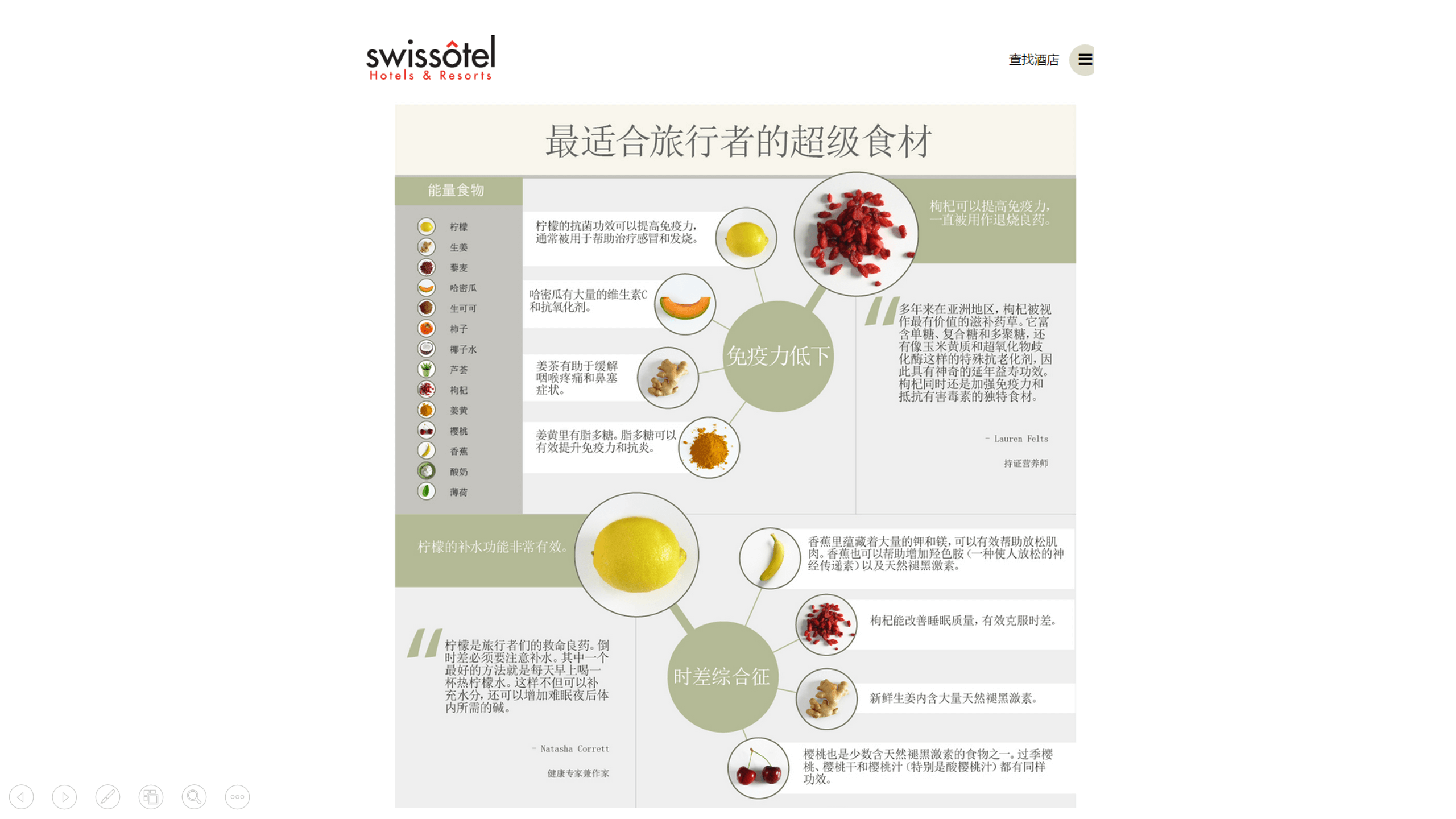

b) Swissotel’s “Best Superfoods for Travellers” (最适合旅行者的超级食材)

What:

- Runs through a series of health superfoods such as quinoa, ginger and mint, offering insights into their properties in tackling jet lag, sunburn, travel sickness and other common travel-related ailments

- Offers quotes from industry experts on the properties the foods possess that keep you healthy

Why:

- Healthy food, wellbeing and food safety in general is a key facet of traditional and modern day China

- Some of the foods, such as ginger and cantaloupe are indigenous to China and have long played pivotal parts in Chinese cuisine

- The increase of wealth in China sees more ordinary people travelling, with the infographic appealing to the large travel publication industry and demographic.

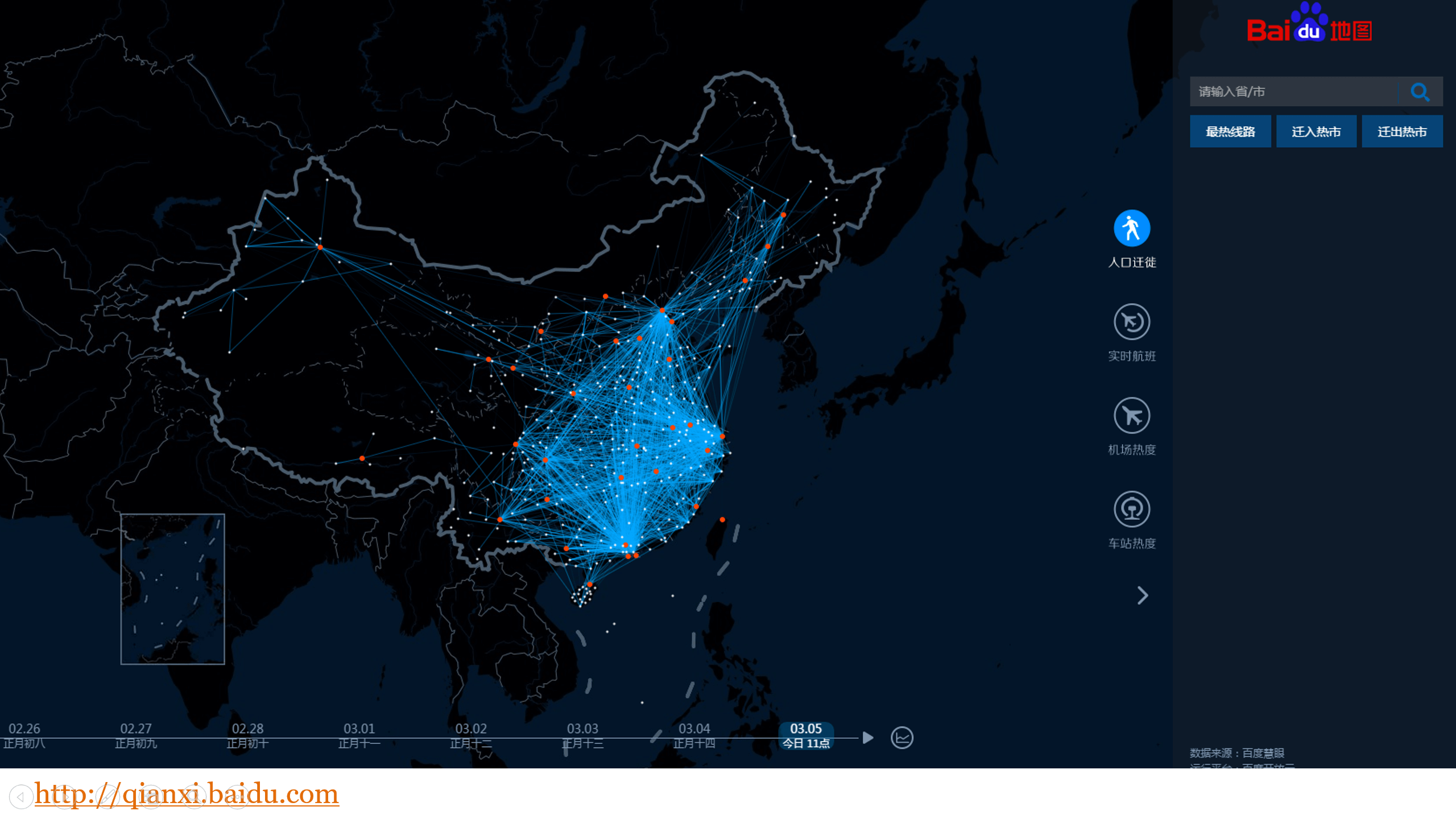

c) Baidu’s “Qianxi” (迁徙) Map

What:

- Interactive map using Baidu Maps mobile tracking data to visualise the movement of citizens across China as they travel home during the busy Chinese New Year period.

- Users able to toggle between flights, train journeys, find out the most frequent journeys from one place to another and more

Why:

- Interactivity. Something which, like in the West, has great appeal

- Again, an issue that effects everyone and one that taps into many social considerations in China such as national holidays, tradition, family, overpopulation, migrant workers, and infrastructure.

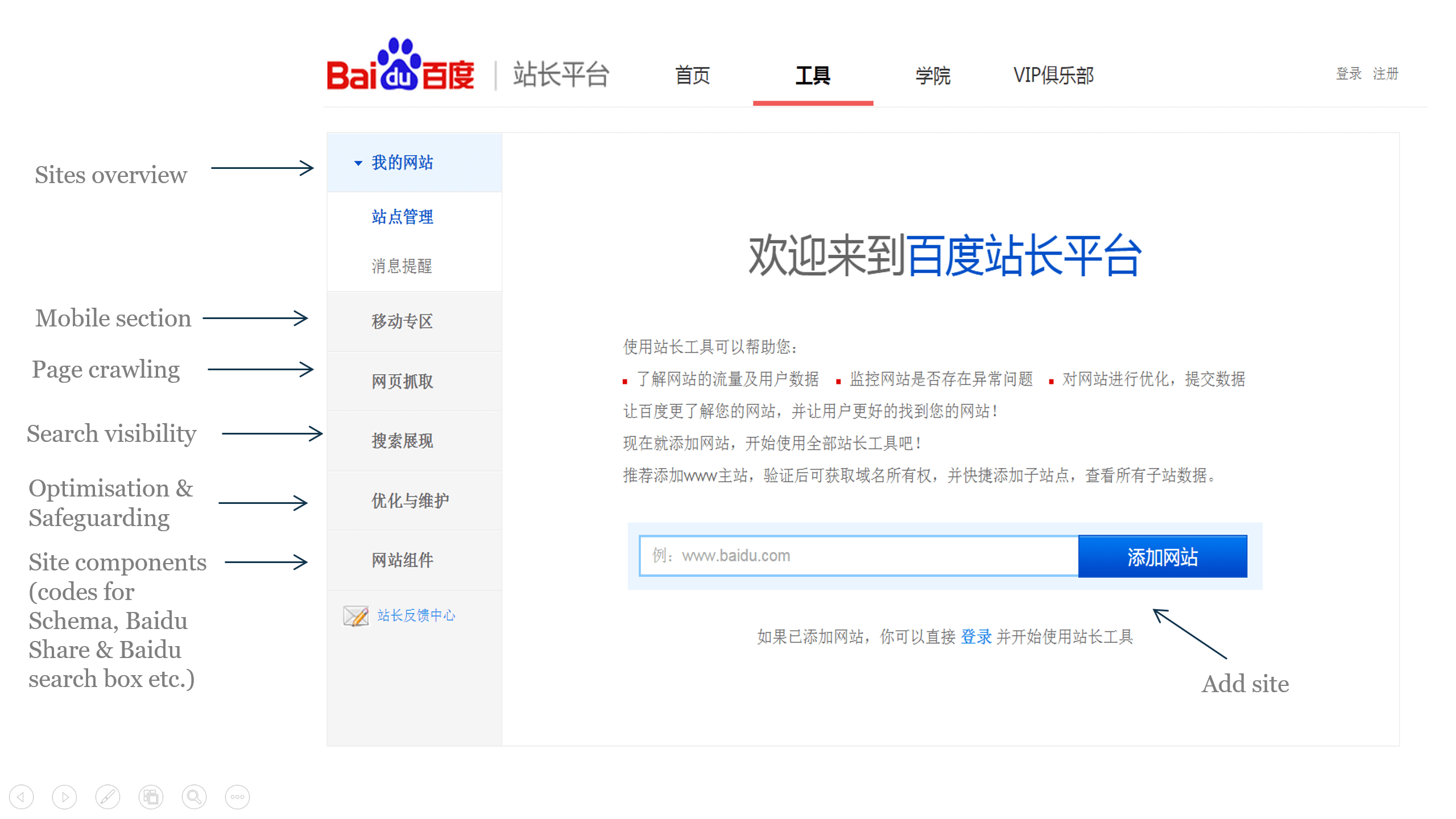

Baidu Webmaster Tools

Much like Baidu has its own incarnation of some of the key SEO and content tools we use on a daily basis for Google, it comes as no surprise that it has its own webmaster tools. Luckily, and despite the fact the interface is in Chinese, it employs a similar structure to Google WMT in terms of layout and the information you can monitor. Naturally, it’s a hugely pivotal part of the world of Baidu SEO for similar reasons to Google WMT. In terms of initial configuration and quick wins however its pricelessness lays in the fact that it will ensure your site is indexed in Baidu’s SERP, something that we’ve seen many well-endowed Western sites with pages targeting China overlook.

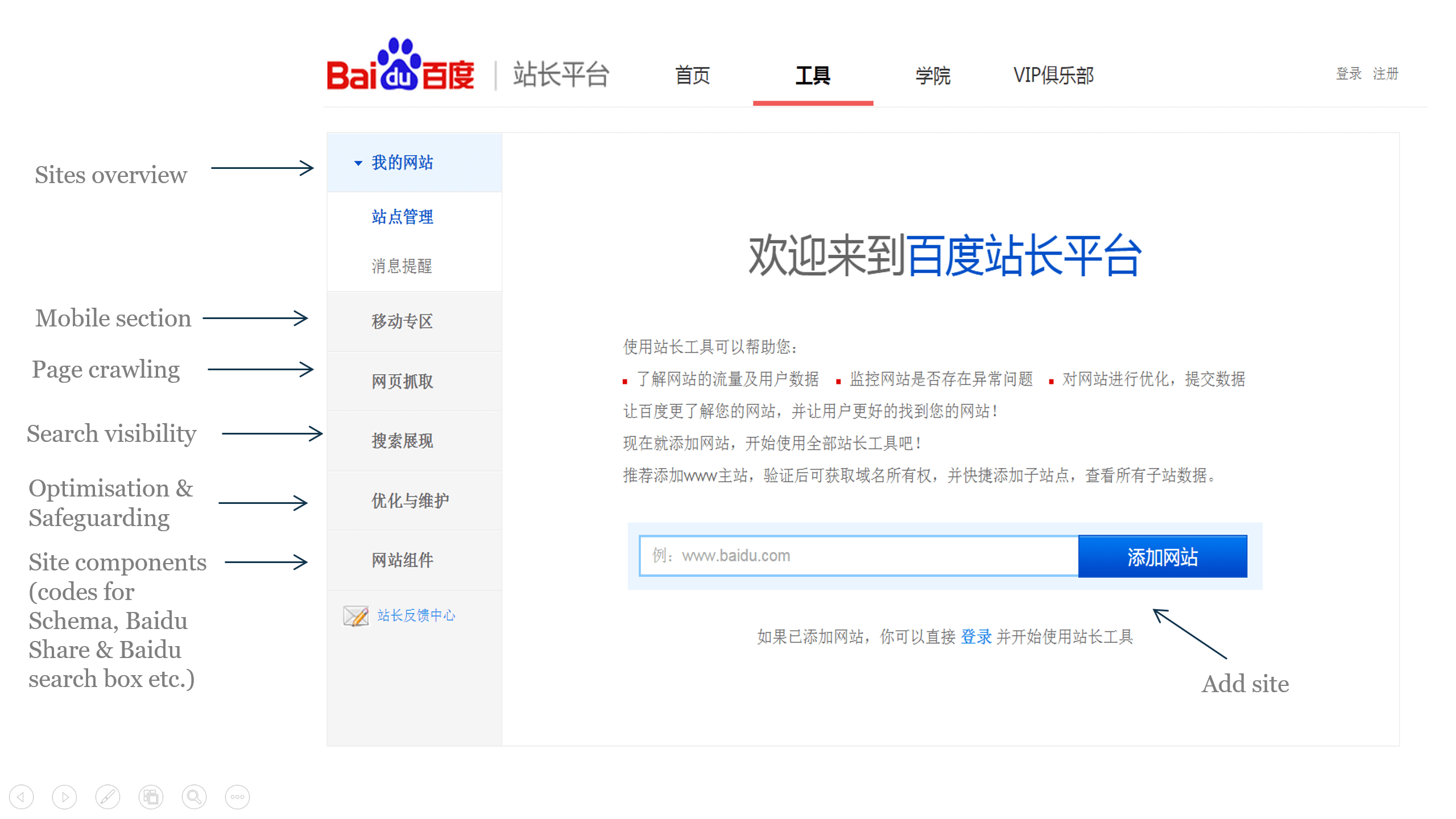

To access it, head to https://zhanzhang.baidu.com and sign in with your Baidu account. After which, you’ll get a confirmation email to activate the account. Once you’ve signed in you’ll be taken to the main interface. Here’s a little look at what each section is:

How to Set Up a Site on Baidu Webmaster Tools

Now, as tempting as it to go to town and offer up a full in-depth guide complete with annotations for every function, we’re going to cover the key basics which will offer up some nice quick win gains and ensure you’re on the right path to Baidu success. A somewhat in-depth guide (although don’t rule us out for the future!) is currently available here, and despite being somewhat outdated it does provide some useful pointers.

First thing’s first however, here’s how we get a site set up on Baidu Webmaster Tools:

- Click on the “Add site” (深加网站) button as depicted in the previous screenshot.

- You’ll then be taken to a bar where you can enter a URL and submit accordingly, as shown below:

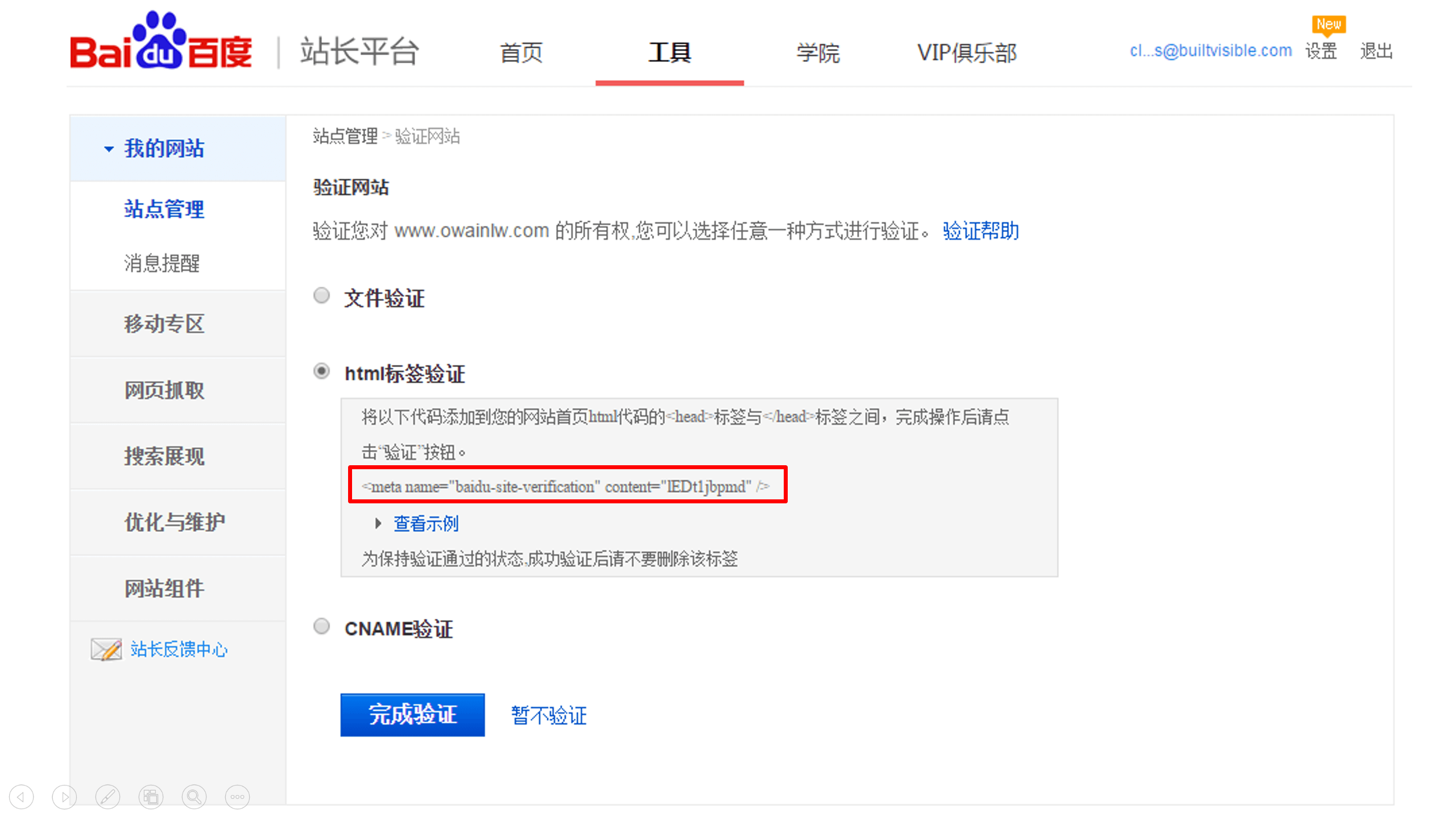

- Once you’ve clicked on the “深加网站” button once more you’ll then be taken to a verification screen where you’ll be prompted to insert the Baidu WMT tracking code into your site’s code either by file upload, HTML tag or CNAME. We recommend copying the HTML code as this is the most straight forward – simply paste it betweenandsection of your site’s homepage.

- Once you’ve done that, hit the blue “完成验证” (verification complete) button at the bottom and you’re done!

Baidu Webmaster Tools Basics: Crawling and Indexing

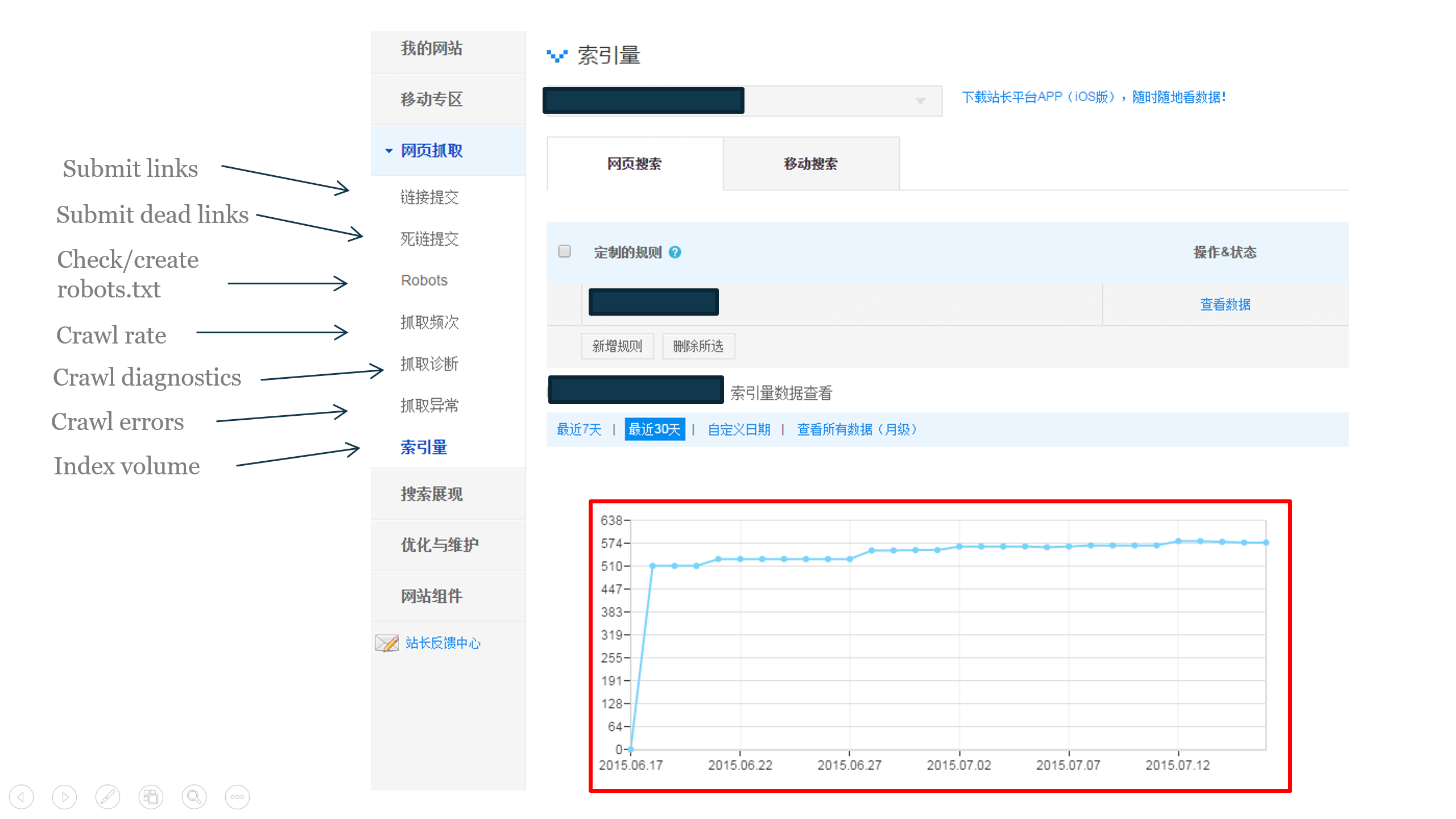

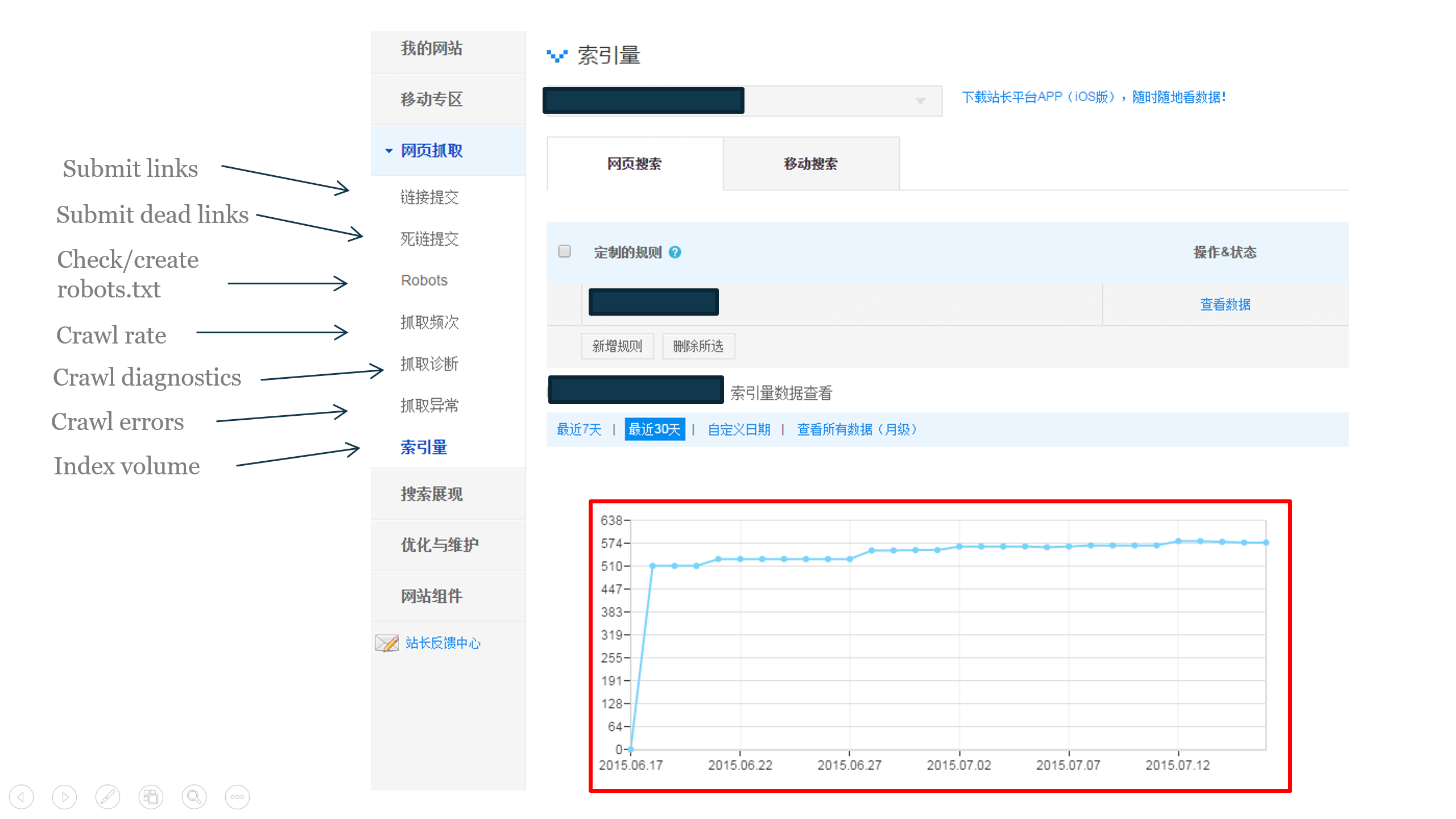

Within the third left-hand tab (网页抓取) on the main Baidu WMT interface you can submit links, dead links, check (or create) your site’s robots.txt file and access data on individual URL crawl rate. The below screenshot shows pointers to these functions, though once you’ve verified your site with Baidu WMT you might want to head over to the index tab soon after to see the effect:

As you can see with this particular domain in question, since the site was correctly configured with Baidu Webmaster Tools its indexation into Baidu skyrocketed, allowing ultimately for the path to be set out for the visibility on Baidu we’re after.

Baidu Webmaster Tools Basics: Site Optimisation

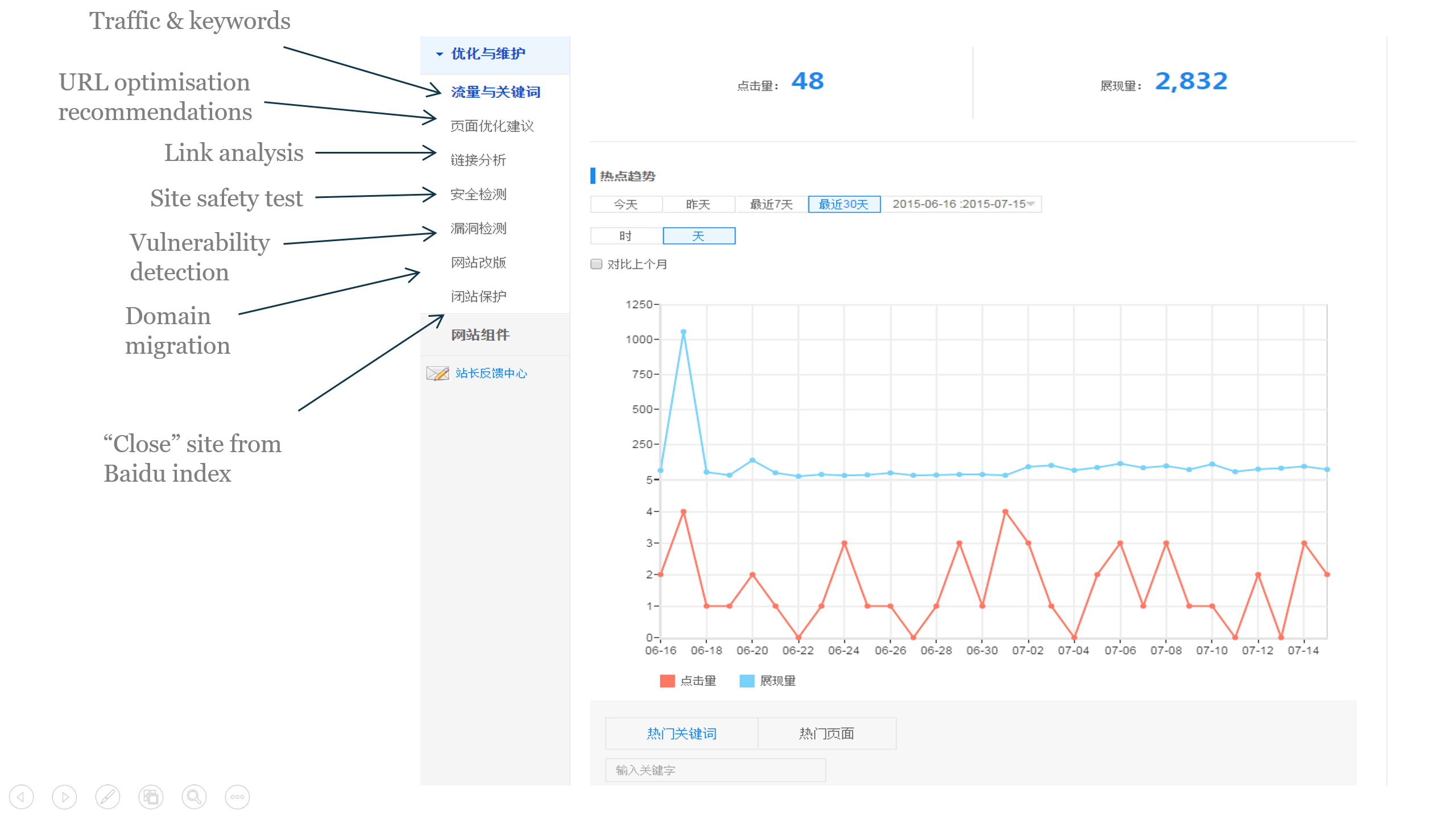

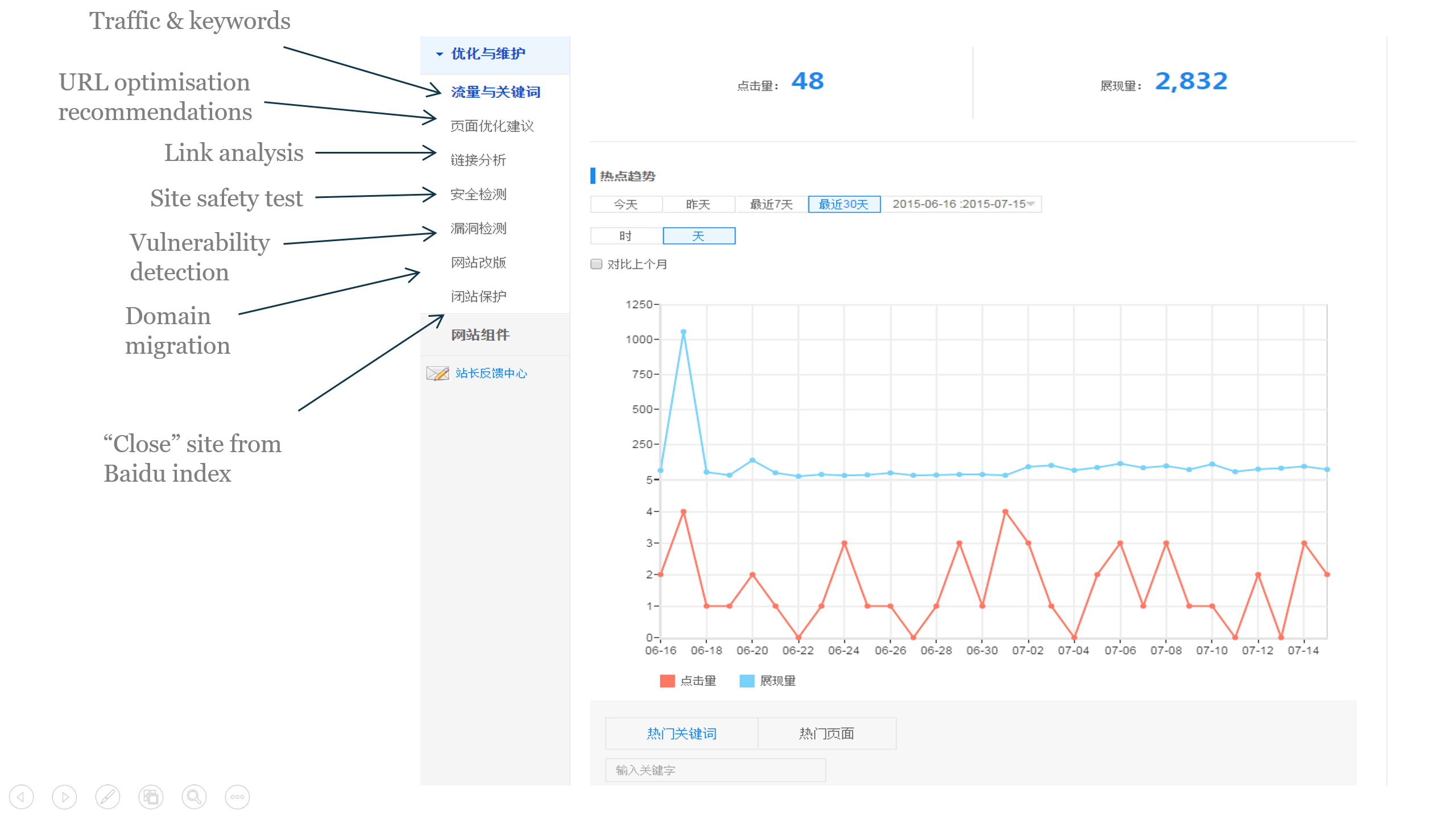

On the fifth tab down (优化与维护) you can get to grips with how your site is doing in Baidu in what, much like what is featured in Google WMT, is a scaled down version of Analytics (of which Baidu also has its own). Here’s a breakdown of some of the key functions where you can learn about Baidu traffic, link data, site-related keyword click through rate and more.

As you can see on the right, you can have a look at site appearance in the Baidu SERP as well as click through rate over a period of time, compare it to previous time periods and take a look at the keywords which are granting you the most traffic. Another useful tool worth mentioning here is the “URL optimisation recommendations” (页面优化建议) tab, which allows Baidu to diagnose individual URLs and offer up some SEO recommendations accordingly. Both the “Site safety test” (安全检测) and “Vulnerability detection” ( 漏洞检测) tools are worth checking out too to check if your site is free from security issues and malware as unfortunately these do plague the Chinese internet space somewhat.

To stay on top of some of the neatest tips and tricks for Baidu Webmaster Tools, check out its own learning centre. Alternatively, (and if you don’t speak Chinese) be sure to check out some of the resources listed at the end of this guide.

Mobile

Much like any modern-day SEO is used to when optimising for Google, mobile plays a huge part of the overall Chinese digital marketing pie. Mobile is something that is taken up a notch somewhat in China, with around 500 million active monthly mobile users and with mobile accounting for well over a third of overall traffic and ecommerce sales for many websites. This has rocketed with the rise of WhatsApp hybrid WeChat, mobile gaming and the overall notion of being plugged in and in touch with peers, colleagues and the digital space in general being of huge significance for users in China.

As such, it’s vital that your site is Baidu-mobile friendly. Baidu have released a full mobile optimisation guide in Chinese here, though here are some key pointers to take in consideration:

Baidu Site App

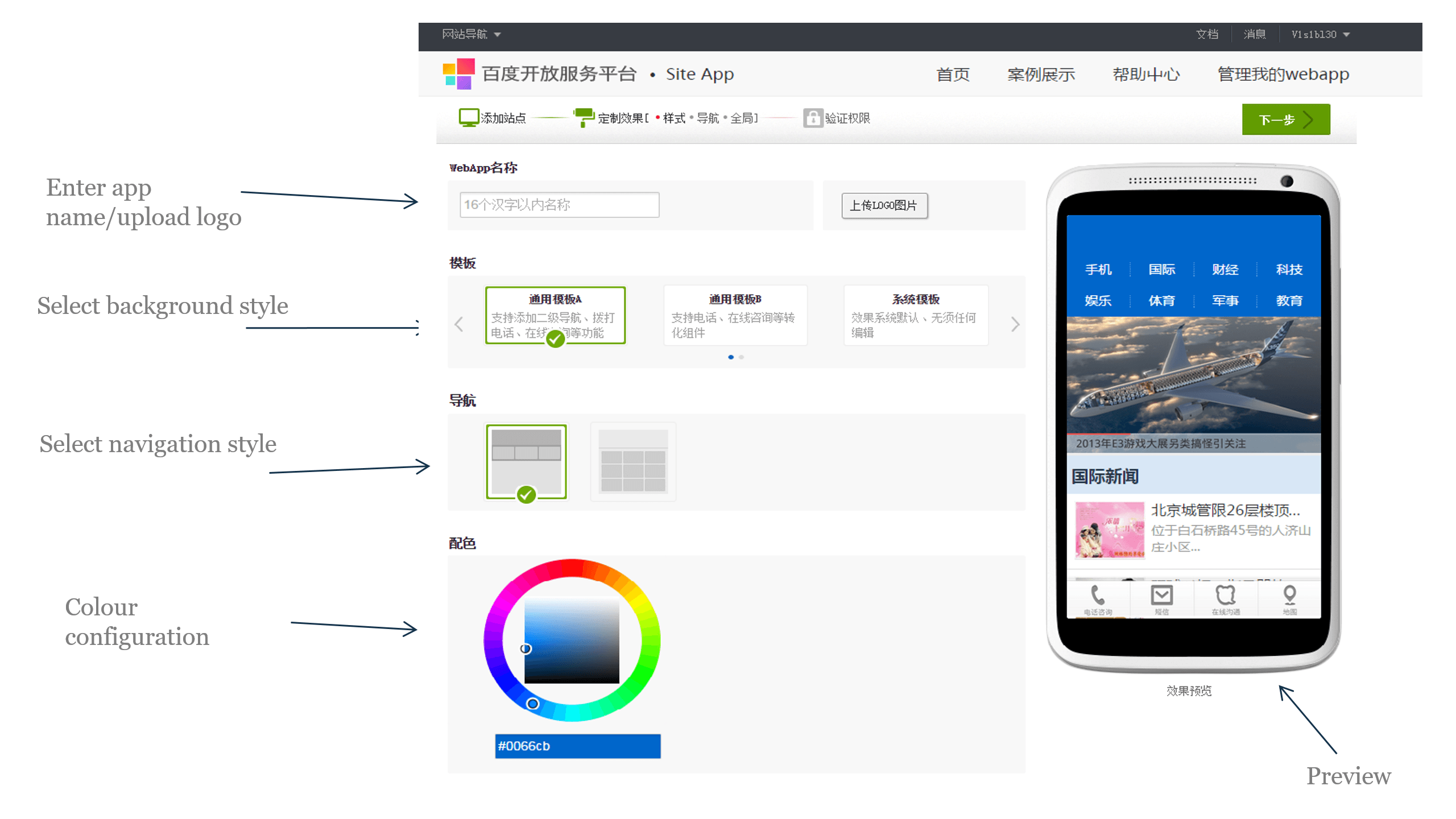

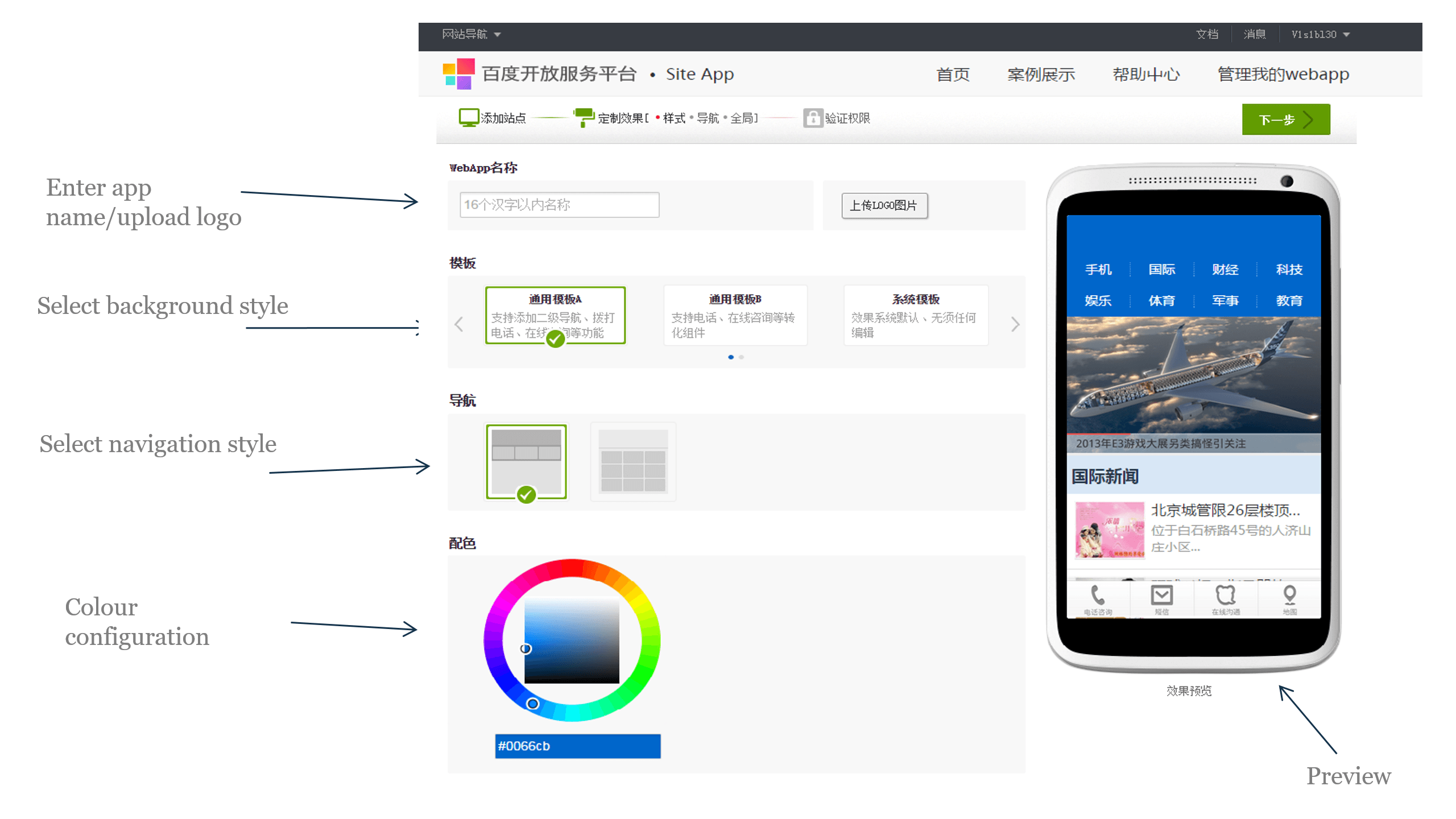

Baidu Webmaster Tools offers a wonderful feature which, if you don’t have a mobile site, allows you to create an app-like version of your site based on your desktop site. Site App, which is also accessible via the “Mobile section” (移动专区) of Baidu WMT, allows you to customise your site through a series of relatively self-explanatory steps, such as the design phase pictured below:

For those of you with an existing mobile site, assuming this is nicely put together and is well optimised, the key point lies in making Baidu recognise it as a mobile site and crawl it accordingly. This is easily achieved by using the correct meta tags. The mobile user agent for Baidu is the same as desktop (Baiduspider), and adding the below meta tag into your desktop pages will ensure they’re crawled for mobile:

<meta name="mobile-agent" content="format=[wml|xhtml|html5]; url=url">

Final Thoughts

Aside from providing you with an overview of some key SEO, social media, content and cultural factors, hopefully this guide serves as a useful, actionable starting point for getting your digital strategy for China right.

As with any local SEO or all-round digital strategy, there are a wide plethora of facets to consider, and while things may seem vastly different at first glance, taking with you the right ingredients of what makes a good SEO, an objective mind-set and a thirst for a new challenge will set you on the right path.

While we’re used to adjusting to a digital world that shifts and changes on a regular basis, remember that with China one crucial element is that this notion is somewhat taken up a notch. The Chinese market may at times appear contrary and perhaps a little fickle, though being able to keep on top of its various developments will doubtless hold you in good stead to make use of what, above all, is a truly massive opportunity.

Resources

Whether it’s a need for further news on Baidu or for more resources on hot content in China overall, here’s a list of some great sites to check out:

- Mop (猫扑) – Essentially China’s Mashable (Chinese)

- Baozoumanhua (暴走漫画) – Great place for popular memes and cartoons making the rounds on Chinese social media (Chinese)

- chinaSMACK – Rounds up viral news stories and translates netizen comments

- Sinocism – Daily China newsletter rounding up popular news stories in China

- Tech in Asia – Great resource for industry news across the region

- Tea Leaf Nation – Magazine posting stories from Chinese social media and beyond

- Kantar China Insights – Statistical reports on a variety of industries

- China Internet Watch – Chinese social media, mobile and SEO insights

- Free Weibo – Uncensored version of Weibo (partial English interface)