1. Get to know your audience

Audience insights are the foundations of a successful campaign strategy. Only when you understand the lifestyles, hobbies, habits and passions of existing and potential audiences can you present them with a story that will grab their attention and garner genuine interest in a product.

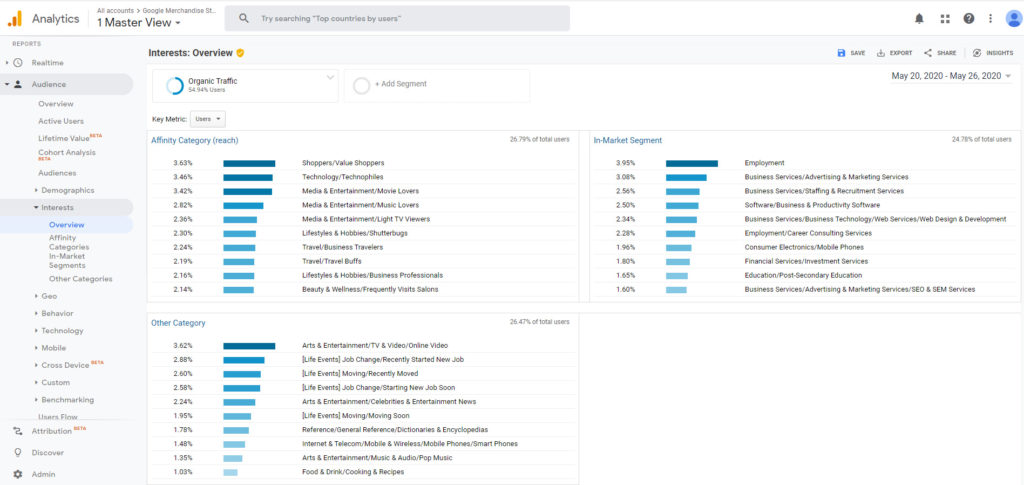

There are myriad ways to gain insights into your audience’s interests: customer reviews, interviews, surveys, forums, to name a few. But one quick and key method is by using Google Analytics (GA) Interests reports. GA splits the Interests section into three:

- Affinity category:segments of people who could be interested in your product or service categorised by their overall interests

- In-market segment: types of products or services that your potential audience is ready to buy

- Other category: more granular categories that aren’t covered in the above two categories

In this instance, we want to focus on affinity categories as this will give you a sense of what topic areas your audience is interested in, which can also be sub-categorised into particular niches. For example, if a significant percentage of your audience is labeled with the interest ‘Lifestyle and Hobbies Green Living Enthusiasts’, this indicates that they might respond well to a lifestyle campaign with an eco-friendly or environmental focus.

2. Understanding industry conversation

Examining the applicable industry landscape and the content/topics that are being shared within it will help you determine how your brand can contribute and add to the conversations. Start with a bit of search work across key platforms and publications that relate to your industry. As you’re searching, ask yourself:

- What are thought leaders discussing?

- What are customers saying is of value to them?

- Are there any major reports/surveys being discussed?

- How do they relate to wider topics of conversation?

A good place to start is the brand’s own blog or long-form content as by finding out what is most highly-engaged with here, you’ll be able to see what topics interest this audience and how it aligns with what you’ve already uncovered.

A published piece of research that includes a high number of responses is also an excellent springboard from which to get an overview of topics that people within the industry are concerned about. Platforms such as Statista and YouGov are great for this, as is research conducted by companies that hold a lot of weight in your industry.

For example, during a campaign strategy project for a client, we found a survey conducted by Statista that looked at reasons people go to the gym. This uncovered four main topics, giving us a starting point from which to begin our research. After seeing that ‘to counterbalance stress’ was one of the main reasons given in the survey, we knew that content in relation to exercise’s effect on mental health and wellbeing would be worth exploring.

With this in hand, you can then use a host of tools to further back your industry conversation research. Here are just a few:

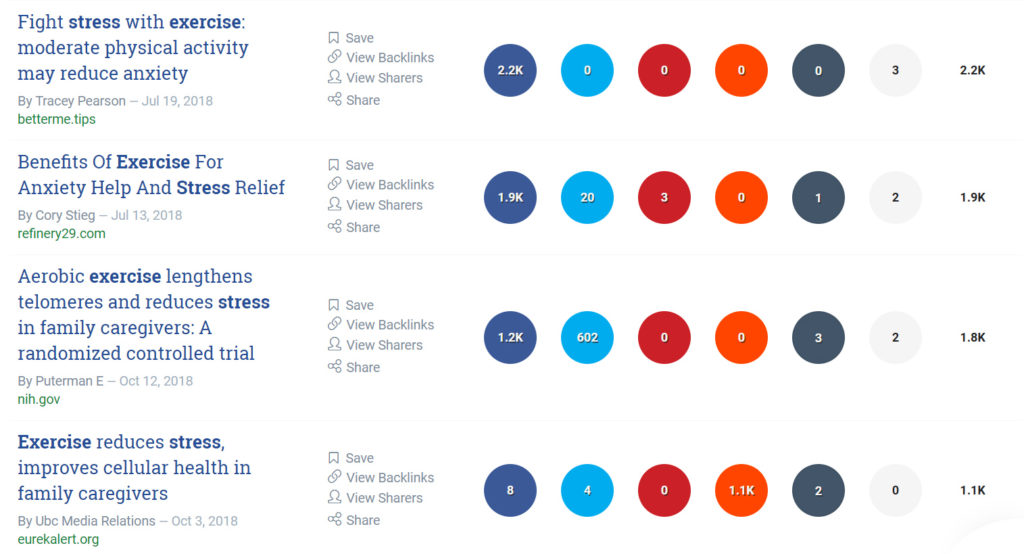

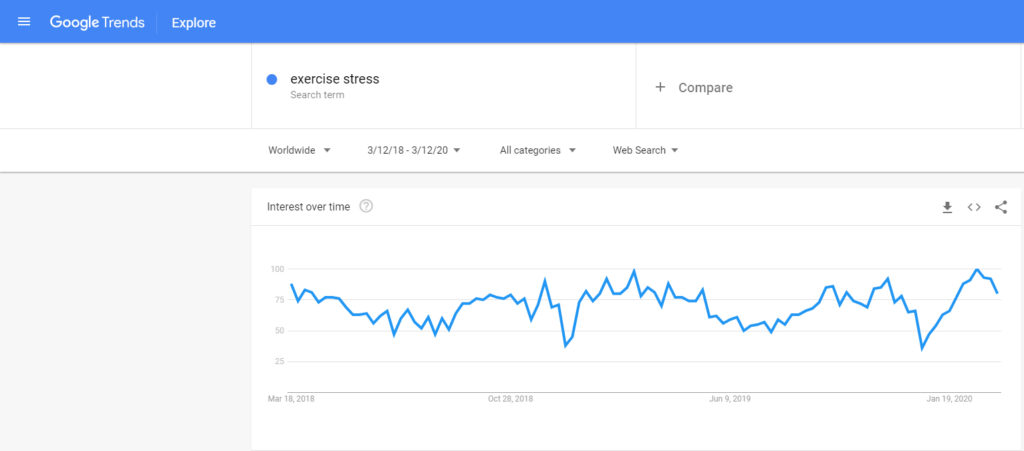

BuzzSumo and Google Trends

Inputing keywords relating to your topics into Buzzsumo and Google Trends will present the type of content being shared and searched for online, as well as giving you an understanding of the topic’s popularity over time.

In the case of our client, we entered the terms ‘exercise’ and ‘stress’ and these were the results:

We can see that ‘exercise stress’ has a significant dip in search volume around December each year with a definitive rise between January and March. This tells us that a seasonal campaign could be successful as people are clearly interested in the topic throughout the first few months of the year.

Reddit and Quora

User-generated tools such as Reddit and Quora are also incredibly useful at this stage, as you can gain specific insight into the types of questions your audience is asking and what they’re discussing about the topic in general. It also gives you a more customer-focused insight into industry discussion.

For example, while conducting recent campaign research for airline Icelandair, we found – through audience research – that a main interest of their key audience group was food and dining. Searching ‘Iceland food’ on Quora revealed that a prevalent topic of conversation among people who were looking to travel to Iceland was the price of food and accessing food on a budget.

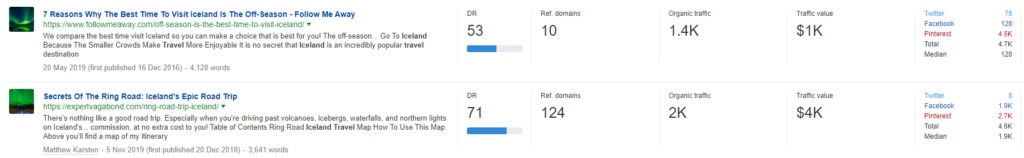

Content Explorer and Keyword Planner

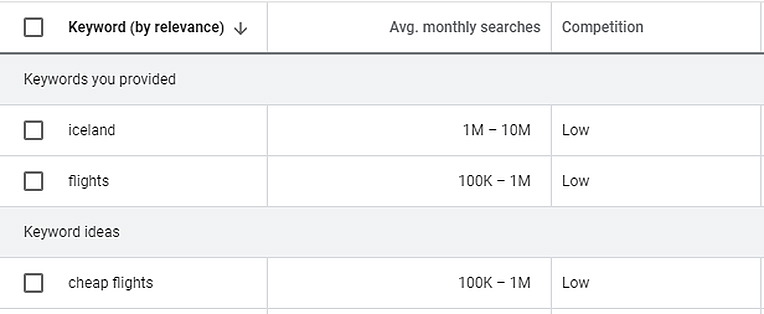

Continuing with the Icelandair example, we then used a content explorer tool that advises on share popularity (in this case, Ahrefs) and a keyword search volume platform (Keyword Planner) to find that the topic of price in Iceland was of interest across multiple verticals and therefore a valuable topic to continue researching.

‘People also ask’ and ‘searches related to’

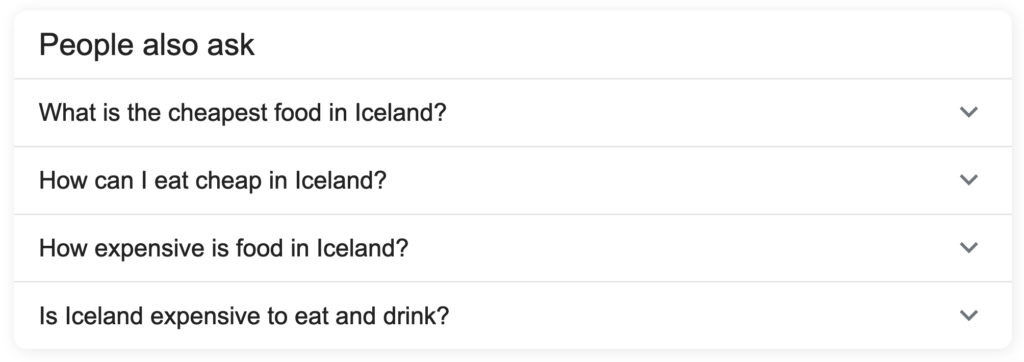

Now that you have a bank of potential top-level topics, you can use Google’s ‘people also ask’ and ‘searches related to’ to show you related search queries. This could uncover threads of conversation that you may not have initially considered.

3. Analysing media coverage

It’s vital that your target publications are sites that your audience read and engage with; you should already have a broad understanding of this as part of the initial steps. Landing a campaign on sites with readers who are never going to buy your products is futile. So, when analysing media coverage, keep in mind:

- Brand values: do the publications you’re looking at hold the same values and goals as the brand?

- Audience interest: do the publication’s readership demographics and interests align with those of your target audience?

- Popularity: are there any industry-specific topics that are being covered frequently or in a particular style?

It’s useful to break your media analysis down into three steps:

Existing coverage

Make a list of publications from the vertical of your top-level idea and use the search function on their site to see if/how they’re already covering it. For instance, a Google News search for your chosen subject can help you get a feel for the tone of the publication or journalist, if they have a particular interest in an age group or gender, and related subjects that are being covered. This exercise will also give you a list of journalists who would be likely to cover your campaign should you run with the topics you’re searching for.

Examples of linkable content

If you’re trying to get buy-in from the brand about your ideas, find examples of relevant linkable content that has been produced from similar campaigns and gained media traction to present to them. Doing this may also highlight popular content formats that could either be beneficial for your own campaign, or to steer clear of due to market popularity. For example, if you’ve found that regional heatmaps are regularly covered, ensure that you differentiate from or add value to the existing format as opposed to simply copying it.

Identifying content gaps

When creating a link-building campaign, it’s important to be heard above the noise. With so many well-used ideas floating around, it’s crucial to identify content formats that will not only allow your research and campaign to shine, but that will also stand out in an often-over-saturated market. Are there gaps in what publications are already covering that your campaign can fill?

These could be new data angles or different content types. Maybe there’s a high number of questions being asked about a specific angle to your topic that an advice-style piece could answer, or an interest in the future of the industry that forward-planning data could predict.

As many marketers will tell you, industry landscapes and customer demand are liable to dramatic changes at very little notice. Whether you’re in the process of planning a campaign that has been in the works for some time, or you’re gathering ideas and inspiration for a campaign further down the line, these processes will help you stay on top of changes in conversation and accurately reflect the fluctuating needs of your customer base.

Having employed the above, you’ll have gathered relevant data that will enable you to create well-researched, valid and linkable campaigns that respond to the needs of your customers and boost your overall sales potential.

If you have any questions or you’d like to discuss any of these points further, please let me know in the comments below.