Who are Millennials and Gen Z?

Before we discuss the value of targeting these generations, it’s important that we define the age groups that we’re talking about. There’s plenty of debate as to the cut-off point for each generation; some sources imply that Millennials are as young as 24, while others claim that Generation Z extends to 27-year-olds. There’s even the concept of ‘Zillennials’ circulating, which is a demographic of 90s babies who are too old/young to identify with either group.

However, for the purpose of this article, we’re defining these generations by the age groups outlined by Beresford Research, which states that Gen Z are aged 10-25, and Millennials are 26-41.* Our survey was completed by people over the age of 16, making the Gen Z audience smaller in this case.

Naturally, these age groups are still quite broad and incorporate many different ‘micro-generations’. But dividing them in this way allows us to examine the sentiments around making financial decisions at key milestones such as being in/freshly out of education, versus those who are perhaps deeper into their careers and have different priorities.

*Note: This is accurate at the current time of publication (April 2022), and age groups are subject to change.

Why target Gen Z and Millennials?

To survive and thrive in the increasingly saturated landscape, banks and financial services providers ultimately need to look to their future clients: i.e. they must turn their attention to the Millennial-Zillennial-Gen Z groups in order to reap the rewards.

A 2019 study by Morgan Stanley revealed that Millennials are the highest driver of net new loan demand, and this is set to continue for the next seven years. It’s also acknowledged that banks will face a competitive struggle to win the loyalty of Gen Z, who are forecast to account for one third of all consumer debt by 2040.

Not only will these generations make up the majority of the customer base, but their collective characteristics, attitudes, and beliefs have pushed the banking and financial services industries to pivotal change. Organisations can no longer appeal to Gen Z and Millennials in the same way they did to Baby Boomers, who had better personal finance experiences thanks to low-interest rates and inflated house prices.

Why and how have financial attitudes changed?

The impact of economic and social factors has shaped the outlook of these generations to some degree – young people better understand the importance of taking control of their finances. But other shifts in expectations are heavily influenced by these generations’ immersion in technology. Gen Z in particular are considered to be ‘digital natives’: born into an era of technological innovation, growing up with smartphones and other technologies as the norm rather than adapting to developments. This sets them apart even from their older Millennial counterparts. Salesforce recognises that as a result of their digitised upbringing, Gen Z consumers expect more innovation from brands, particularly with regard to digital experiences.

A Financial Brand study examining Millennial and Gen Z banking trends revealed that trust and security are top priorities when choosing a FS provider. The research showed that these generations are 10% less likely to completely trust them than Baby Boomers, with Gen Z being the least trusting of all. This shows that companies will need to work harder to earn the trust of younger generations, particularly with regard to personal security.

Gen Z and Millennials are indeed set to ‘reinvent’ the banking industry, and in many respects, these changes are already taking place. The consumer landscape is now dominated by a tech-savvy, mobile-first audience, who are more focused on meaningful experiences and brand trust than ever.

How much do Gen Z and Millennials know about finance?

To kickstart our research, we asked participants how much they knew about general personal finance matters. The results showed that around one third (31%) of both Millennials and Gen Z said they were confident on the topic, and nearly half (47%) said they were ‘somewhat confident’.

When more specific questions were asked in relation to getting a mortgage, insurance, or a loan, Millennials were 21% more likely to consider these actions when compared to Gen Z. This is unsurprising given the contrast in life circumstances for each age group.

On the other hand, almost two thirds (63%) of both Millennial and Gen Z participants said that they’d considered investing. The growth of investment culture among younger generations is partly down to technology. Mobile apps such as Freetrade and IG Trading have made investing easy and accessible to Gen Z and Millennials. Cryptocurrencies such as Bitcoin, Dogecoin, and NFTs have become synonymous with Gen Z consumer habits, with 78% of Gen Z participants showing an understanding of one or more forms of crypto.

Despite this level of awareness, it’s concerning that only 26% of Gen Z and 34% of Millennials are confident enough to take out these actions.

Where taxes, credit, and credit scores are concerned, 39% of all participants (and 48% of Gen Z) revealed that they do not fully understand these topics. Several respondents highlighted where they had gaps in their knowledge, and showed a willingness to learn more about financial products.

What topics are most relevant for these audiences right now?

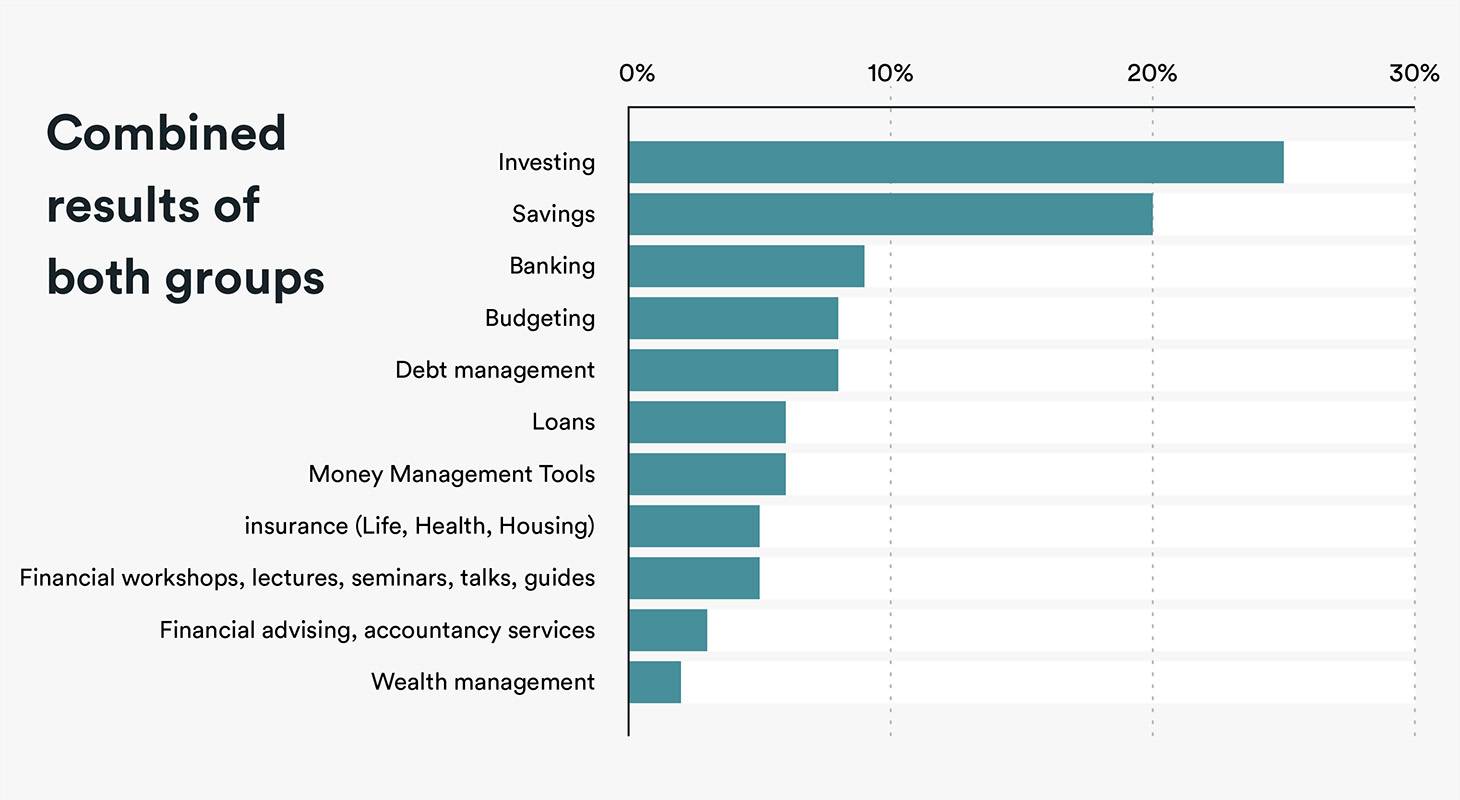

When asked about developing their financial knowledge, investing (25%) and savings (20%) were identified as the two most popular areas for Gen Z and Millennials to learn about. These topics are followed by banking (9%), budgeting (8%), and debt management (8%).

When examining whether each generation fits this overarching trend, Millennials follow suit, but Gen Z’s priorities differ. One quarter (25%) of Gen Z selected savings as the most valuable area, followed by budgeting (15%) and money management tools (12%).

Naturally, different age groups have different priorities, but as Gen Z age they are likely to adopt the same priorities as Millennials where their personal finances are concerned. Differences aside, however, both generations show a genuine desire for further financial education.

This is great news for FS companies and banks, as there is demand for educational content surrounding their products and services. By covering all bases and catering to the informational needs of Gen Z and Millennials, financial organisations can position themselves as reliable sources of advice and support.

These efforts alone will help to build the much sought-after trust and rapport at multiple stages of the funnel. But what else matters to Millennials and Gen Z when choosing a financial services provider?

What do Millennials and Gen Z value highest when interacting with financial companies?

The idea of ‘digital as the future’ is the dominant theme in any opinion piece exploring Gen Z and Millennial finance trends. And this is with good reason.

When attracting customers of these ‘mobile-first’ generations, offering a seamless digital banking experience isn’t just an option, it’s a necessity.

This digital experience must go further than just mobile banking apps: extending to other features such as virtual customer support, money management tools, and in-app credit check services. Both CX and UX are pivotal in allowing traditional banks to compete with alternative banking companies (e.g. Monzo and Revolut) and financial products and start-ups (Stripe, Cashapp, Venmo etc.).

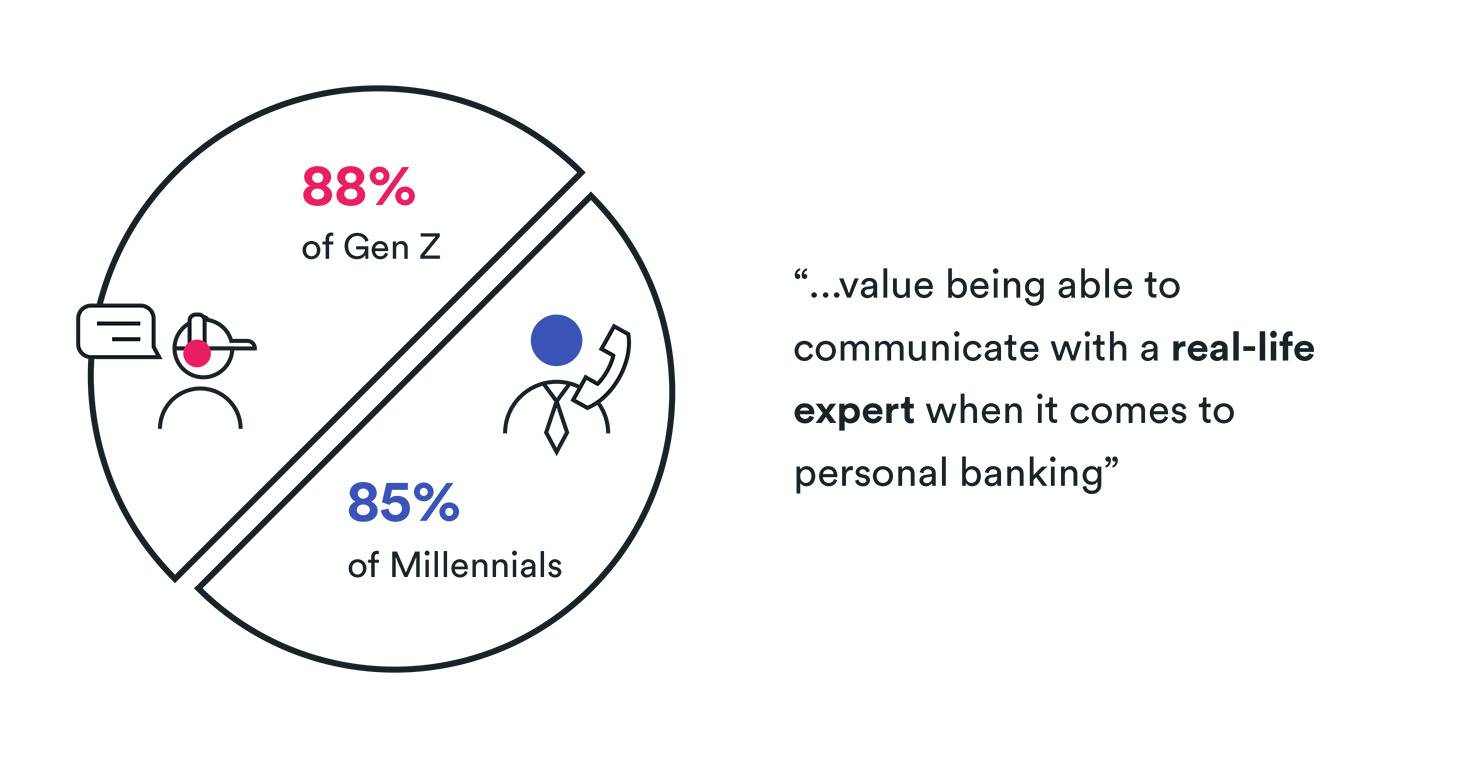

But while digitisation is the future of banking in some respect, there’s strong evidence to suggest that the human element is still greatly important to Millennials and Gen Z.

Our survey showed that 86% of Gen Z and Millennials value being able to speak to a real-life expert when it comes to personal finance. What’s perhaps more surprising is that a higher percentage of Gen Z accounted for this statistic (88%). A high level of importance is placed on the human factor, despite this focus on all things digital.

Forbes Council Member Allison Netzer cautions organisations that while technology is important, it’s only part of the value equation for younger customers. She outlines the importance of placing less emphasis on developing new features and focusing instead on improving existing products and processes.

She explains that “accountability beyond technology means leaning into the service, communication and community aspects of banking — not neglecting these in pursuit of a killer app or the UX to beat all UXs.”

In other words, making experiences better is valued higher than creating new features in the long term. However, this is just the tip of the iceberg where marketing to Gen Z and Millennials is concerned.

So how else can your content strategy align with the values of these generations?

1.Solve emotional needs

According to BAI, a key way to appeal to Gen Z and Millennial customers is by ensuring that your content and products cater to emotional needs. This involves developing an understanding of the motivations and pain points of your client base, displaying empathy, and offering solutions to their problems.

The pain point could be something as basic as sending money to a friend, making it relatable (e.g. showing the faff of splitting the bill), then showing how your product or service can solve the problem.

Authenticity is key when portraying the services you offer. If your target audience can clearly see their own issues and pain points reflected in your content, it has a much higher chance of resonating with Millennials and Gen Z.

2.Make your content trustworthy

With such a huge emphasis placed on trust by these generations – in particular regard to the banking and financial sectors – it’s essential that your content reflects this.

The E-A-T principles of Expertise, Authority, and Trust are crucial to any form of YMYL (Your Money Your Life) content. E-A-T practices such as relevant authorship, accessible contact forms, and testimonials, all ensure that your content is high quality enough to legitimately advise others on the topic.

Not only does this strengthen customer rapport and build brand trust and authority, but these principles are considered to be important by search engines when prioritising content in the SERP. In other words, the better and more relevant the content is to your brand, the higher its potential to rank.

We recently produced a guide all about E-A-T and Site Quality for Financial Services Brands, so we’d recommend taking a look if you’re interested in learning more.

3.Emphasise ethics

We are living in an age where the ethical values of a company take precedence over the quality of its services (and rightly so). Michelle King of Finextra notes that while Millennials are certainly socially conscious, Gen Z take this a step further, and will actually hold you accountable. She highlights the growth in popularity of tools such as Bankgreen which let you compare ‘good’ and ‘bad’ banks.

If the ethical/social goals of a brand are misaligned with these generations’ values, they have more of an incentive to switch providers. Virtue signalling and framing greenwashing in an authentic, truthful manner should therefore be another consideration for banks and financial services organisations.

4.Consider the ‘TLDR’ mentality

The TLDR, or ‘Too Long Didn’t Read’ mindset of many Gen Z and Millennials can make getting your message across particularly difficult. With platforms like TikTok only demanding seconds, not minutes of their time, there’s a dilemma of wanting to create meaningful informational content but not wanting to lose the audience’s attention.

While long-form guides and videos are still popular educational resources, they should be carefully structured to prioritise the important information first/at the top of the page. Referring again to the strengths of considering multiple content types in your content strategy, there’s even more potential to be seen when combining different content formats.

For example, a short video at the top of a longer guide can nicely summarise the key learnings of the article for users with shorter attention spans. Videos are also extremely sharable on social channels which can generate additional traffic to your blog.

How can banks/financial services brands use content to bridge the knowledge gaps for these audiences?

When asked how they’d like to develop their knowledge of financial products, two thirds (65%) of Gen Z and Millennials chose online research as their preferred method of learning. Fortunately for marketing teams, this interest in online content lends itself well to many different formats, notably how-to/product guides, case studies, and even detailed product pages.

Second to online research is being directly informed by a bank/insurance provider (48%) or seeking advice from friends and family (48%). This shows that respondents trust their bank or FS provider to educate them, reflecting the demand for reliable content. On the other hand, the interest in receiving advice from non-finance personnel implies a desire to learn through indirect sources, real-life case studies and more simplified means.

Other mediums of note include social media/influencers (40%), and videos/podcasts (34%). Social media is rapidly becoming a respected platform for learning. TikTok in particular has the potential to reshape how younger generations learn about finance by condensing complex personal finance topics into short, sharable videos.

Finance TikTok – also known as ‘FinTok’ – has made personal finance advice accessible to Gen Z in particular, the most avid users of the app. The content instantly engages users by jumping on popular trends, while adding educational value. ‘Finfluencers’ on various social platforms are making a fundamental difference to Gen Z’s financial habits by shaping how young people learn about and take control of their finances.

To show how easy it is to engage with the UK TikTok Finance Tips community, we tried out some FinTok trends for ourselves:

Aside from being engaging, this content is easy to create at minimal expense. Companies such as Monzo and Natwest have already created TikTok accounts, while others like HSBC have teamed with influencers to resonate with a Millennial and Gen Z audience.

While there’s certainly huge potential in tapping into FinTok, other forms of content must not be overlooked.

89% of survey respondents chose more than one learning method. This suggests that if banks are to capture the attention of Gen Z and Millennials, they require a diverse content strategy that incorporates multiple resources to spark consumer curiosity at every stage of the funnel.

There’s no secret formula for creating the perfect content for Millennials and Gen Z, but what’s clear is that diverse, trustworthy content that solves their key pain points should factor into every strategic effort.

Need inspiration for alternative B2B and FS content ideas? Check out our guide on How To Turn Complex Topics Into Engaging Content.

Conclusion

With financial literacy, curiosity, and engagement at an all-time high for younger generations, now is as good a time as any to target your future customers. Although there are some generational differences in topic understanding and financial priorities, it’s clear that meaningful customer experiences (both digital and face-to-face) coupled with relatable and diverse educational resources are the top priorities for Millennials and Gen Z.

Appealing to these customers will take more than just streamlining digital experiences and partnering with the latest ‘Finfluencers’. It involves thinking about the pain points of younger customers and presenting them with comprehensive solutions in relevant, accessible formats. A key part of this acquisition will likely involve a content strategy to target Gen Z and Millennial audiences at multiple stages of the funnel through various content formats.

At Builtvisible, we’ve developed content strategies for a broad range of B2B and financial service brands. Check out our case studies for examples of how we can help you, or get in touch via our contact form to find out more.